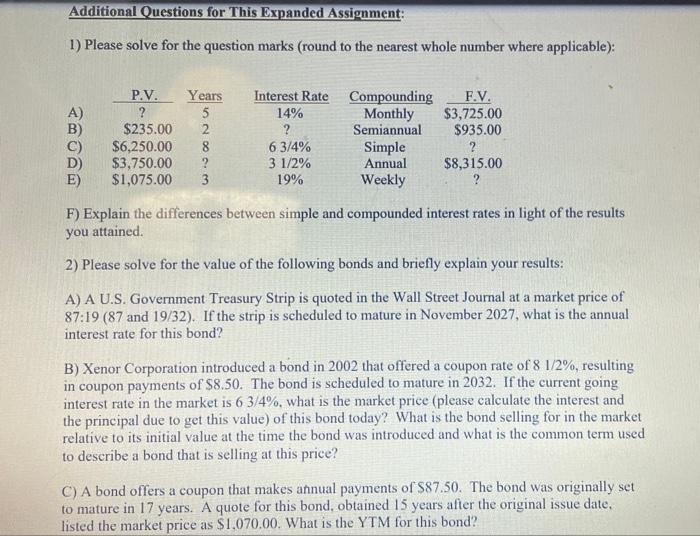

1) Please solve for the question marks (round to the nearest whole number where applicable): F) Explain the differences between simple and compounded interest rates in light of the results you attained. 2) Please solve for the value of the following bonds and briefly explain your results: A) A U.S. Government Treasury Strip is quoted in the Wall Street Journal at a market price of 87:19(87 and 19/32). If the strip is scheduled to mature in November 2027, what is the annual interest rate for this bond? B) Xenor Corporation introduced a bond in 2002 that offered a coupon rate of 81/2%, resulting in coupon payments of $8.50. The bond is scheduled to mature in 2032 . If the current going interest rate in the market is 63/4%, what is the market price (please calculate the interest and the principal due to get this value) of this bond today? What is the bond selling for in the market relative to its initial value at the time the bond was introduced and what is the common term used to describe a bond that is selling at this price? C) A bond offers a coupon that makes annual payments of $87.50. The bond was originally set to mature in 17 years. A quote for this bond, obtained 15 years after the original issue date. listed the market price as $1,070.00. What is the YTM for this bond? 3) Construct a detailed Fixed Loan Amortization schedule for a 2 year corporate equipment loan of $750,000.00, payable at a 71/2% annual interest rate, with payments scheduled to be made on a quarterly basis. This loan calls for the payback of $93,750.00 toward the principal with each scheduled payment. Note that the schedule may be off by several dollars due to rounding. The schedule should include the following parts, which you should put in the form of a table: A) Beginning Balance B) Payment per Period C) Interest Paid D) Principal Paid E) Ending Balance 4) Please solve for the value of the following stocks and briefly explain your results: A) Your research on Skyway Corp. indicates that the company will be paying dividends of $1.75 per share in 2023, S1.95 per share in 2024, \$2.25 per share in 2025 and \$2.65 per share in 2026. You are given an estimate that the stoek price in 2026 will be worth 537.50 per share. If your A) Your research on Skyway Corp. indicates that the company will be paying dividends of $1.75 per share in 2023, \$1.95 per share in 2024, \$2.25 per share in 2025 and \$2.65 per share in 2026. You are given an estimate that the stock price in 2026 will be worth $37.50 per share. If your required annual return for all investments is 12%, what is the most you are willing to pay for Skyway stock today? B) Meltran, Inc. has issued a series of preferred stock that is priced at $80 per share and has a quarterly dividend payable at $0.75 per share. What is the dividend yield of this preferred stock? C) Tenomar Corp. is about to experience a 5 year restructuring plan and will not pay dividends during that time. However, management promises that this initiative will be so successful that the company can then pay out a $6.75 per share dividend that will then grow at a rate of 10% per year. What is the maximum price you are willing to pay for Tenomar's stock if your required annual return is 15% ? D) Gibralter, Inc. has just announced EPS of $3.75 and future earnings are expected to grow 20% per year for the foreseeable future. The most recent stock quote for Gibralter indicates that the company is trading at $48.50 as a result of this announcement. What is the PEG for Gibralter and would the stock of this company be worth buying at these levels as the result of your PEG analysis