Question

1. Please tell me where on a classified balance sheet the following accounts would be located. I have put a couple of accounts that dont

1. Please tell me where on a classified balance sheet the following accounts would be located. I have put a couple of accounts that dont belong, so pay attention to what each account is. Use the following chart for the answer keys:

| Current asset | CA |

| Investment | I |

| Property, Plant, & equipment | PPE |

| Intantgible | Tan |

| Current Liab. | CL |

| Long term Liab. | LtL |

| Contributed capital/common stock | CL |

| Retained Earnings | RE |

The lettered items that follow represent a classification scheme for a balance sheet, and the numbered items in the list below are account titles. Match each account with the letter of the category in which it belongs from question 1. Most letters will be used more than once.

1. Patent ____

2. Building Held for Sale ____

3. Prepaid Rent ____

4. Wages Payable ____

5. Note Payable in Five Years ____

6. Building Used in Operations ____

7. Fund Held to Pay Off Long-Term Debt ____

8. Inventory ____

9. Prepaid Insurance ____

10. Depreciation Expense ____

11. Accounts Receivable ____

12. Interest Expense ____

13. Unearned Revenue ____

14. Short-Term Investments ____

15. Accumulated Depreciation ____

16. Common Stock ____

3. Using the following accounts prepare a classified balance sheet at year end May 31, 2020. Accounts payable, $800; Accounts Receivable, $1,100; Accumulated Depreciation Equipment, $700; cash, $200; common stock, $1,000; Equipment, $3,000; Franchise, $200; Investments (long Term) $500; Inventory $600; Notes Payable (long term)$400; wages payable, $100. Im leaving Retained earning balance out for a reason. Please include RETAINED EARNINGS on your balance sheet with the correct number. Keep in mind your accounting equation. A=L+SE. Thats how you figure out the retained earning balance. Make sure to view your template to follow proper format.

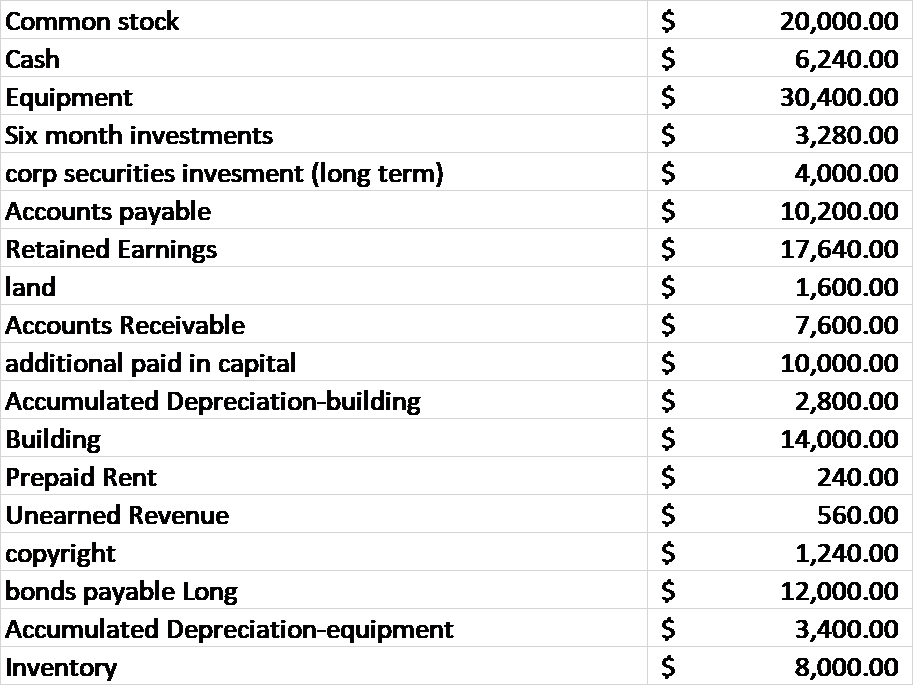

4. Use the following chart of accounts with balances to prepare the Classified Balance Sheet. Please make sure you follow the template in your slides. Notes: Accumulated Depreciation is CONTRA account, so it is an asset, but has the opposite balance. Also additional Paid in capital account is part of contributed capital. It is listed directly below common stock and has a normal credit balance. Make up a company name and make sure you follow your slides.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started