Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Please use e (continuously compounded) to answer. 2. Typed answer would be better. Thanks!! 1. The current stock price of H is $65. It

1. Please use "e" (continuously compounded) to answer.

1. Please use "e" (continuously compounded) to answer.

2. Typed answer would be better. Thanks!!

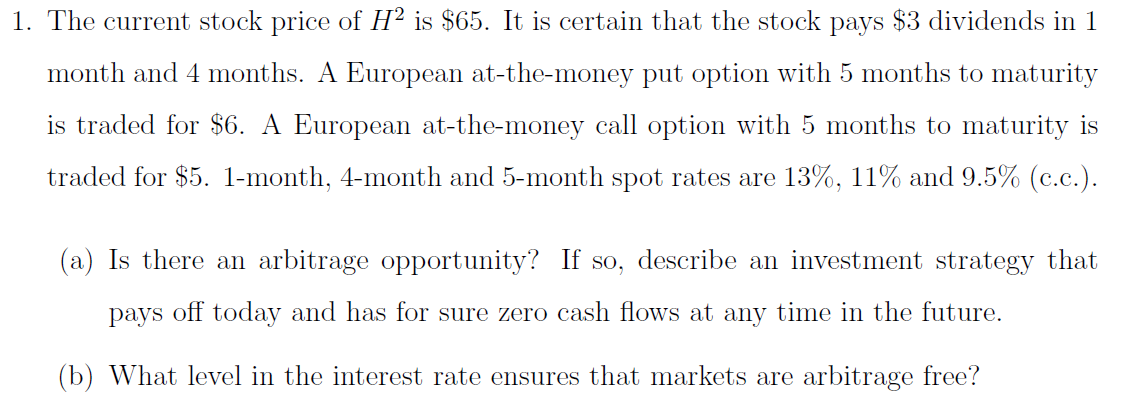

1. The current stock price of H is $65. It is certain that the stock pays $3 dividends in 1 month and 4 months. A European at-the-money put option with 5 months to maturity is traded for $6. A European at-the-money call option with 5 months to maturity is traded for $5. 1-month, 4-month and 5-month spot rates are 13%, 11% and 9.5% (c.c.). (a) Is there an arbitrage opportunity? If so, describe an investment strategy that pays off today and has for sure zero cash flows at any time in the future. (b) What level in the interest rate ensures that markets are arbitrage freeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started