Question

1. Plutonic Inc. had $560 million in taxable income for the current year. Plutonic also had an increase in deferred tax liabilities of $66 million

1. Plutonic Inc. had $560 million in taxable income for the current year. Plutonic also had an increase in deferred tax liabilities of $66 million and recognized tax expense of $112 million. The company is subject to a tax rate of 25%. The change in deferred tax assets (ignoring any valuation allowance) was a/an:

Multiple Choice

-

increase of $46 million.

-

increase of $94 million.

-

decrease of $94 million.

-

decrease of $46 million.

2. Pearsall Company's defined benefit pension plan had a PBO of $276,000 on January 1, 2021. During 2021, pension benefits paid were $42,000. The discount rate for the plan for this year was 12%. Service cost for 2021 was $90,000. Plan assets (fair value) increased during the year by $46,000. The amount of the PBO at December 31, 2021, was:

Multiple Choice

-

$399,120.

-

None of these answer choices are correct.

-

$234,000.

-

$357,120.

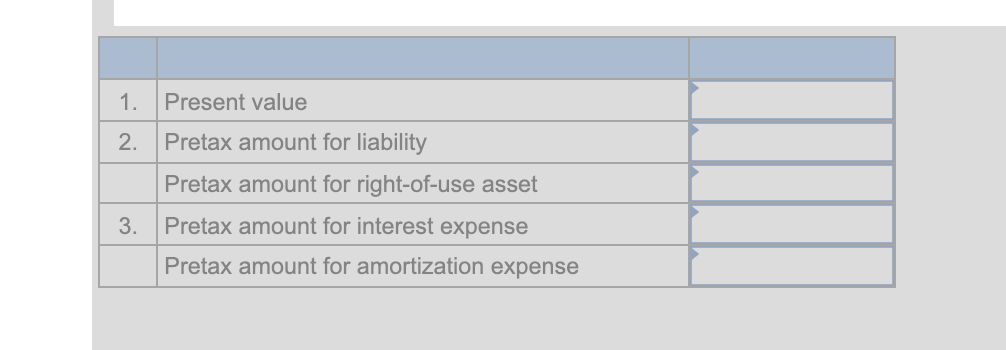

3. On June 30, 2021, Georgia-Atlantic, Inc. leased a warehouse equipment from IC Leasing Corporation. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $681,229 over a four-year lease term, payable each June 30 and December 31, with the first payment at June 30, 2021. Georgia-Atlantic's incremental borrowing rate is 8%, the same rate IC uses to calculate lease payment amounts. Amortization is recorded on a straight-line basis at the end of each fiscal year. The fair value of the equipment is $4.8 million. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the present value of the lease payments at June 30, 2021 that Georgia-Atlantic uses to record the right-of-use asset and lease liability. 2. What pretax amounts related to the lease would Georgia-Atlantic report in its balance sheet at December 31, 2021? 3. What pretax amounts related to the lease would Georgia-Atlantic report in its income statement for the year ended December 31, 2021? (For all requirements, enter your answers in whole dollars and not in millions. Round your final answers to the nearest whole dollar.)  4. On January 1, 2018, Ameen Company purchased major pieces of manufacturing equipment for a total of $76 million. Ameen uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. At December 31, 2020, the book value of the equipment was $70 million and its tax basis was $60 million. At December 31, 2021, the book value of the equipment was $68 million and its tax basis was $53 million. There were no other temporary differences and no permanent differences. Pretax accounting income for 2021 was $55 million. Required: 1. Prepare the appropriate journal entry to record Ameens 2021 income taxes. Assume an income tax rate of 25%. 2. What is Ameens 2021 net income?

4. On January 1, 2018, Ameen Company purchased major pieces of manufacturing equipment for a total of $76 million. Ameen uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. At December 31, 2020, the book value of the equipment was $70 million and its tax basis was $60 million. At December 31, 2021, the book value of the equipment was $68 million and its tax basis was $53 million. There were no other temporary differences and no permanent differences. Pretax accounting income for 2021 was $55 million. Required: 1. Prepare the appropriate journal entry to record Ameens 2021 income taxes. Assume an income tax rate of 25%. 2. What is Ameens 2021 net income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started