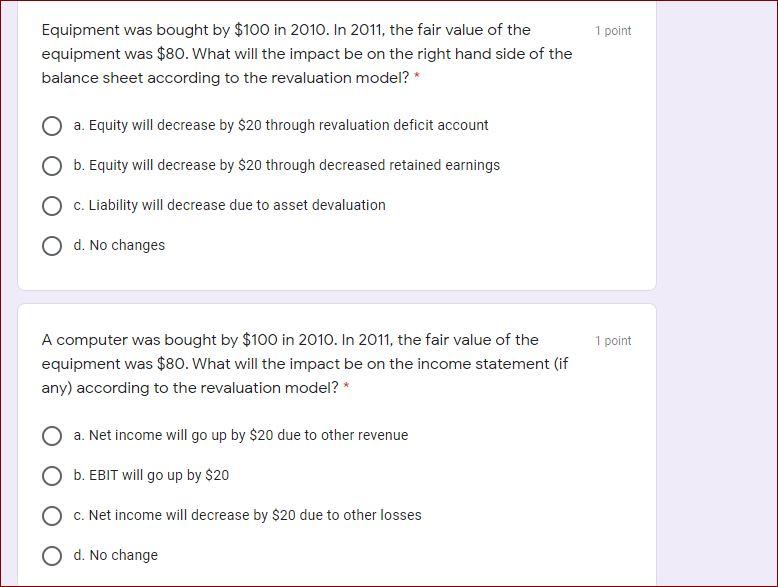

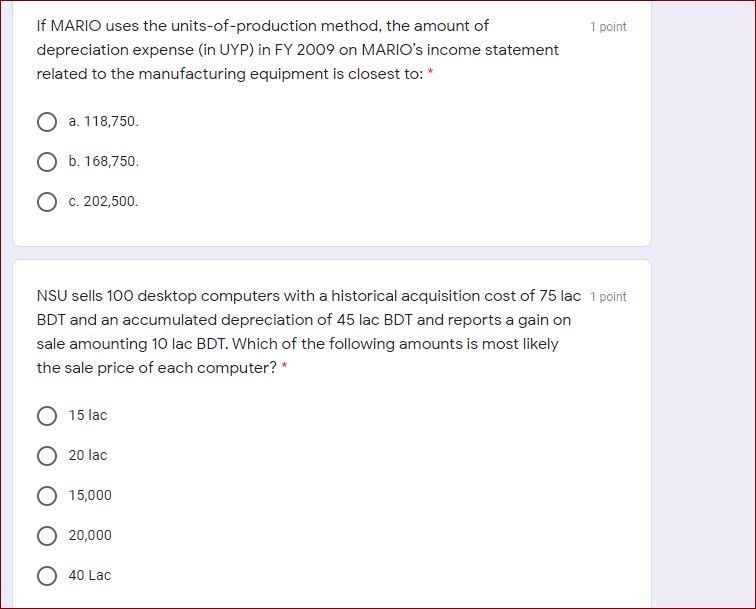

1 point Equipment was bought by $100 in 2010. In 2011, the fair value of the equipment was $80. What will the impact be on the right hand side of the balance sheet according to the revaluation model?* O a. Equity will decrease by $20 through revaluation deficit account O b. Equity will decrease by $20 through decreased retained earnings O c. Liability will decrease due to asset devaluation d. No changes 1 point A computer was bought by $100 in 2010. In 2011, the fair value of the equipment was $80. What will the impact be on the income statement (if any) according to the revaluation model?* O a. Net income will go up by $20 due to other revenue b. EBIT will go up by $20 c. Net income will decrease by $20 due to other losses d. No change 1 point If MARIO uses the units-of-production method, the amount of depreciation expense (in UYP) in FY 2009 on MARIO's income statement related to the manufacturing equipment is closest to: * O a. 118,750. O b. 168,750 c. 202,500 NSU sells 100 desktop computers with a historical acquisition cost of 75 lac 1 point BDT and an accumulated depreciation of 45 lac BDT and reports a gain on sale amounting 10 lac BDT. Which of the following amounts is most likely the sale price of each computer? 15 lac 20 lac 15,000 20,000 40 Lac 1 point Equipment was bought by $100 in 2010. In 2011, the fair value of the equipment was $80. What will the impact be on the right hand side of the balance sheet according to the revaluation model?* O a. Equity will decrease by $20 through revaluation deficit account O b. Equity will decrease by $20 through decreased retained earnings O c. Liability will decrease due to asset devaluation d. No changes 1 point A computer was bought by $100 in 2010. In 2011, the fair value of the equipment was $80. What will the impact be on the income statement (if any) according to the revaluation model?* O a. Net income will go up by $20 due to other revenue b. EBIT will go up by $20 c. Net income will decrease by $20 due to other losses d. No change 1 point If MARIO uses the units-of-production method, the amount of depreciation expense (in UYP) in FY 2009 on MARIO's income statement related to the manufacturing equipment is closest to: * O a. 118,750. O b. 168,750 c. 202,500 NSU sells 100 desktop computers with a historical acquisition cost of 75 lac 1 point BDT and an accumulated depreciation of 45 lac BDT and reports a gain on sale amounting 10 lac BDT. Which of the following amounts is most likely the sale price of each computer? 15 lac 20 lac 15,000 20,000 40 Lac