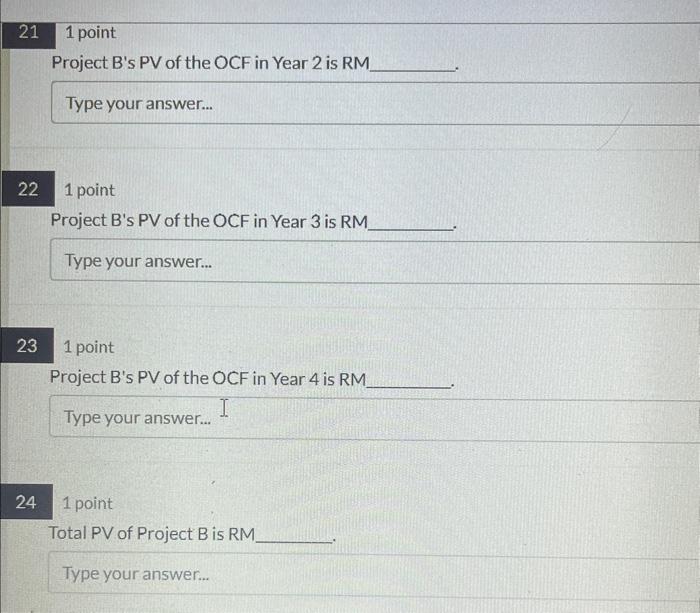

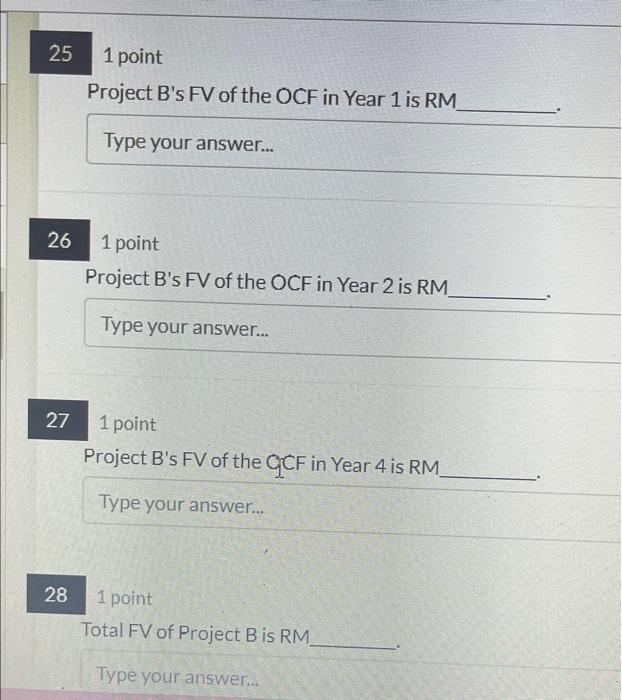

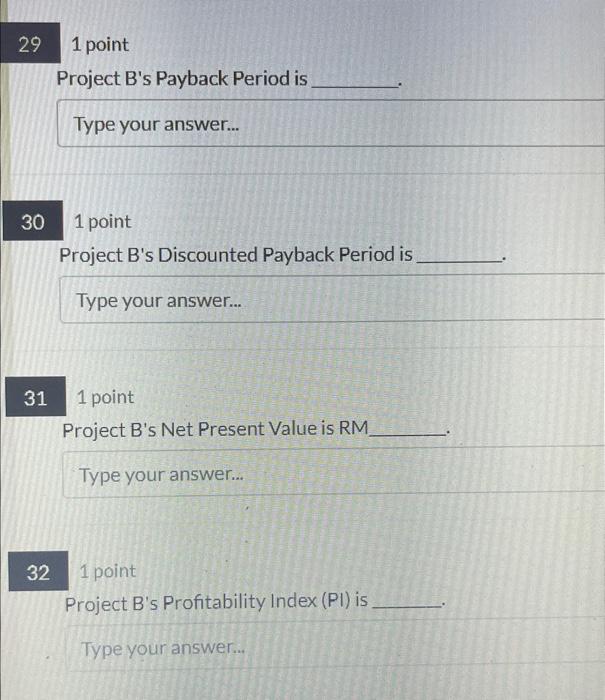

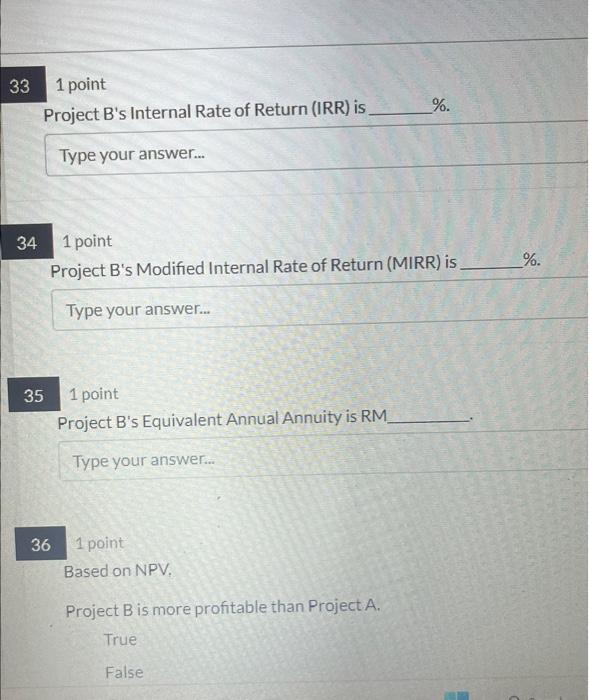

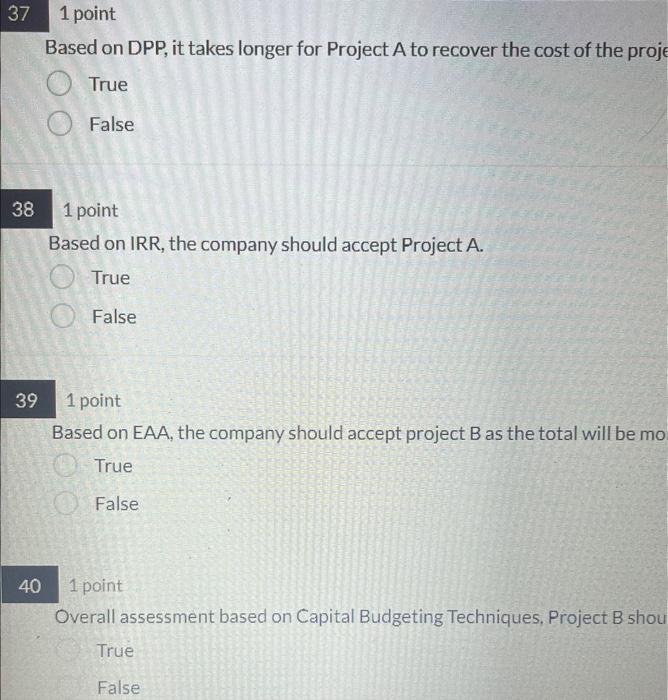

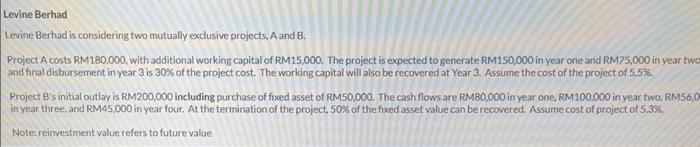

1 point Project B's PV of the OCF in Year 3 is RM Type your answer... 1 point Project B's PV of the OCF in Year 4 is RM 1 point Total PV of Project B is RM 251 point Project B's FV of the OCF in Year 1 is RM Type your answer... 261 point Project B's FV of the OCF in Year 2 is RM Type your answer... 271 point Project B's FV of the GCF in Year 4 is RM Type your answer... 281 point Total FV of Project B is RM Type your answer... 291 point Project B's Payback Period is Type your answer... 301 point Project B's Discounted Payback Period is Type your answer... 311 point Project B's Net Present Value is RM Type your answer... 321 point Project B's Profitability Index (PI) is Type your answer... 1 point Project B's Internal Rate of Return (IRR) is %. Type your answer... 1 point Project B's Modified Internal Rate of Return (MIRR) is %. Type your answer... 1 point Project B's Equivalent Annual Annuity is RM Type your answer... 1 point Based on NPV. Project B is more profitable than Project A. True False Based on DPP, it takes longer for Project A to recover the cost of the proj True False 1 point Based on IRR, the company should accept Project A. True False 1 point Based on EAA, the company should accept project B as the total will be mc True False 1 point Overall assessment based on Capital Budgeting Techniques, Project B shol True False Levine Berhad is considering two mutually ecclusive projects, A and B. Project A costs RM180,000, with additional working Capital of RM15,000. The project is expected to generate RM150,000 in year one and RM75,000 in year two and final disbursement in year 3 is 30%6 of the project cost. The working capital will also be recovered at Year 3 . Assume the cost of the project of 5.5%. Project B's initial outlay is RM. 200,000 including purchase of foced asset of RM50,000. The cash flows are RMB0,000 in year one, RM100.000 in year two, RM56,0 in year three, and RM45,000 in year four. At the termination of the project, 5086 of the froed asset value can be recovered. Assume cost of project of 5.3%. Notes reinvestment value refers to future value