Answered step by step

Verified Expert Solution

Question

1 Approved Answer

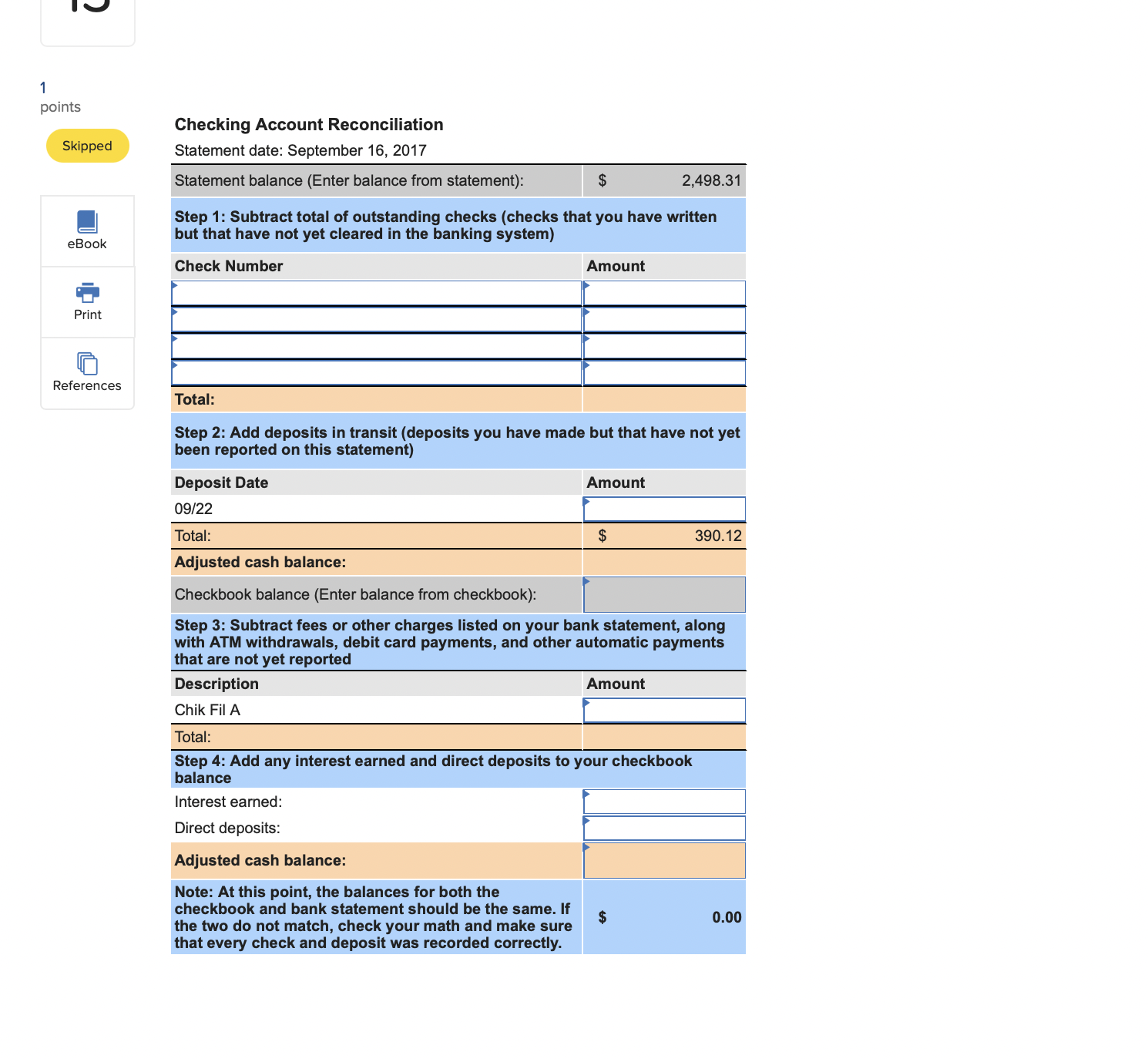

1 points Checking Account Reconciliation begin{tabular}{l|ll} Statement date: September 16, 2017 & hline Statement balance (Enter balance from statement): & $ & 2,498.31 end{tabular}

1 points Checking Account Reconciliation \begin{tabular}{l|ll} Statement date: September 16, 2017 & \\ \hline Statement balance (Enter balance from statement): & $ & 2,498.31 \end{tabular} Step 1: Subtract total of outstanding checks (checks that you have written but that have not yet cleared in the banking system) Check Number Step 2: Add deposits in transit (deposits you have made but that have not yet been reported on this statement) \begin{tabular}{l|ll|} \hline Deposit Date & & \\ \hline 09/22 & $390.12 \\ \hline Total: & & \\ \hline Adjusted cash balance: & & \\ \hline Checkbook balance (Enter balance from checkbook): & & \\ \hline \end{tabular} Step 3: Subtract fees or other charges listed on your bank statement, along with ATM withdrawals, debit card payments, and other automatic payments that are not yet reported \begin{tabular}{ll} \hline Description & Amount \\ \hline Chik Fil A & \\ \hline Total: & \\ \hline \end{tabular} Step 4: Add any interest earned and direct deposits to your checkbook balance Interest earned: Direct deposits: Adjusted cash balance: Note: At this point, the balances for both the checkbook and bank statement should be the same. If the two do not match, check your math and make sure that every check and deposit was recorded correctly

1 points Checking Account Reconciliation \begin{tabular}{l|ll} Statement date: September 16, 2017 & \\ \hline Statement balance (Enter balance from statement): & $ & 2,498.31 \end{tabular} Step 1: Subtract total of outstanding checks (checks that you have written but that have not yet cleared in the banking system) Check Number Step 2: Add deposits in transit (deposits you have made but that have not yet been reported on this statement) \begin{tabular}{l|ll|} \hline Deposit Date & & \\ \hline 09/22 & $390.12 \\ \hline Total: & & \\ \hline Adjusted cash balance: & & \\ \hline Checkbook balance (Enter balance from checkbook): & & \\ \hline \end{tabular} Step 3: Subtract fees or other charges listed on your bank statement, along with ATM withdrawals, debit card payments, and other automatic payments that are not yet reported \begin{tabular}{ll} \hline Description & Amount \\ \hline Chik Fil A & \\ \hline Total: & \\ \hline \end{tabular} Step 4: Add any interest earned and direct deposits to your checkbook balance Interest earned: Direct deposits: Adjusted cash balance: Note: At this point, the balances for both the checkbook and bank statement should be the same. If the two do not match, check your math and make sure that every check and deposit was recorded correctly Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started