Answered step by step

Verified Expert Solution

Question

1 Approved Answer

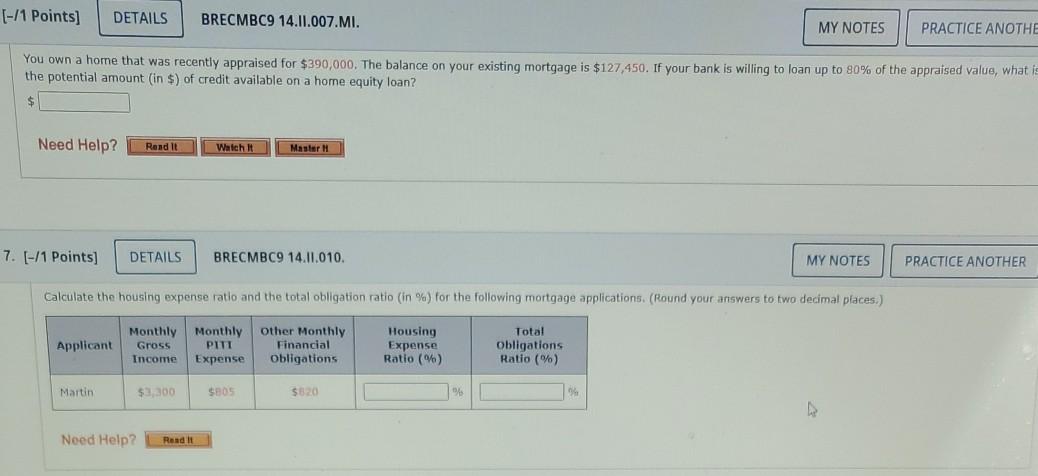

[-/1 Points) DETAILS BRECMBC9 14.11.007.MI. MY NOTES PRACTICE ANOTHE You own a home that was recently appraised for $390,000. The balance on your existing mortgage

[-/1 Points) DETAILS BRECMBC9 14.11.007.MI. MY NOTES PRACTICE ANOTHE You own a home that was recently appraised for $390,000. The balance on your existing mortgage is $127,450. If your bank is willing to loan up to 80% of the appraised value, what is the potential amount (in $) of credit available on a home equity loan? $ Need Help? Rand it Watch it Master 7. [-/1 Points) DETAILS BRECMBC9 14.11.010. MY NOTES PRACTICE ANOTHER Calculate the housing expense ratio and the total obligation ratio (in %) for the following mortgage applications. (Round your answers to two decimal places.) Monthly Gross Monthly Applicant PITI Expense other Monthly Financial Obligations Housing Expense Ratio (%) Total Obligations Ratio (%) Income Martin $3,300 $80 $520 Need Help? Rendit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started