Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 points eBookPrintCheck my workCheck My Work button is now disabledItem 3 Jan is the sole shareholder of Jan Ltd . Summer is the sole

points

eBookPrintCheck my workCheck My Work button is now disabledItem

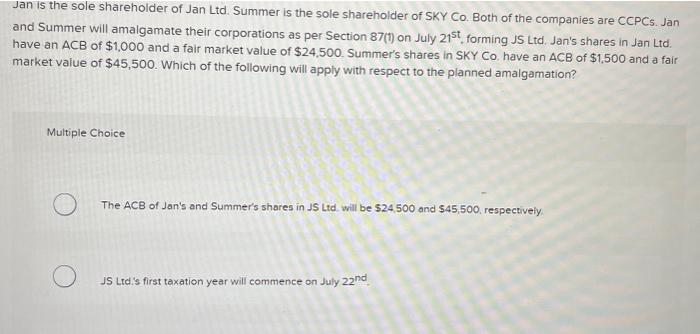

Jan is the sole shareholder of Jan Ltd Summer is the sole shareholder of SKY Co Both of the companies are CCPCs Jan and Summer will amalgamate their corporations as per Section on July st forming JS Ltd Jan's shares in Jan Ltd have an ACB of $ and a fair market value of $ Summer's shares in SKY Co have an ACB of $ and a fair market value of $ Which of the following will apply with respect to the planned amalgamation?

JS Ltds first taxation year will commence on July nd

All carry forward balances in Jan Ltd and SKY Co are deemed to have expired prior to the amalgamation.

The ACB of Jan's and Summer's shares in JS Ltd will be $ and $ respectively.

Summer will control JS Ltd after the amalgamation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started