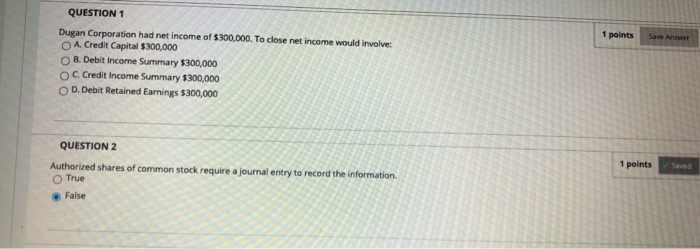

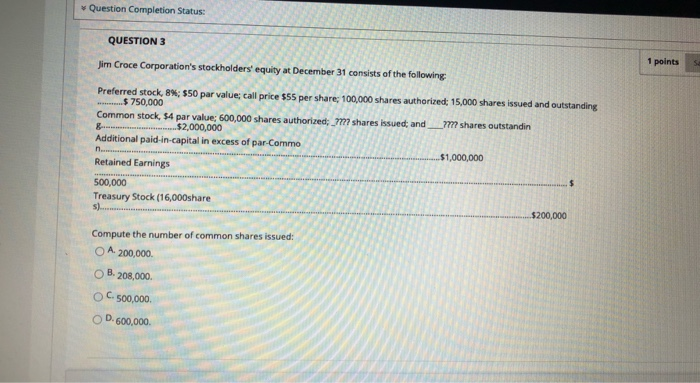

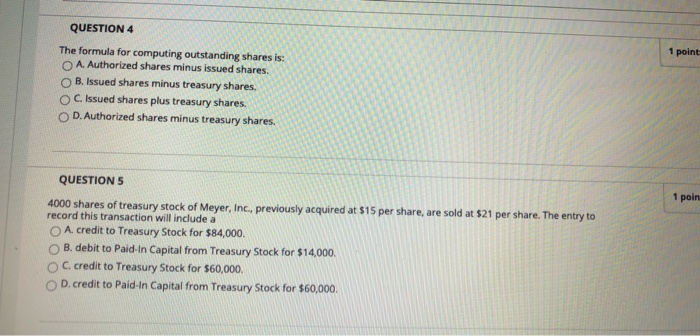

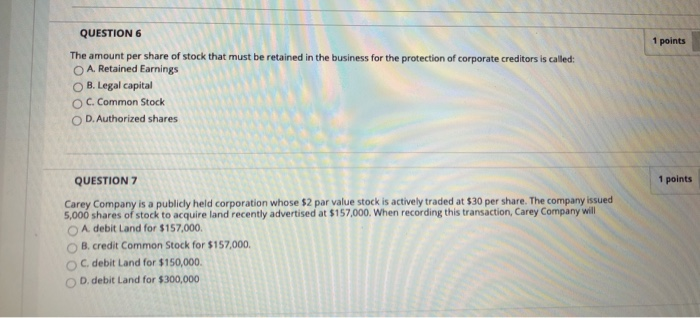

1 points Save Answer QUESTION 1 Dugan Corporation had net income of $300,000. To close net income would involve: A Credit Capital $300,000 OB. Debit Income Summary $300,000 OC Credit Income Summary $300,000 D. Debit Retained Earnings $300,000 QUESTION 2 Authorized shares of common stock require a journal entry to record the information 1 points Saved O True False Question Completion Status: QUESTION 3 Jim Croce Corporation's stockholders' equity at December 31 consists of the following 1 points Preferred stock, 8%; $50 par value; call price $55 per share 100,000 shares authorized: 15,000 shares issued and outstanding $750,000 Common stock, 34 par value: 600,000 shares authorized; 777shares issued, and _7777 shares outstandin ...$2,000,000 Additional paid-in-capital in excess of par-Commo $1,000,000 Retained Earnings $ 500,000 Treasury Stock (16,000share $200,000 Compute the number of common shares issued: O A 200,000 OB. 208,000 C. 500,000 OD 600,000 1 point QUESTION 4 The formula for computing outstanding shares is: A. Authorized shares minus issued shares. B. Issued shares minus treasury shares. C. Issued shares plus treasury shares. OD. Authorized shares minus treasury shares. 1 poin QUESTION 5 4000 shares of treasury stock of Meyer, Inc., previously acquired at $15 per share are sold at $21 per share. The entry to record this transaction will include a A. credit to Treasury Stock for $84,000. OB. debit to Paid-In Capital from Treasury Stock for $14,000. C. credit to Treasury Stock for 560,000. OD. credit to Paid-In Capital from Treasury Stock for $60,000. QUESTION 6 1 points The amount per share of stock that must be retained in the business for the protection of corporate creditors is called: A. Retained Earnings OB. Legal capital OC. Common Stock D. Authorized shares 1 points QUESTION 7 Carey Company is a publicly held corporation whose 52 par value stock is actively traded at $30 per share. The company issued 5,000 shares of stock to acquire land recently advertised at $157,000. When recording this transaction, Carey Company will A debit Land for $157,000. B. credit Common Stock for $157,000. C. debit Land for $150,000. D. debit Land for $300,000