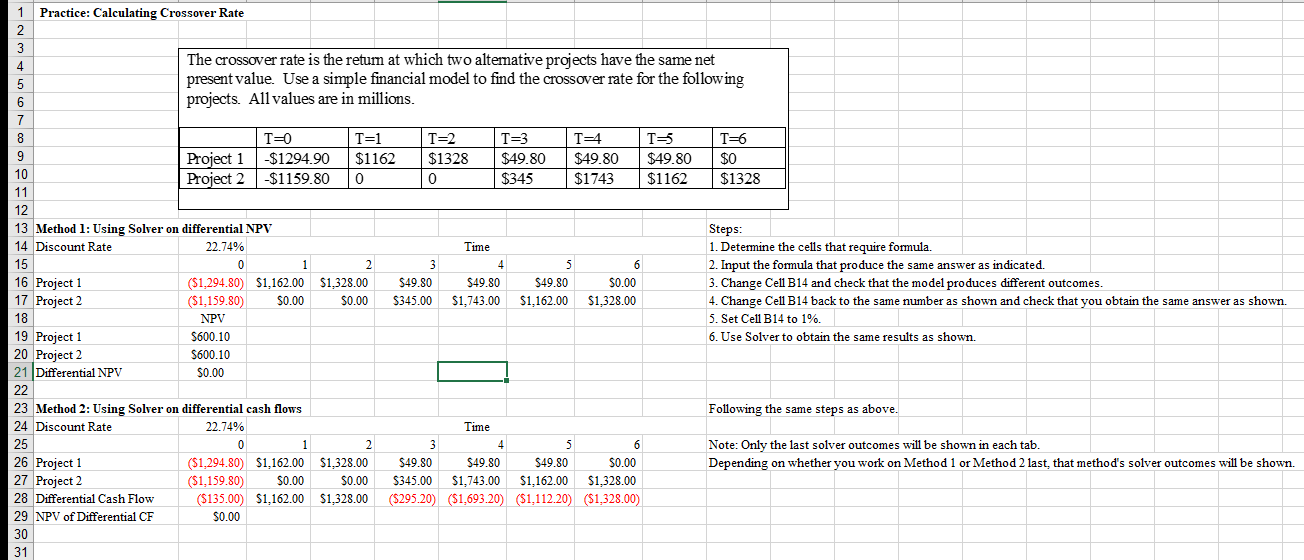

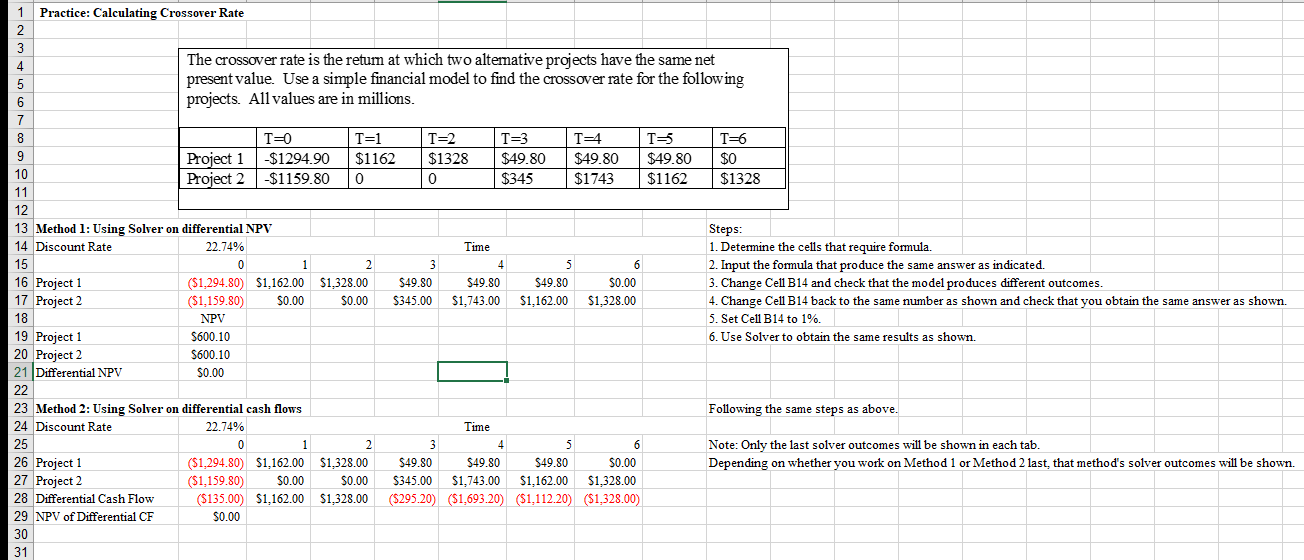

1 Practice: Calculating Crossover Rate 2 3 4 The crossover rate is the retum at which two alternative projects have the same net 5 present value. Use a simple financial model to find the crossover rate for the following 6 projects. All values are in millions. 7 8 T=0 T=1 T=2 T=3 T-4 T35 T=6 9 Project 1 -$1294.90 $1162 $1328 $49.80 $49.80 $49.80 $0 10 Project 2 -$1159.80 0 0 $345 $1743 $1162 $1328 11 12 13 Method 1: Using Solver on differential NPV Steps: 14 Discount Rate 22.74% Time 1. Determine the cells that require formula. 15 4 2. Input the formula that produce the same answer as indicated. 16 Project 1 ($1,294.80) $1,162.00 $1,328.00 $49.80 $49.80 $49.80 $0.00 3. Change Cell B14 and check that the model produces different outcomes. 17 Project 2 ($1,159.80) $0.00 $0.00 $345.00 $1,743.00 $1,162.00 $1,328.00 4. Change Cell B14 back to the same number as shown and check that you obtain the same answer as shown. 18 NPV 5. Set Cell B14 to 1%. 19 Project 1 $600.10 6. Use Solver to obtain the same results as shown. 20 Project 2 $600.10 21 Differential NPV $0.00 22 23 Method 2: Using Solver on differential cash flows Following the same steps as above. 24 Discount Rate 22.74% Time 25 0 1 5 6 Note: Only the last solver outcomes will be shown in each tab. Project 1 ($1,294.80) $1,162.0 $1,328.00 $49.80 $49.80 $49.80 $0.00 Depending on whether you work on Method 1 or Method 2 last, that method's solver outcomes will shown 27 Project 2 ($1,159.80) $0.00 $0.00 $345.00 $1,743.00 $1.162.00 $1,328.00 28 Differential Cash Flow ($135.00) $1,162.00 $1,328.00 ($295.20) ($1,693.20) ($1.112.20) ($1,328.00) 29 NPV of Differential CF $0.00 30 31 1 Practice: Calculating Crossover Rate 2 3 4 The crossover rate is the retum at which two alternative projects have the same net 5 present value. Use a simple financial model to find the crossover rate for the following 6 projects. All values are in millions. 7 8 T=0 T=1 T=2 T=3 T-4 T35 T=6 9 Project 1 -$1294.90 $1162 $1328 $49.80 $49.80 $49.80 $0 10 Project 2 -$1159.80 0 0 $345 $1743 $1162 $1328 11 12 13 Method 1: Using Solver on differential NPV Steps: 14 Discount Rate 22.74% Time 1. Determine the cells that require formula. 15 4 2. Input the formula that produce the same answer as indicated. 16 Project 1 ($1,294.80) $1,162.00 $1,328.00 $49.80 $49.80 $49.80 $0.00 3. Change Cell B14 and check that the model produces different outcomes. 17 Project 2 ($1,159.80) $0.00 $0.00 $345.00 $1,743.00 $1,162.00 $1,328.00 4. Change Cell B14 back to the same number as shown and check that you obtain the same answer as shown. 18 NPV 5. Set Cell B14 to 1%. 19 Project 1 $600.10 6. Use Solver to obtain the same results as shown. 20 Project 2 $600.10 21 Differential NPV $0.00 22 23 Method 2: Using Solver on differential cash flows Following the same steps as above. 24 Discount Rate 22.74% Time 25 0 1 5 6 Note: Only the last solver outcomes will be shown in each tab. Project 1 ($1,294.80) $1,162.0 $1,328.00 $49.80 $49.80 $49.80 $0.00 Depending on whether you work on Method 1 or Method 2 last, that method's solver outcomes will shown 27 Project 2 ($1,159.80) $0.00 $0.00 $345.00 $1,743.00 $1.162.00 $1,328.00 28 Differential Cash Flow ($135.00) $1,162.00 $1,328.00 ($295.20) ($1,693.20) ($1.112.20) ($1,328.00) 29 NPV of Differential CF $0.00 30 31