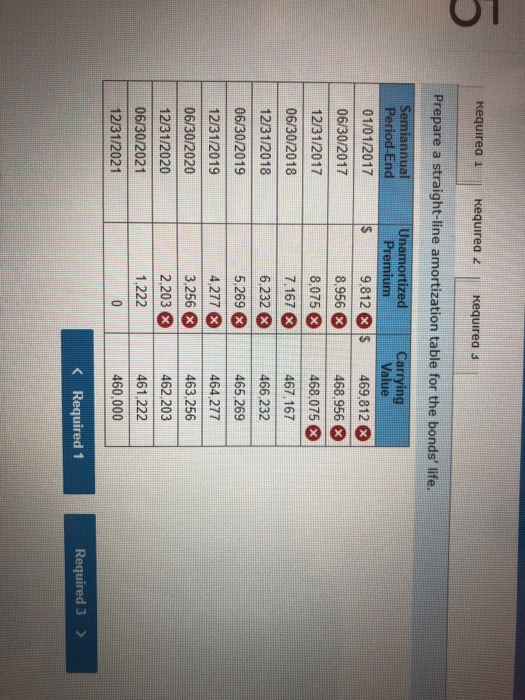

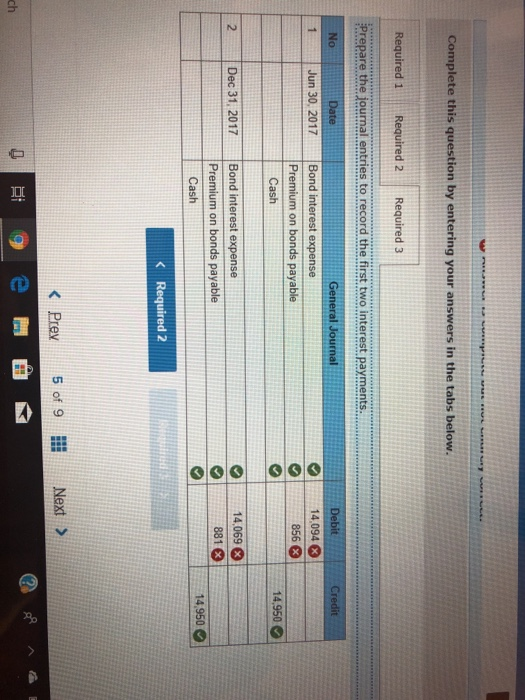

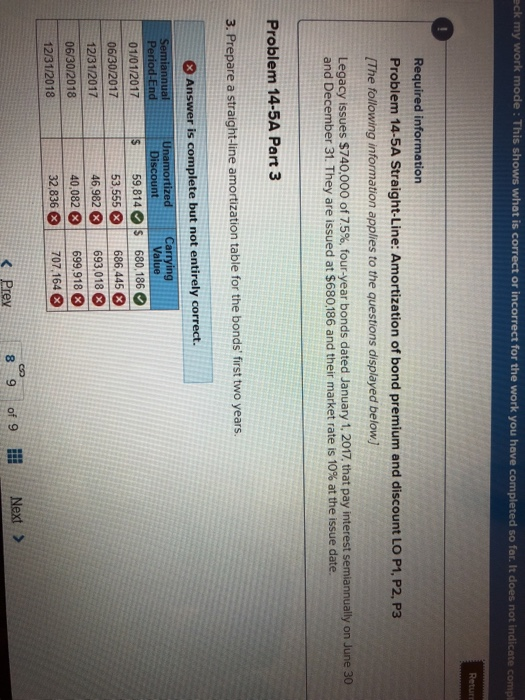

1 Premium Bonds Help eck my work mode : This shows what is correct or incorrect for the work you have completed so for. It does not indicate c Problem 14-4A Straight-Line: Amortization of bond premium LO P1, P3 Ellis issues 6.5%, five-year bonds dated January 1, 2017, with a S460000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $469,810 The annual market rate is 6% on the issue date. 1. Complete the below table to calculate the total bond interest expense over the bonds' life. 2. Prepare a straight-line amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare a straight-line amortization table for the bonds' life. Carrying Value End Prepare a straight-line amortization table for the bonds' life. Semiannual Period-End Unamortized Premium Carrying Value 01/01/2017 06/30/2017 12/31/2017 06/30/2018 12/31/2018 06/30/2019 12/31/2019 06/30/2020 12/31/2020 06/30/2021 12/31/2021 9,812 S 469,812 468.956 8,075468,075 467.167 6.232466,232 465.269 464,277 463,256 462.203 461 222 460,000 8.956 C) 7167A67 1S7 5,269 4,277 2,203 1,222 K Required 1 Required 3 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 prepare the journal entries to record the first two interest payments No Debit Premium on bonds payable 856 14,950 Cash 2 Dec 31,2017 Bond interest expense 881 Premium on bonds payable 14,950 O Cash Required 2 K Prev 5 of 9 l Next e ch eck my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not ind ted Required information Problem 14-5A Straight-Line: Amortization of bond premium and discount LO P1, P2, P3 (The following information applies to the questions displayed below] Legacy issues S740000 of 75% four-year bonds dated January 1, 2017, that pay interest semiannually on June 30 and December 31. They are issued at $680186 and their market rate is 10% at the issue date. Problem 14-5A Part 3 3. Prepare a straight-ine amortization table for the bonds first two years. t entirely correct. Unamortized Carrying Value Period-End 01/01/201759.814S 680,186 06/30/20175 53,555 686.445 46,982 693,018 12/31/2017 06/30/2018 12/31/2018 40,082 699,918 32.836 3 707.164 3