Question

1. Prepaid a one-year premium on liability insurance with cash, $876. Account: Account: 2. Billed participants for karate lessons, $2,200. Account: Account: 3. Prepaid six

1.

Prepaid a one-year premium on liability insurance with cash, $876.

Account:

Account:

2.

Billed participants for karate lessons, $2,200.

Account:

Account:

3.

Prepaid six months rent with cash, $6,450.

Account:

Account:

Answer 1:

Answer 2:

4.

Received cash of $2,200 on account from participants.

Account:

Account:

5.

For this business event, please list the all debits before any credits, and when multiple debits, or credits, are required, please list them from largest to smallest (largest dollar value debit goes first, then next largest debit goes next, etc. After all debits are listed, the largest dollar credit goes next, then the next largest dollar value credit, etc.).

Purchased equipment for $4,750, paying $950 in cash, with the balance due in 30 days.

Account:

Account:

Account:

6.

Paid $3,800 on account for the balance due on equipment.

Account:

Account:

7.

Billed participants for karate lessons, $2,000.

Account:

Account:

8.Paid assistants wages in cash, $950.

Account:

Account:

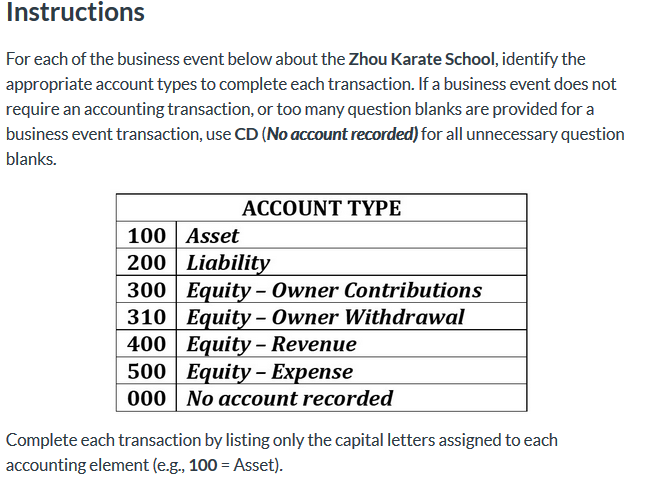

Instructions For each of the business event below about the Zhou Karate School, identify the appropriate account types to complete each transaction. If a business event does not require an accounting transaction, or too many question blanks are provided for a business event transaction, use CD (No account recorded) for all unnecessary question blanks. ACCOUNT TYPE 100 Asset 200 Liability 300 Equity - Owner Contributions 310 Equity - Owner Withdrawal 400 Equity - Revenue 500 Equity - Expense 000 No account recorded Complete each transaction by listing only the capital letters assigned to each accounting element (e.g., 100 = Asset)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started