Answered step by step

Verified Expert Solution

Question

1 Approved Answer

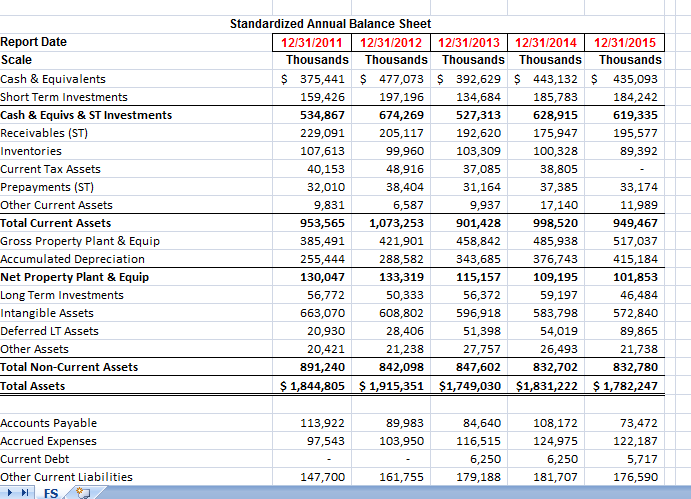

1) Prepare a common size balance sheet by expressing each item on the balance sheet as a percent of total asset. Based on your common

1) Prepare a common size balance sheet by expressing each item on the balance sheet as a percent of total asset. Based on your common size balance sheet, what is total non-current assets to total assets average ratio over the period 2011 to 2015?

Standardized Annual Balance Sheet Report Date Scale Cash & Equivalents Short Term Investments Cash & Equivs & ST Investments Receivables (ST) Inventories Current Tax Assets Prepayments (ST) Other Current Assets Total Current Assets Gross Property Plant & Equip Accumulated Depreciation Net Property Plant & Equip Long Term Investments Intangible Assets Deferred LT Assets Other Assets Total Non-Current Assets Total Assets 12/31/2011 12/31/2012 12/31/2013 12/31/2014 12/31/2015 Thousands Thousands Thousands Thousands Thousands $ 375,441 $ 477,073 392,629 443,132 435,093 184,242 619,335 195,577 89,392 134,684 527,313 192,620 103,309 37,085 185,783 628,915 175,947 100,328 38,805 197,196 674,269 205,117 99,960 48,916 38,404 6,587 953,565 1,073,253 421,901 288,582 133,319 50,333 608,802 28,406 21,238 842,098 159,426 534,867 229,091 107,613 40,153 32,010 9,831 11,989 949,467 517,037 415,184 101,853 46,484 572,840 89,865 21,738 832,780 $1,844,805 $1,915,351 $1,749,030 $1,831,222 1,782,247 9,937 901,428 458,842 343,685 115,157 56,372 596,918 51,398 27,757 847,602 385,491 255,444 13 485,938 376,743 109,195 56,772 663,070 20,930 20,421 891,240 583,798 54,019 26,493 832,702 89,983 103,950 Accounts Payable Accrued Expenses Current Debt Other Current Liabilities 73,472 122,187 108,172 113,922 97,543 84,640 116,515 147,700 161,755 179,188 181,707 176,590Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started