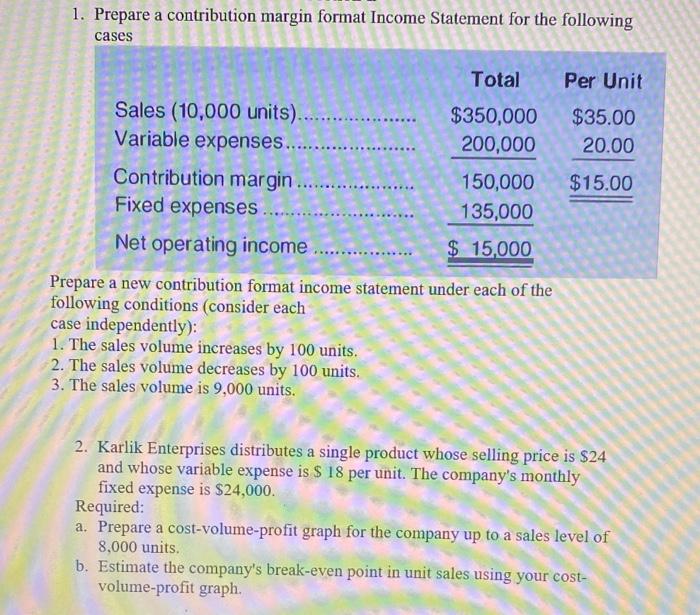

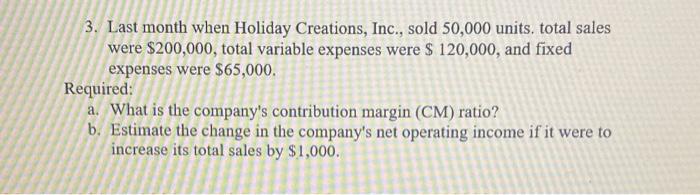

1. Prepare a contribution margin format Income Statement for the following cases Total Per Unit $35.00 20.00 $15.00 Sales (10,000 units).... $350,000 Variable expenses.... 200,000 Contribution margin 150,000 Fixed expenses 135,000 Net operating income $ 15,000 Prepare a new contribution format income statement under each of the following conditions (consider each case independently): 1. The sales volume increases by 100 units. 2. The sales volume decreases by 100 units. 3. The sales volume is 9,000 units. 2. Karlik Enterprises distributes a single product whose selling price is $24 and whose variable expense is $ 18 per unit. The company's monthly fixed expense is $24,000. Required: a. Prepare a cost-volume-profit graph for the company up to a sales level of 8,000 units. b. Estimate the company's break-even point in unit sales using your cost- volume-profit graph 3. Last month when Holiday Creations, Inc., sold 50,000 units. total sales were $200,000, total variable expenses were $ 120,000, and fixed expenses were $65,000. Required: a. What is the company's contribution margin (CM) ratio? b. Estimate the change in the company's net operating income if it were to increase its total sales by $1,000. 1. Prepare a contribution margin format Income Statement for the following cases Total Per Unit $35.00 20.00 $15.00 Sales (10,000 units).... $350,000 Variable expenses.... 200,000 Contribution margin 150,000 Fixed expenses 135,000 Net operating income $ 15,000 Prepare a new contribution format income statement under each of the following conditions (consider each case independently): 1. The sales volume increases by 100 units. 2. The sales volume decreases by 100 units. 3. The sales volume is 9,000 units. 2. Karlik Enterprises distributes a single product whose selling price is $24 and whose variable expense is $ 18 per unit. The company's monthly fixed expense is $24,000. Required: a. Prepare a cost-volume-profit graph for the company up to a sales level of 8,000 units. b. Estimate the company's break-even point in unit sales using your cost- volume-profit graph 3. Last month when Holiday Creations, Inc., sold 50,000 units. total sales were $200,000, total variable expenses were $ 120,000, and fixed expenses were $65,000. Required: a. What is the company's contribution margin (CM) ratio? b. Estimate the change in the company's net operating income if it were to increase its total sales by $1,000