Question

(1) prepare a statement of cash flows using the indirect method; (2) prepare a vertical analysis for both the income statement and the balance sheet;

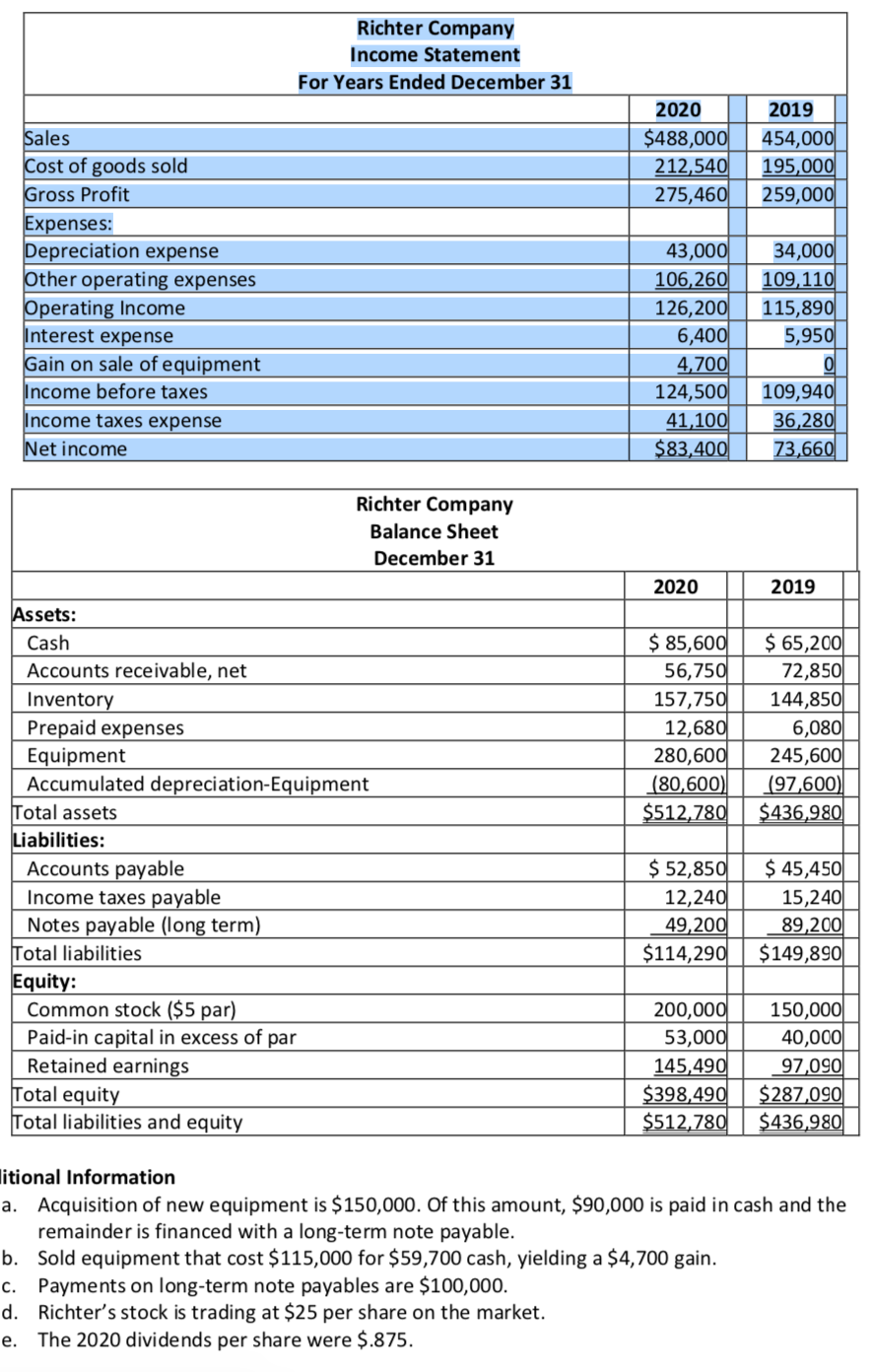

(1) prepare a statement of cash flows using the indirect method;

(2) prepare a vertical analysis for both the income statement and the balance sheet;

(3) prepare a horizontal analysis for both the income statement and the balance sheet; and

(4) calculate at least one ratio from each of the four categories we discussed in class (liquidity/efficiency, solvency, profitability and market prospects). This means you will have a minimum of four ratios. Every student's submission should have different ratios. If they do not, I will assume you were working together and you will receive a zero on this entire assignment.

Richter Company Income Statement For Years Ended December 31 2020 $488,000 212,540 275,460 2019 454,000 195,000 259,000 Sales Cost of goods sold Gross Profit Expenses: Depreciation expense Other operating expenses Operating Income Interest expense Gain on sale of equipment Income before taxes Income taxes expense Net income 34,000 109,110 115,890 5,950 43,000 106,260 126,200 6,400 4,700 124,500 41,100 $83,400 109,940 36,280 73,660 Richter Company Balance Sheet December 31 2020 2019 | $ 85,600 56,750 157,750 12,680 280,600 (80,600) $512,780 $ 65,200 72,850 144,850 6,080 245,600 (97,600) $436,980 Assets: Cash Accounts receivable, net Inventory Prepaid expenses Equipment Accumulated depreciation-Equipment Total assets Liabilities: Accounts payable Income taxes payable Notes payable (long term) Total liabilities Equity: Common stock ($5 par) Paid-in capital in excess of par Retained earnings Total equity Total liabilities and equity $ 52,850 12,240 49,200 $114,290 $ 45,450 15,240 89,200 $149,890 200,000 53,000 145,490 $398,490 $512,780 150,000 40,000 97,090 $287,090 $436,980 litional Information a. Acquisition of new equipment is $150,000. Of this amount, $90,000 is paid in cash and the remainder is financed with a long-term note payable. b. Sold equipment that cost $115,000 for $59,700 cash, yielding a $4,700 gain. c. Payments on long-term note payables are $100,000. d. Richter's stock is trading at $25 per share on the market. e. The 2020 dividends per share were $.875. Richter Company Income Statement For Years Ended December 31 2020 $488,000 212,540 275,460 2019 454,000 195,000 259,000 Sales Cost of goods sold Gross Profit Expenses: Depreciation expense Other operating expenses Operating Income Interest expense Gain on sale of equipment Income before taxes Income taxes expense Net income 34,000 109,110 115,890 5,950 43,000 106,260 126,200 6,400 4,700 124,500 41,100 $83,400 109,940 36,280 73,660 Richter Company Balance Sheet December 31 2020 2019 | $ 85,600 56,750 157,750 12,680 280,600 (80,600) $512,780 $ 65,200 72,850 144,850 6,080 245,600 (97,600) $436,980 Assets: Cash Accounts receivable, net Inventory Prepaid expenses Equipment Accumulated depreciation-Equipment Total assets Liabilities: Accounts payable Income taxes payable Notes payable (long term) Total liabilities Equity: Common stock ($5 par) Paid-in capital in excess of par Retained earnings Total equity Total liabilities and equity $ 52,850 12,240 49,200 $114,290 $ 45,450 15,240 89,200 $149,890 200,000 53,000 145,490 $398,490 $512,780 150,000 40,000 97,090 $287,090 $436,980 litional Information a. Acquisition of new equipment is $150,000. Of this amount, $90,000 is paid in cash and the remainder is financed with a long-term note payable. b. Sold equipment that cost $115,000 for $59,700 cash, yielding a $4,700 gain. c. Payments on long-term note payables are $100,000. d. Richter's stock is trading at $25 per share on the market. e. The 2020 dividends per share were $.875Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started