Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Prepare a variable Costing Income Statement for September 30th 2) Prepare a balance sheet and Income statement for September 30th BUSINESS PUBLISHING UNIVERSITY VIRGINIA

1) Prepare a variable Costing Income Statement for September 30th

2) Prepare a balance sheet and Income statement for September 30th

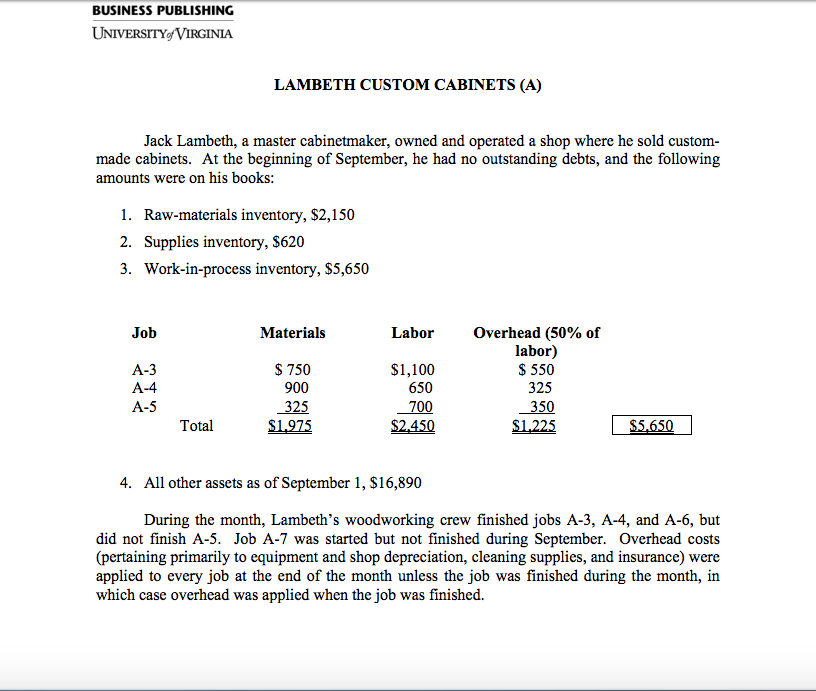

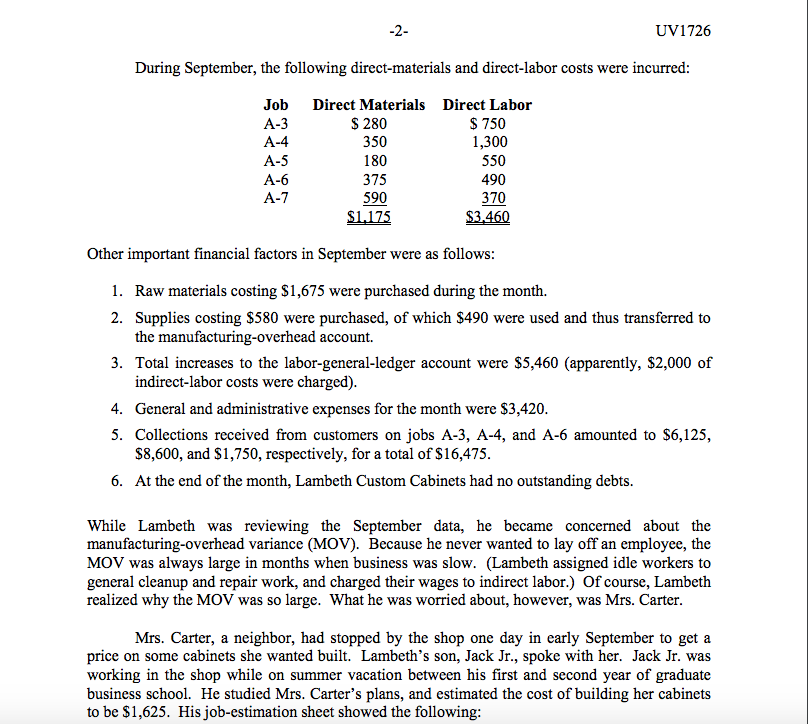

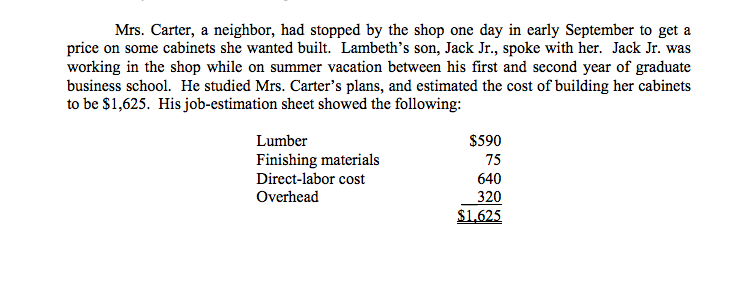

BUSINESS PUBLISHING UNIVERSITY VIRGINIA LAMBETH CUSTOM CABINETS (A) Jack Lambeth, a master cabinetmaker, owned and operated a shop where he sold custom- made cabinets. At the beginning of September, he had no outstanding debts, and the following amounts were on his books: 1. Raw-materials inventory, $2,150 2. Supplies inventory, $620 3. Work-in-process inventory, $5,650 Materials Job Labor Overhead (50% of labor) 750 A-3 $1,100 550 900 650 A-4 325 325 700 350 A-5 Total 4. All other assets as of September 1, S16,890 During the month, Lambeth's woodworking crew finished jobs A-3, A-4, and A-6, but did not finish A-5. Job A-7 was started but not finished during September. Overhead costs (pertaining primarily to equipment and shop depreciation, cleaning supplies, and insurance) were applied to every job at the end of the month unless the job was finished during the month, in which case overhead was applied when the job was finishedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started