Question

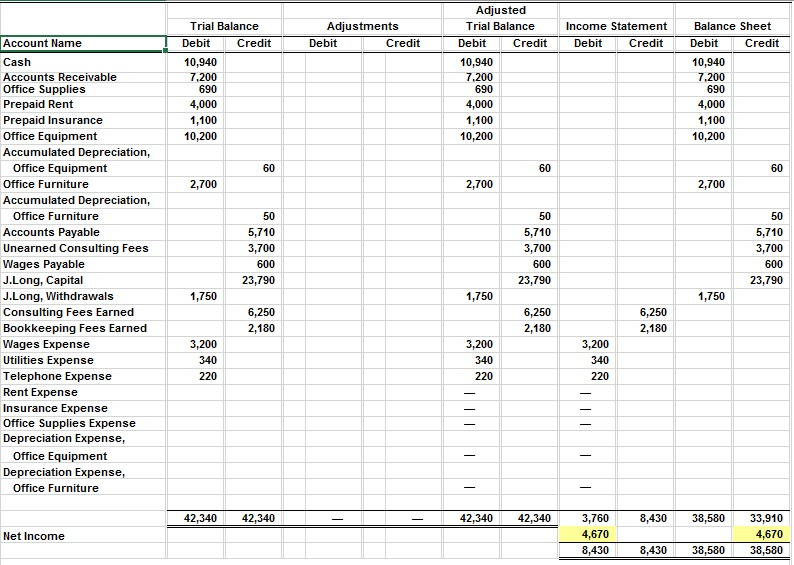

1. Prepare adjusting entries in a worksheet using the information below: Paid an extra $480 in wages accrued by the end of June. Consulting services

1. Prepare adjusting entries in a worksheet using the information below: Paid an extra $480 in wages accrued by the end of June. Consulting services performed (that will not be billed until July) total $380. Performed consulting services for which payment had been received in advance that amounted to $1,460. Depreciation on office equipment for June is $320. Depreciation on office furniture for June is $200. An inventory of office supplies shows $200 still on hand as of June 30. One months prepaid insurance has expired in the amount of $100. Milestone 1 - One months prepaid rent has expired in the amount of $2,000. 2. Record the closing entries and post them to the ledger accounts. 3. Prepare a post-closing trial balance

Trial Balance Trial Balance Income Statement Balance Sheet Adjustments Debit T Credit Debit Credit Debit Credit Debit Credit Debit Credit 10,940 10,940 10,940 Accounts Receivable Office Supplies 4,000 4,000 4,000 Prepaid Rent 1,100 1,100 1,100 Prepaid Insurance 10,200 10, 200 10, 200 Office Equipment Accumulated Depreciation, 60 60 60 Office Equipment 2,700 2,700 2,700 Office Furniture Accumulated Depreciation, 50 50 50 Office Furniture Accounts payable 5,710 5,710 5,710 3,700 3700 3700 Unearned Consulting Fees 600 600 600 Wages Payable J.Long, Capital 23,790 23,790 23,790 J.Long, Withdrawals 11750 1,750 1,750 6 250 6 250 250 Consulting Fees Earned Bookkeeping Fees Earned 2,180 2,180 2,180 3 200 3,200 3, 200 Wages Expense 340 340 340 Utilities Expense 220 220 220 Telephone Expense Rent Expense Insurance Expense Office Supplies Expense Depreciation Expense, office Equipment Depreciation Expense, Office Furniture 42,340 42,340 42,340 42,340 3,760 8, 430 38,580 33,910 Net Income 430 38 580 308 580 8,430Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started