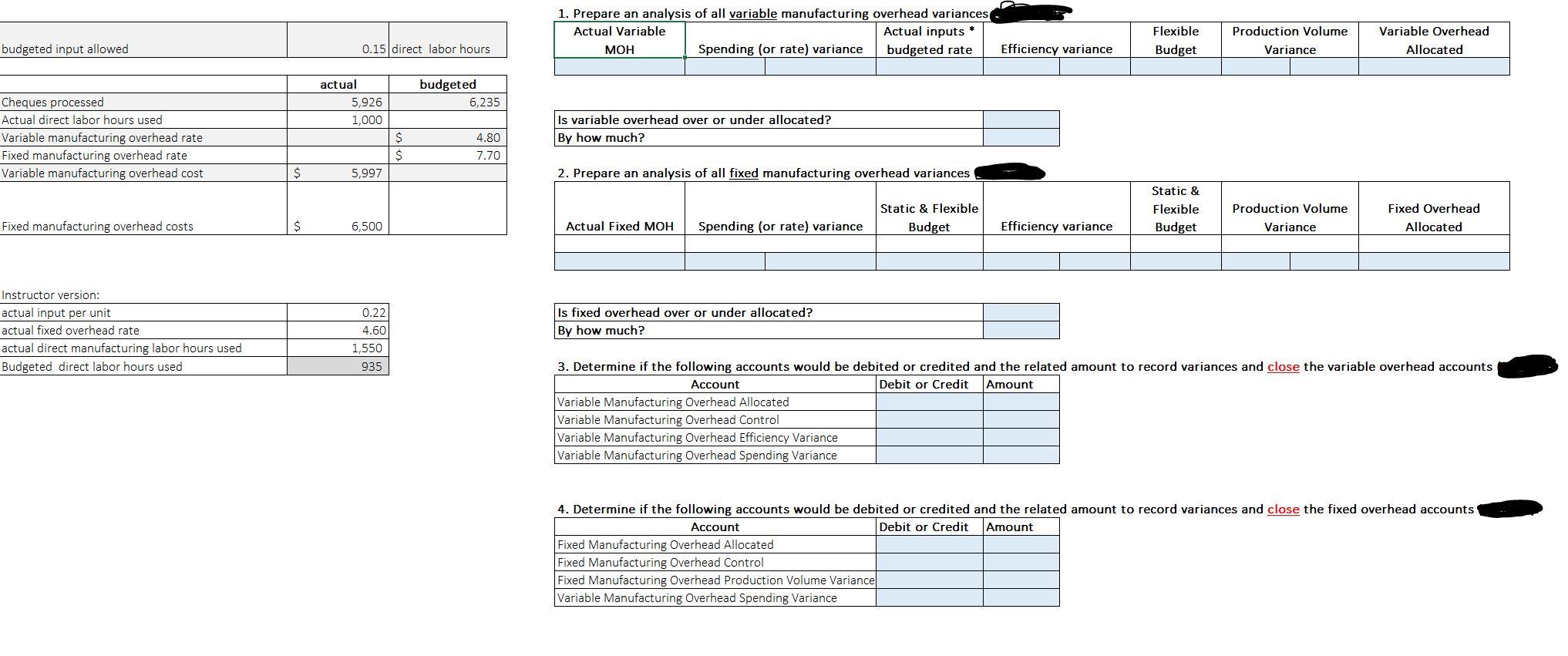

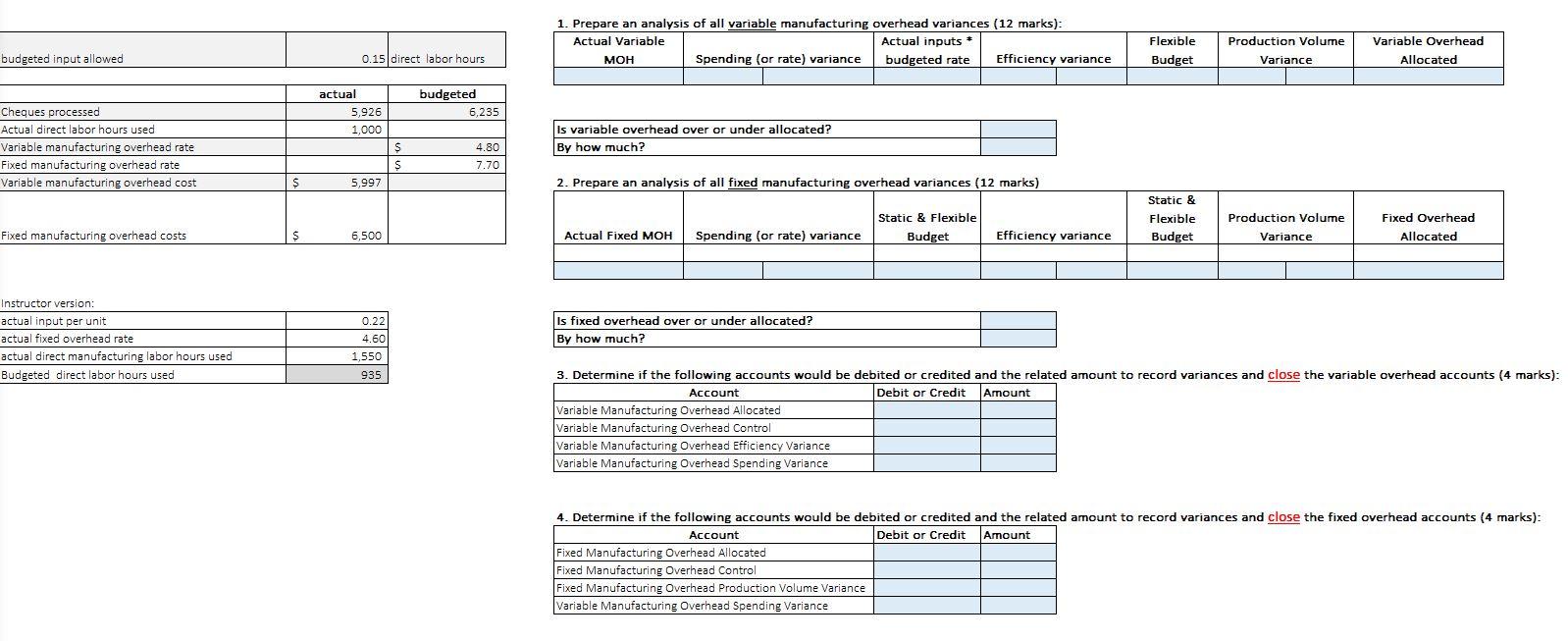

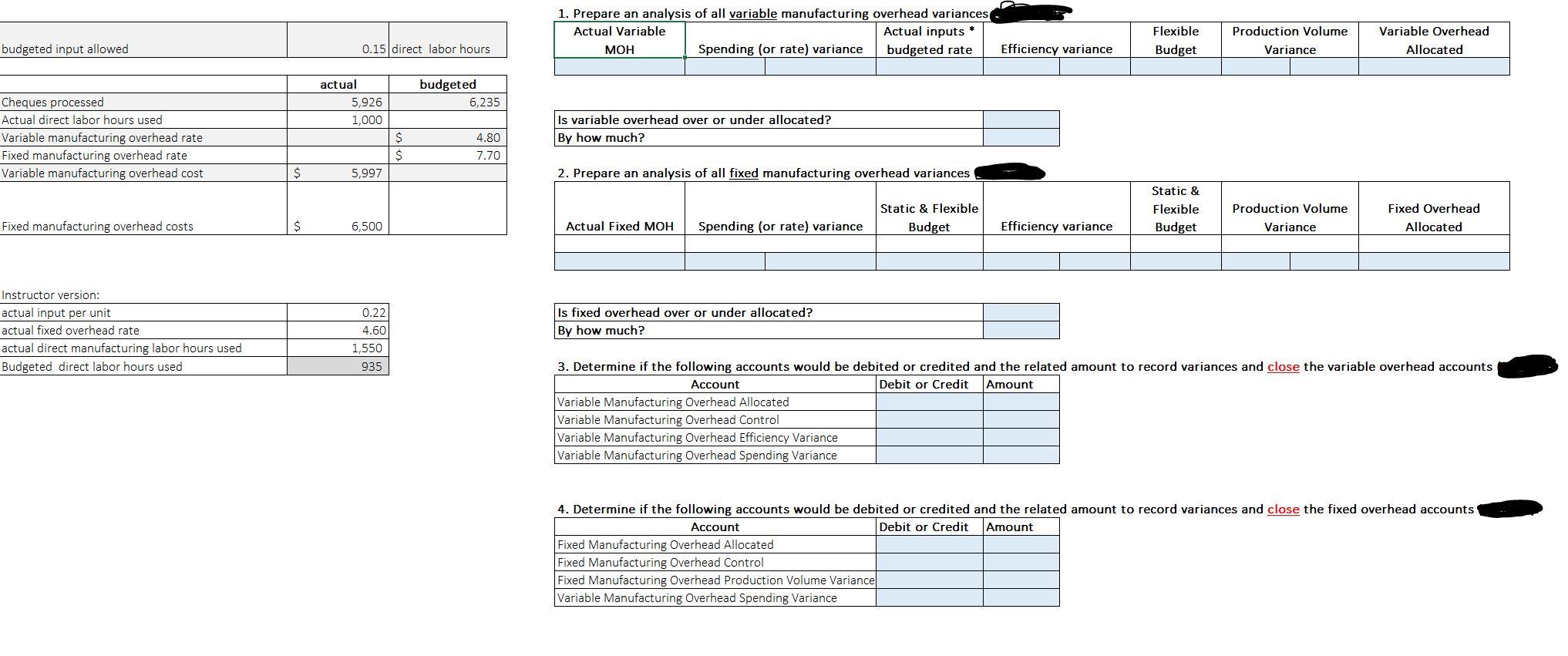

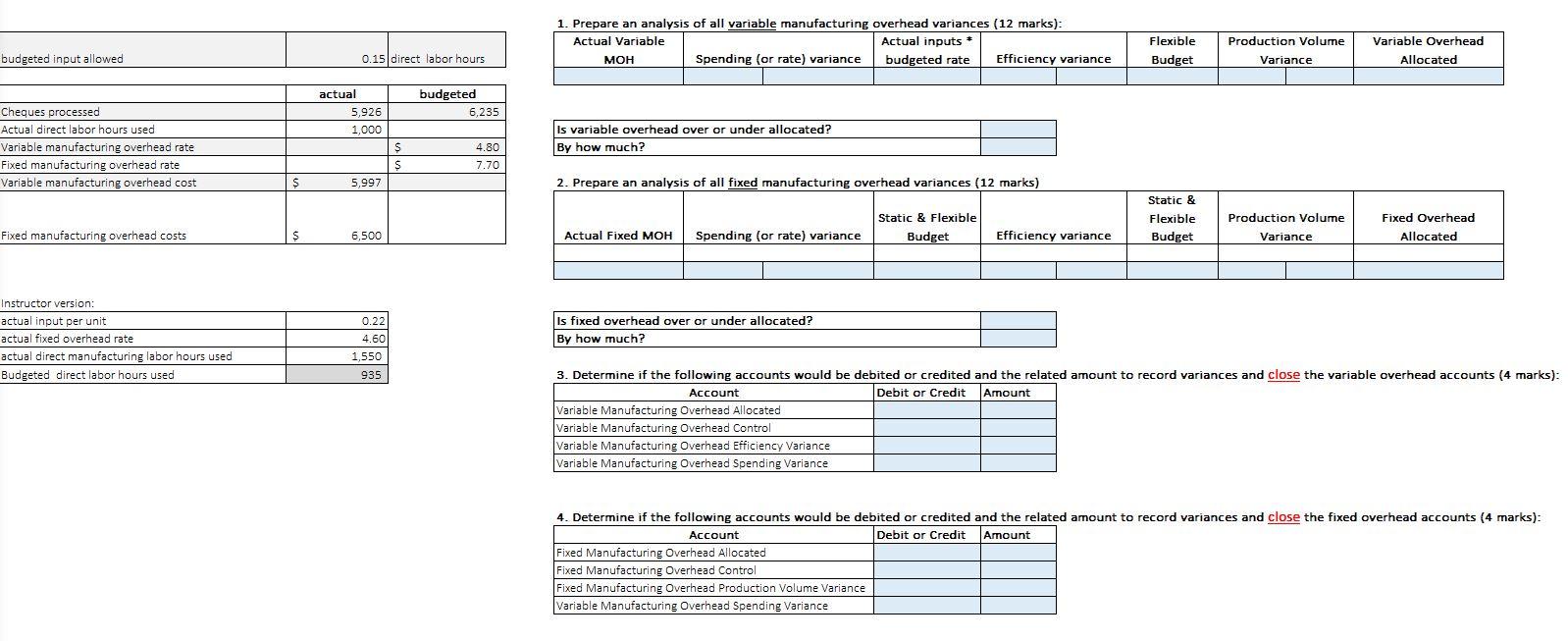

1. Prepare an analysis of all variable manufacturing overhead variances Actual Variable Actual inputs * MOH Spending (or rate) variance budgeted rate Efficiency variance Production Volume Variance Flexible Budget Variable Overhead Allocated budgeted input allowed 0.15 direct labor hours actual 5,926 1,000 budgeted 6,235 Cheques processed Actual direct labor hours used Variable manufacturing overhead rate Fixed manufacturing overhead rate Variable manufacturing overhead cost Is variable overhead over or under allocated? By how much? $ 4.80 7.70 5,997 2. Prepare an analysis of all fixed manufacturing overhead variances Static & Flexible Budget Static & Flexible Budget Production Volume Variance Fixed Overhead Allocated Fixed manufacturing overhead costs $ 6,500 Actual Fixed MOH Spending (or rate) variance Efficiency variance Instructor version: actual input per unit actual fixed overhead rate actual direct manufacturing labor hours used Budgeted direct labor hours used Is fixed overhead over or under allocated? By how much? 0.22 4.60 1,550 935 3. Determine if the following accounts would be debited or credited and the related amount to record variances and close the variable overhead accounts Account Debit or Credit Amount Variable Manufacturing Overhead Allocated Variable Manufacturing Overhead Control Variable Manufacturing Overhead Efficiency Variance Variable Manufacturing Overhead Spending Variance 4. Determine if the following accounts would be debited or credited and the related amount to record variances and close the fixed overhead accounts Account Debit or Credit Amount Fixed Manufacturing Overhead Allocated Fixed Manufacturing Overhead Control Fixed Manufacturing Overhead Production Volume Variance Variable Manufacturing Overhead Spending Variance 1. Prepare an analysis of all variable manufacturing overhead variances (12 marks): Actual Variable Actual inputs * MOH Spending (or rate) variance budgeted rate Efficiency variance Flexible Budget Production Volume Variance Variable Overhead Allocated budgeted input allowed 0.15 direct labor hours actual budgeted 6,235 5,926 1,000 Cheques processed Actual direct labor hours used Variable manufacturing overhead rate Fixed manufacturing overhead rate Variable manufacturing overhead cost is variable overhead over or under allocated? By how much? S S 4.80 7.70 $ 5,997 2. Prepare an analysis of all fixed manufacturing overhead variances (12 marks) Static & Flexible & Static & Flexible Budget Production Volume Variance Fixed Overhead Allocated Fixed manufacturing overhead costs $ 6,500 Actual Fixed MOH Budget Spending (or rate) variance Efficiency variance Instructor version: actual input per unit actual fixed overhead rate actual direct manufacturing labor hours used Budgeted direct labor hours used 0.22 4.60 1,550 Is fixed overhead over or under allocated? ? By how much? 935 3. Determine if the following accounts would be debited or credited and the related amount to record variances and close the variable overhead accounts (4 marks): Account Debit or Credit Amount Variable Manufacturing Overhead Allocated Variable Manufacturing Overhead Control Variable Manufacturing Overhead Efficiency Variance Variable Manufacturing Overhead Spending Variance 4. Determine if the following accounts would be debited or credited and the related amount to record variances and close the fixed overhead accounts (4 marks): Account Debit or Credit Amount Fixed Manufacturing Overhead Allocated Fixed Manufacturing Overhead Control Fixed Manufacturing Overhead Production Volume Variance Variable Manufacturing Overhead Spending Variance 1. Prepare an analysis of all variable manufacturing overhead variances Actual Variable Actual inputs * MOH Spending (or rate) variance budgeted rate Efficiency variance Production Volume Variance Flexible Budget Variable Overhead Allocated budgeted input allowed 0.15 direct labor hours actual 5,926 1,000 budgeted 6,235 Cheques processed Actual direct labor hours used Variable manufacturing overhead rate Fixed manufacturing overhead rate Variable manufacturing overhead cost Is variable overhead over or under allocated? By how much? $ 4.80 7.70 5,997 2. Prepare an analysis of all fixed manufacturing overhead variances Static & Flexible Budget Static & Flexible Budget Production Volume Variance Fixed Overhead Allocated Fixed manufacturing overhead costs $ 6,500 Actual Fixed MOH Spending (or rate) variance Efficiency variance Instructor version: actual input per unit actual fixed overhead rate actual direct manufacturing labor hours used Budgeted direct labor hours used Is fixed overhead over or under allocated? By how much? 0.22 4.60 1,550 935 3. Determine if the following accounts would be debited or credited and the related amount to record variances and close the variable overhead accounts Account Debit or Credit Amount Variable Manufacturing Overhead Allocated Variable Manufacturing Overhead Control Variable Manufacturing Overhead Efficiency Variance Variable Manufacturing Overhead Spending Variance 4. Determine if the following accounts would be debited or credited and the related amount to record variances and close the fixed overhead accounts Account Debit or Credit Amount Fixed Manufacturing Overhead Allocated Fixed Manufacturing Overhead Control Fixed Manufacturing Overhead Production Volume Variance Variable Manufacturing Overhead Spending Variance 1. Prepare an analysis of all variable manufacturing overhead variances (12 marks): Actual Variable Actual inputs * MOH Spending (or rate) variance budgeted rate Efficiency variance Flexible Budget Production Volume Variance Variable Overhead Allocated budgeted input allowed 0.15 direct labor hours actual budgeted 6,235 5,926 1,000 Cheques processed Actual direct labor hours used Variable manufacturing overhead rate Fixed manufacturing overhead rate Variable manufacturing overhead cost is variable overhead over or under allocated? By how much? S S 4.80 7.70 $ 5,997 2. Prepare an analysis of all fixed manufacturing overhead variances (12 marks) Static & Flexible & Static & Flexible Budget Production Volume Variance Fixed Overhead Allocated Fixed manufacturing overhead costs $ 6,500 Actual Fixed MOH Budget Spending (or rate) variance Efficiency variance Instructor version: actual input per unit actual fixed overhead rate actual direct manufacturing labor hours used Budgeted direct labor hours used 0.22 4.60 1,550 Is fixed overhead over or under allocated? ? By how much? 935 3. Determine if the following accounts would be debited or credited and the related amount to record variances and close the variable overhead accounts (4 marks): Account Debit or Credit Amount Variable Manufacturing Overhead Allocated Variable Manufacturing Overhead Control Variable Manufacturing Overhead Efficiency Variance Variable Manufacturing Overhead Spending Variance 4. Determine if the following accounts would be debited or credited and the related amount to record variances and close the fixed overhead accounts (4 marks): Account Debit or Credit Amount Fixed Manufacturing Overhead Allocated Fixed Manufacturing Overhead Control Fixed Manufacturing Overhead Production Volume Variance Variable Manufacturing Overhead Spending Variance