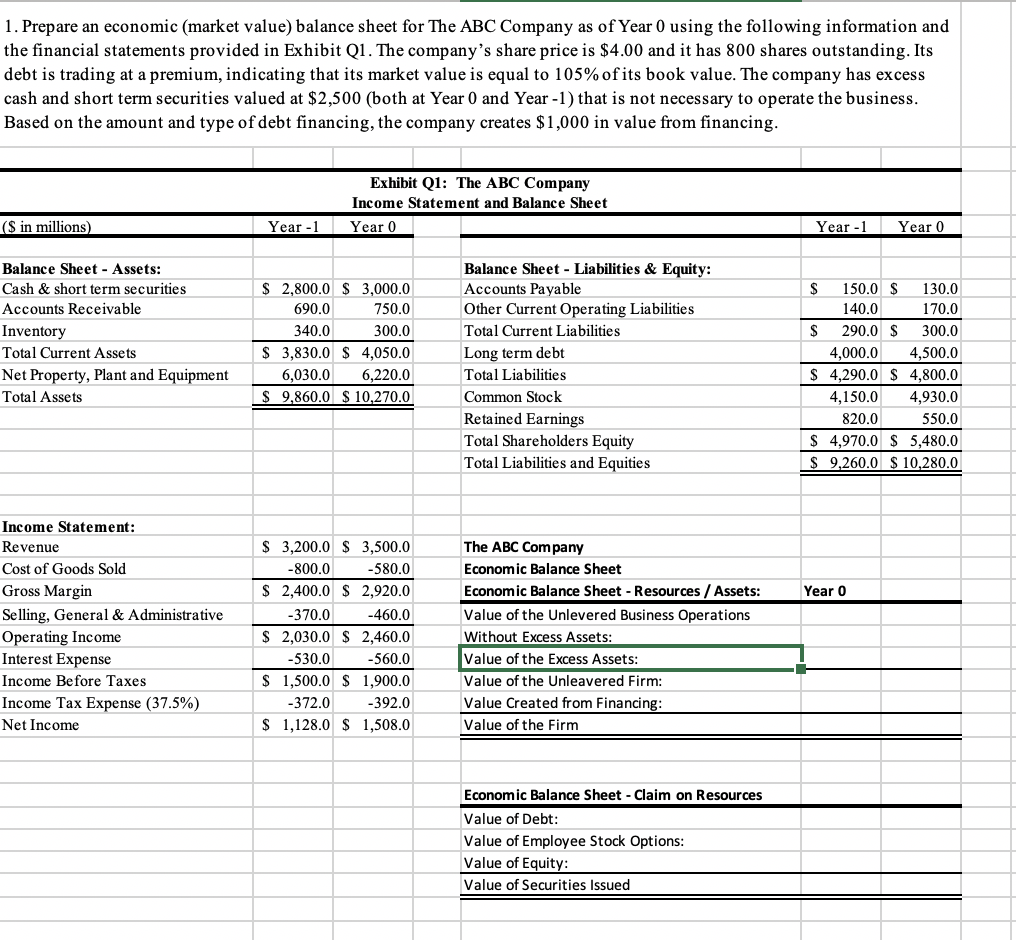

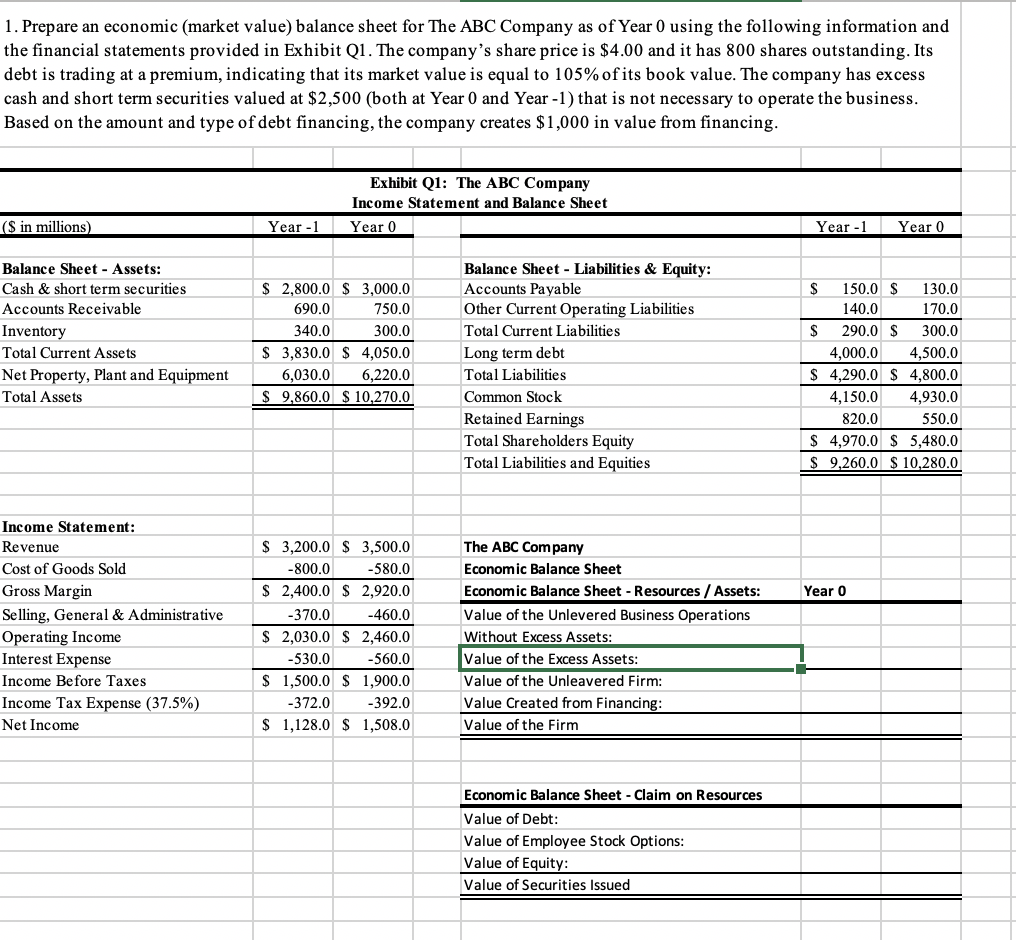

1. Prepare an economic (market value) balance sheet for The ABC Company as of Year 0 using the following information and the financial statements provided in Exhibit Q1. The company's share price is $4.00 and it has 800 shares outstanding. Its debt is trading at a premium, indicating that its market value is equal to 105% of its book value. The company has excess cash and short term securities valued at $2,500 (both at Year 0 and Year -1) that is not necessary to operate the business. Based on the amount and type of debt financing, the company creates $1,000 in value from financing. Exhibit Q1: The ABC Company Income Statement and Balance Sheet Year 0 (S in millions) Year - 1 Year - 1 Year 0 Balance Sheet - Assets: Cash & short term securities Accounts Receivable Inventory Total Current Assets Net Property, Plant and Equipment Total Assets $ 2,800.0 $3,000.0 690.0 750.0 340.0 300.0 $ 3,830.0 $ 4,050.0 6,030.0 6,220.0 $ 9,860.0 $ 10,270.0 Balance Sheet - Liabilities & Equity: Accounts Payable Other Current Operating Liabilities Total Current Liabilities Long term debt Total Liabilities Common Stock Retained Earnings Total Shareholders Equity otal Liabilities and Equities $ 150.0 $ 130.0 140.0 170.0 S 290.0 $ 300.0 4,000.0 4,500.0 $ 4,290.0 S 4,800.0 4,150.0 4,930.0 820.0 550.0 $ 4,970.0 $ 5,480.0 9,260.0 $ 10.280.0 Year 0 Income Statement: Revenue Cost of Goods Sold Gross Margin Selling, General & Administrative Operating Income Interest Expense Income Before Taxes Income Tax Expense (37.5%) Net Income $ 3,200.0 $ 3,500.0 -800.0 -580.0 $ 2,400.0 $ 2,920.0 -370.0 -460.0 $ 2,030.0 $ 2,460.0 -530.0 -560.0 $ 1,500.0 $ 1,900.0 -372.0 -392.0 $ 1,128.0 $ 1,508.0 The ABC Company Economic Balance Sheet Economic Balance Sheet - Resources / Assets: Value of the Unlevered Business Operations Without Excess Assets: Value of the Excess Assets: Value of the Unleavered Firm: Value Created from Financing: Value of the Firm Economic Balance Sheet - Claim on Resources Value of Debt: Value of Employee Stock Options: Value of Equity: Value of Securities Issued 1. Prepare an economic (market value) balance sheet for The ABC Company as of Year 0 using the following information and the financial statements provided in Exhibit Q1. The company's share price is $4.00 and it has 800 shares outstanding. Its debt is trading at a premium, indicating that its market value is equal to 105% of its book value. The company has excess cash and short term securities valued at $2,500 (both at Year 0 and Year -1) that is not necessary to operate the business. Based on the amount and type of debt financing, the company creates $1,000 in value from financing. Exhibit Q1: The ABC Company Income Statement and Balance Sheet Year 0 (S in millions) Year - 1 Year - 1 Year 0 Balance Sheet - Assets: Cash & short term securities Accounts Receivable Inventory Total Current Assets Net Property, Plant and Equipment Total Assets $ 2,800.0 $3,000.0 690.0 750.0 340.0 300.0 $ 3,830.0 $ 4,050.0 6,030.0 6,220.0 $ 9,860.0 $ 10,270.0 Balance Sheet - Liabilities & Equity: Accounts Payable Other Current Operating Liabilities Total Current Liabilities Long term debt Total Liabilities Common Stock Retained Earnings Total Shareholders Equity otal Liabilities and Equities $ 150.0 $ 130.0 140.0 170.0 S 290.0 $ 300.0 4,000.0 4,500.0 $ 4,290.0 S 4,800.0 4,150.0 4,930.0 820.0 550.0 $ 4,970.0 $ 5,480.0 9,260.0 $ 10.280.0 Year 0 Income Statement: Revenue Cost of Goods Sold Gross Margin Selling, General & Administrative Operating Income Interest Expense Income Before Taxes Income Tax Expense (37.5%) Net Income $ 3,200.0 $ 3,500.0 -800.0 -580.0 $ 2,400.0 $ 2,920.0 -370.0 -460.0 $ 2,030.0 $ 2,460.0 -530.0 -560.0 $ 1,500.0 $ 1,900.0 -372.0 -392.0 $ 1,128.0 $ 1,508.0 The ABC Company Economic Balance Sheet Economic Balance Sheet - Resources / Assets: Value of the Unlevered Business Operations Without Excess Assets: Value of the Excess Assets: Value of the Unleavered Firm: Value Created from Financing: Value of the Firm Economic Balance Sheet - Claim on Resources Value of Debt: Value of Employee Stock Options: Value of Equity: Value of Securities Issued