Answered step by step

Verified Expert Solution

Question

1 Approved Answer

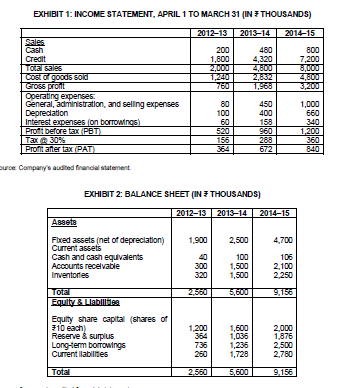

1. Prepare and analyze the cash flow statement of the company. 2. Prepare and analyze the common size statements of the company. EXHIBIT 1: INCOME

1. Prepare and analyze the cash flow statement of the company. 2. Prepare and analyze the common size statements of the company.

EXHIBIT 1: INCOME STATEMENT, APRIL 1 TO MARCH 31 (IN THOUSANDS) 201213 2013-14 2014-15 Sales Cash 200 480 800 Credit 1,800 4,320 7,200 Totales 2.000 4.800 8,000 Cost of goods old 4,800 Gross pront 1.968 3,200 Operating expenses General, administration, and selling expenses 80 450 1,000 Depreciation 100 400 660 Interest expenses con borrowings) 60 158 340 Proft before tax PBT 520 960 1,200 Tax 30% 156 288 360 Profit after tax PATI 672 840 Our Company's audited francial statement & EXHIBIT 2: BALANCE SHEET (IN 7 THOUSANDS) 201213 201314 2014-15 Assets Fixed assets (net of depreciation) 1.900 2,500 4.700 Current assets Cash and cash equivalents 100 106 Accounts receivable 300 1,500 2,100 Inventores 320 1,500 2.250 Total 5.600 Equity & Liabile Equity share capital shares of 310 each 1,200 1,600 2,000 Reserve & surplus 364 1,036 1,876 Long-term borrowings 736 1,236 2,500 Current ilabilites 260 1,728 2.780 Total 2.560 5,600 9.156 EXHIBIT 1: INCOME STATEMENT, APRIL 1 TO MARCH 31 (IN THOUSANDS) 201213 2013-14 2014-15 Sales Cash 200 480 800 Credit 1,800 4,320 7,200 Totales 2.000 4.800 8,000 Cost of goods old 4,800 Gross pront 1.968 3,200 Operating expenses General, administration, and selling expenses 80 450 1,000 Depreciation 100 400 660 Interest expenses con borrowings) 60 158 340 Proft before tax PBT 520 960 1,200 Tax 30% 156 288 360 Profit after tax PATI 672 840 Our Company's audited francial statement & EXHIBIT 2: BALANCE SHEET (IN 7 THOUSANDS) 201213 201314 2014-15 Assets Fixed assets (net of depreciation) 1.900 2,500 4.700 Current assets Cash and cash equivalents 100 106 Accounts receivable 300 1,500 2,100 Inventores 320 1,500 2.250 Total 5.600 Equity & Liabile Equity share capital shares of 310 each 1,200 1,600 2,000 Reserve & surplus 364 1,036 1,876 Long-term borrowings 736 1,236 2,500 Current ilabilites 260 1,728 2.780 Total 2.560 5,600 9.156Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started