Answered step by step

Verified Expert Solution

Question

1 Approved Answer

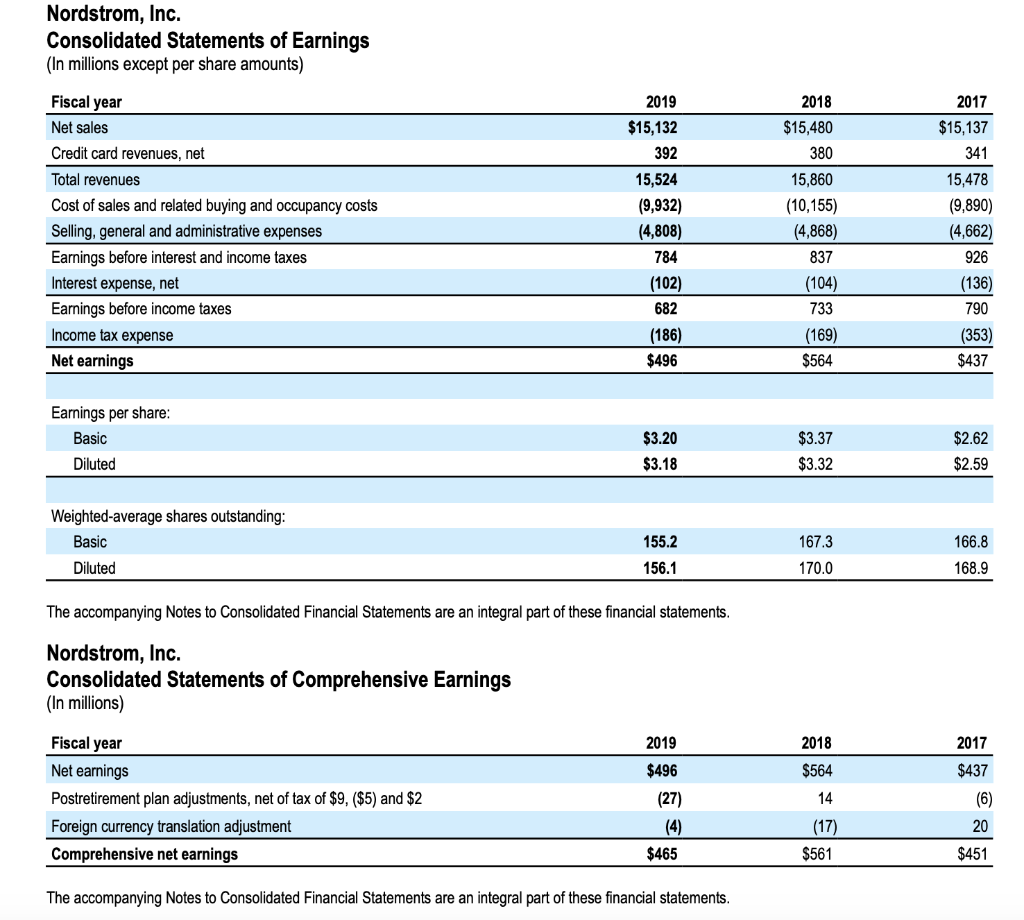

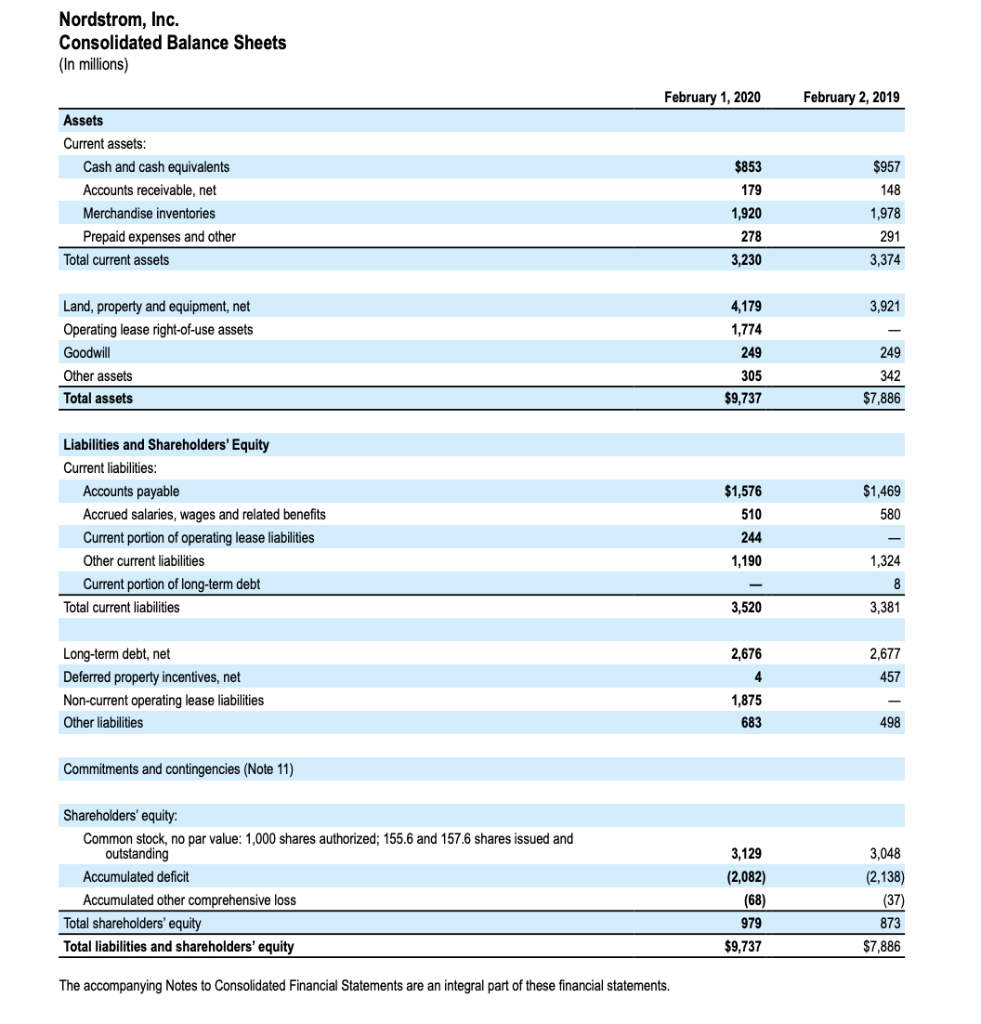

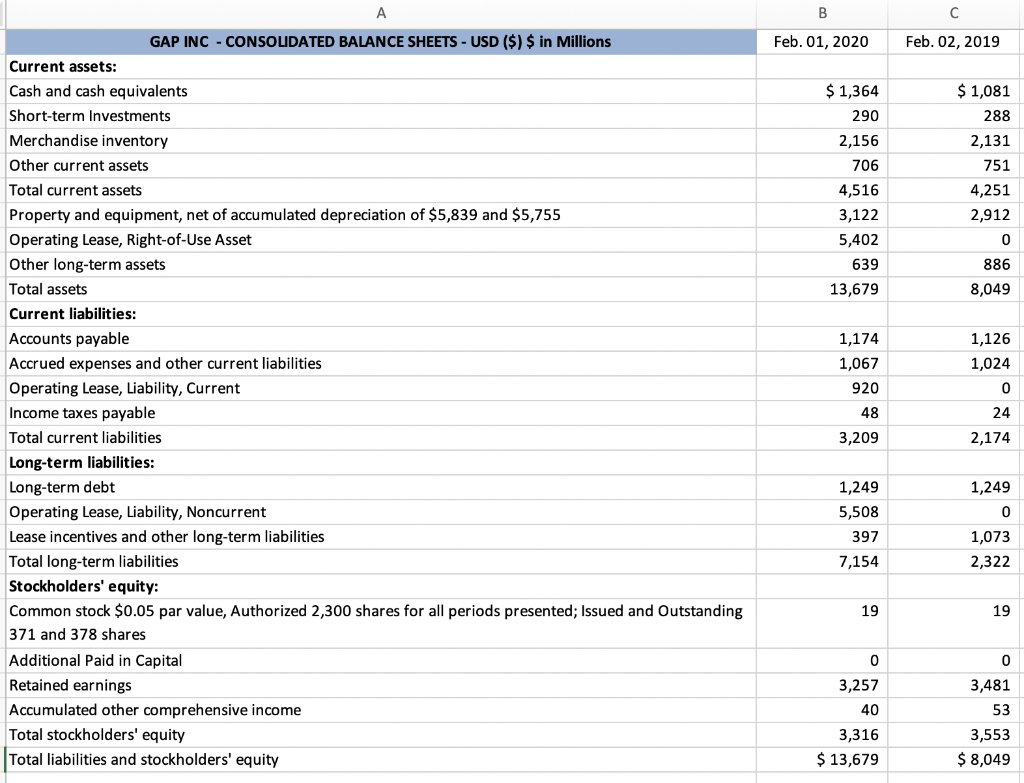

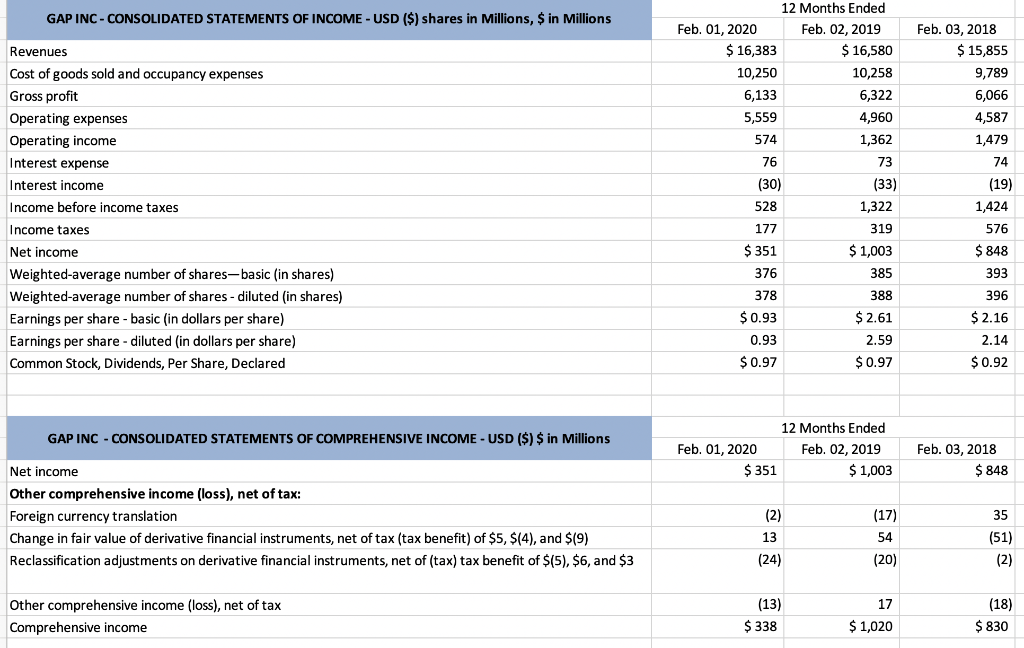

1) Prepare common size income statement using vertical analysis for the most recent year for both companies. Nordstrom, Inc. Consolidated Statements of Earnings (In millions

1) Prepare common size income statement using vertical analysis for the most recent year for both companies.

Nordstrom, Inc. Consolidated Statements of Earnings (In millions except per share amounts) 2018 Fiscal year Net sales Credit card revenues, net Total revenues Cost of sales and related buying and occupancy costs Selling, general and administrative expenses Earnings before interest and income taxes Interest expense, net Earnings before income taxes Income tax expense Net earnings 2019 $15,132 392 15,524 (9,932) (4,808) 784 (102) $15,480 380 15,860 (10,155) (4,868) 837 (104) 733 (169) $564 2017 $15,137 341 15,478 (9,890) (4,662) 926 (136) 790 (353) $437 682 (186) $496 Earnings per share: Basic Diluted $3.20 $3.18 $3.37 $3.32 $2.62 $2.59 Weighted average shares outstanding: Basic Diluted 155.2 167.3 166.8 156.1 170.0 168.9 The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements. Nordstrom, Inc. Consolidated Statements of Comprehensive Earnings (In millions) 2019 2018 2017 $496 $564 $437 Fiscal year Net earnings Postretirement plan adjustments, net of tax of $9, ($5) and $2 Foreign currency translation adjustment Comprehensive net earnings 14 (6) (27) (4) 20 (17) $561 $465 $451 The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements. Nordstrom, Inc. Consolidated Balance Sheets (In millions) February 1, 2020 February 2, 2019 $853 Assets Current assets: Cash and cash equivalents Accounts receivable, net Merchandise inventories Prepaid expenses and other Total current assets 179 1,920 278 3,230 $957 148 1,978 291 3,374 3,921 Land, property and equipment, net Operating lease right-of-use assets Goodwill Other assets Total assets 4,179 1,774 249 305 $9,737 249 342 $7,886 $1,469 580 Liabilities and Shareholders' Equity Current liabilities: Accounts payable Accrued salaries, wages and related benefits Current portion of operating lease liabilities Other current liabilities Current portion of long-term debt Total current liabilities $1,576 510 244 1,190 1,324 3,520 3,381 2,677 457 Long-term debt, net Deferred property incentives, net Non-current operating lease liabilities Other liabilities 2,676 4 1,875 683 498 Commitments and contingencies (Note 11) Shareholders' equity: Common stock, no par value: 1,000 shares authorized; 155.6 and 157.6 shares issued and outstanding Accumulated deficit Accumulated other comprehensive loss Total shareholders' equity Total liabilities and shareholders' equity 3,129 (2,082) (68) 979 $9,737 3,048 (2,138) (37) 873 $7,886 The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements. A B Feb. 01, 2020 Feb. 02, 2019 $ 1,364 290 2,156 $ 1,081 288 2,131 751 4,251 2,912 706 4,516 3,122 5,402 0 639 886 8,049 13,679 1,174 1,067 1,126 1,024 920 0 GAP INC - CONSOLIDATED BALANCE SHEETS - USD ($) $ in Millions Current assets: Cash and cash equivalents Short-term Investments Merchandise inventory Other current assets Total current assets Property and equipment, net of accumulated depreciation of $5,839 and $5,755 Operating Lease, Right-of-Use Asset Other long-term assets Total assets Current liabilities: Accounts payable Accrued expenses and other current liabilities Operating Lease, Liability, Current Income taxes payable Total current liabilities Long-term ilities: Long-term debt Operating Lease, Liability, Noncurrent Lease incentives and other long-term liabilities Total long-term liabilities Stockholders' equity: Common stock $0.05 par value, Authorized 2,300 shares for all periods presented; Issued and Outstanding 371 and 378 shares Additional Paid in Capital Retained earnings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity 48 24 3,209 2,174 1,249 1,249 5,508 397 0 1,073 2,322 7,154 19 19 0 3,257 40 3,316 $ 13,679 0 3,481 53 3,553 $ 8,049 GAP INC - CONSOLIDATED STATEMENTS OF INCOME - USD ($) shares in Millions, $ in Millions 12 Months Ended Feb. 01, 2020 Feb. 02, 2019 $ 16,383 $ 16,580 10,250 10,258 6,133 6,322 5,559 4,960 574 1,362 Feb. 03, 2018 $ 15,855 9,789 6,066 4,587 1,479 74 (19) 1,424 76 Revenues Cost of goods sold and occupancy expenses Gross profit Operating expenses Operating income Interest expense Interest income Income before income taxes Income taxes Net income Weighted-average number of shares-basic (in shares) Weighted average number of shares - diluted (in shares) Earnings per share - basic in dollars per share) Earnings per share - diluted (in dollars per share) Common Stock, Dividends, Per Share, Declared 73 (30) 528 (33) 1,322 319 $ 1,003 385 576 $ 848 393 177 $ 351 376 378 $0.93 0.93 $ 0.97 388 $ 2.61 2.59 $ 0.97 396 $ 2.16 2.14 $0.92 GAP INC - CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME - USD ($) $ in Millions 12 Months Ended Feb. 01, 2020 Feb. 02, 2019 $ 351 $ 1,003 Feb. 03, 2018 $ 848 Net income Other comprehensive income (loss), net of tax: Foreign currency translation Change in fair value of derivative financial instruments, net of tax (tax benefit) of $5, $(4), and $(9) Reclassification adjustments on derivative financial instruments, net of (tax) tax benefit of $(5), $6, and $3 (2) (17) 54 13 (24) 35 (51) (2) (20) 17 Other comprehensive income (loss), net of tax Comprehensive income (13) $ 338 (18) $ 830 $1,020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started