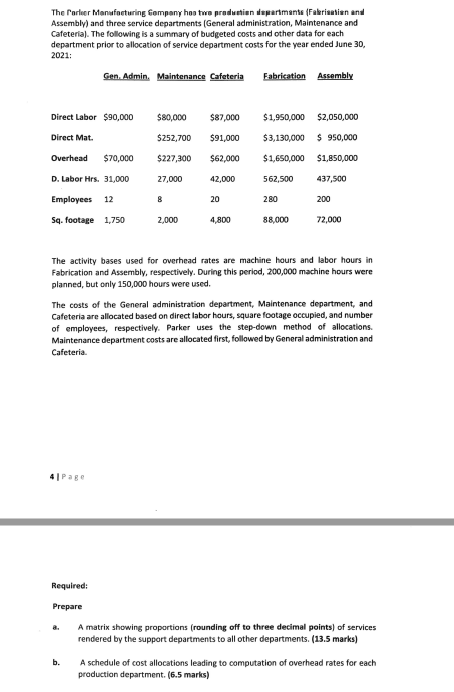

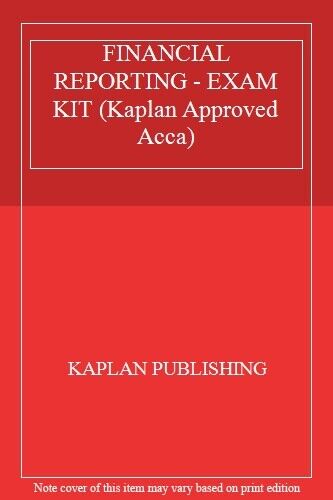

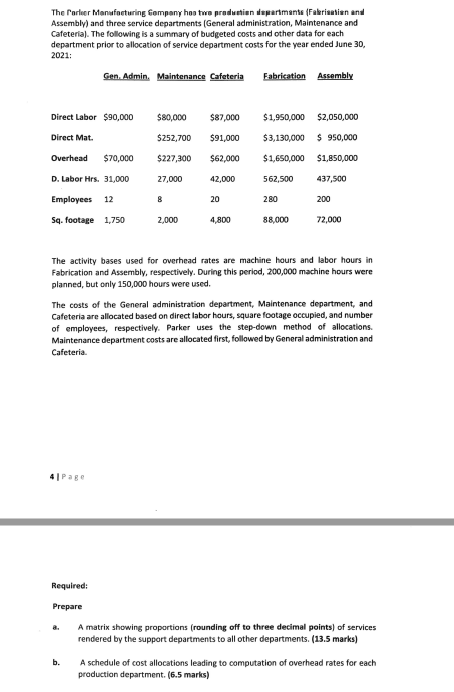

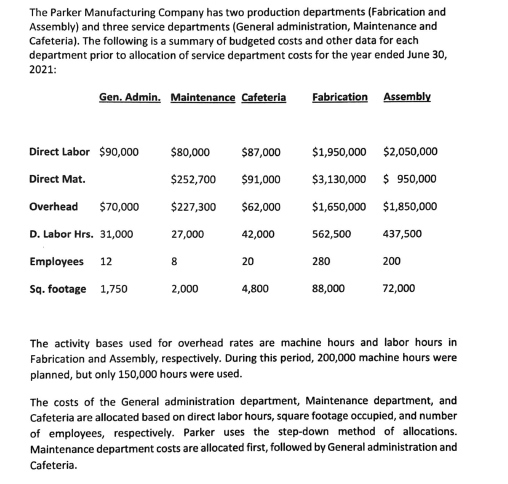

The Parler Manufacturing company has twa production departments (Fakerisation and Assembly) and three service departments (General administration, Maintenance and Cafeteria). The following is a summary of budgeted costs and other data for each department prior to allocation of service department costs for the year ended June 30, 2021: Gen. Admin. Maintenance Cafeteria Fabrication Assembly Direct Labor $90,000 $80,000 $87,000 $1,950,000 $2,050,000 Direct Mat. $252,700 $91,000 $3,130,000 $ 950,000 Overhead $70,000 $227,300 $62,000 $1,650,000 $1,850,000 D. Labor Hrs. 31,000 27,000 42,000 562,500 437,500 Employees 12 8 20 280 200 Sq. footage 1,750 2,000 4,800 88,000 72,000 The activity bases used for overhead rates are machine hours and labor hours in Fabrication and Assembly, respectively. During this period, 200,000 machine hours were planned, but only 150,000 hours were used. The costs of the General administration department, Maintenance department, and Cafeteria are allocated based on direct labor hours, square footage occupied, and number of employees, respectively. Parker uses the step-down method of allocations. Maintenance department costs are allocated first, followed by General administration and Cafeteria. 4 Page Required: Prepare 8. A matrix showing proportions (rounding off to three decimal points) of services rendered by the support departments to all other departments. (13.5 marks) b. A schedule of cost allocations leading to computation of overhead rates for each production department. (6.5 marks) The Parker Manufacturing Company has two production departments (Fabrication and Assembly) and three service departments (General administration, Maintenance and Cafeteria). The following is a summary of budgeted costs and other data for each department prior to allocation of service department costs for the year ended June 30, 2021: Gen. Admin. Maintenance Cafeteria Fabrication Assembly $80,000 $87,000 $1,950,000 $2,050,000 $3,130,000 $ 950,000 $252,700 $91,000 $227,300 $62,000 $1,650,000 $1,850,000 Direct Labor $90,000 Direct Mat Overhead $70,000 D. Labor Hrs. 31,000 Employees 12 Sq. footage 1,750 27,000 42,000 562,500 437,500 8 20 280 200 2,000 4,800 88,000 72,000 The activity bases used for overhead rates are machine hours and labor hours in Fabrication and Assembly, respectively. During this period, 200,000 machine hours were planned, but only 150,000 hours were used. The costs of the General administration department, Maintenance department, and Cafeteria are allocated based on direct labor hours, square footage occupied, and number of employees, respectively. Parker uses the step-down method of allocations. Maintenance department costs are allocated first, followed by General administration and Cafeteria