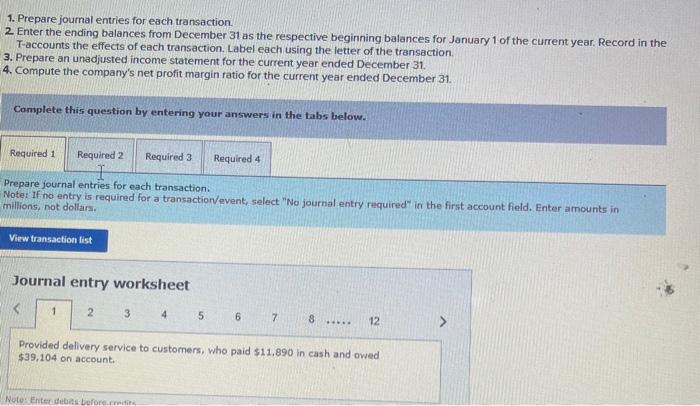

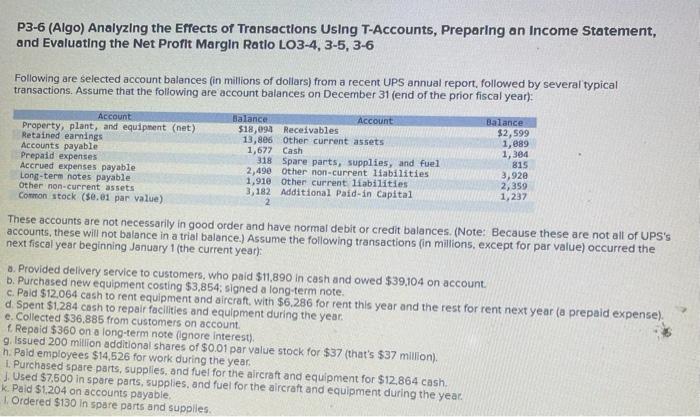

1. Prepare joumal entries for each transaction. 2. Enter the ending balances from December 31 as the respective beginning balances for January 1 of the current year. Record in the T-accounts the effects of each transaction. Label each using the letter of the transaction. 3. Prepare an unadjusted income statement for the current year ended December 31. 4. Compute the company's net profit margin ratio for the current year ended December 31. Complete this question by entering your answers in the tabs below. Prepare journal entries for each transaction. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter amounts in millions, not dollars. P3-6 (Algo) Analyzing the Effects of Transactions Using T-Accounts, Preparing an Income Statement, and Evaluating the Net Proft Margin Ratio LO3-4, 3-5, 3-6 Following are selected account balences (in millions of dollars) from a recent ups annual report, followed by several typical transactions. Assume that the following are account balances on December 31 (end of the prior fiscal year): These accounts are not necessarily in good order and have normal debit or credit balances. (Note: Because these are not all of UPS's accounts, these will not balance in a trial balance.) Assume the following transactions (in millions, except for par value) occurred the next fiscal year beginning January 1 (the current year): a. Provided delivery service to customers, who paid $11,890 in cash and owed $39.104 on account. b. Purchased new equipment costing $3,854; slgned a long-term note. c. Paid $12.064 cash to rent equipment and aircraft, with $6.286 for rent this year and the rest for rent next year (a prepaid expense). d. Spent $1,284 cosh to repair facilities and equipment during the year. e. Collected $36,885 from customers on account. . Repaid $360 on a long-term note (lgnore interest). 9. Issued 200 million additional shares of $0.01 par value stock for $37 (that's $37 million). h. Paid employees $14,526 for work during the year I. Purchased spare parts, supplies, and fuel for the aircraft and equipment for $12,864cash. 1. Used $7,500 in spare parts, supplies, and fuel for the aircraft and equipment during the year. Paid $1,204 on accounts payable. 1. Ordered $130 in spare parts and suppiles