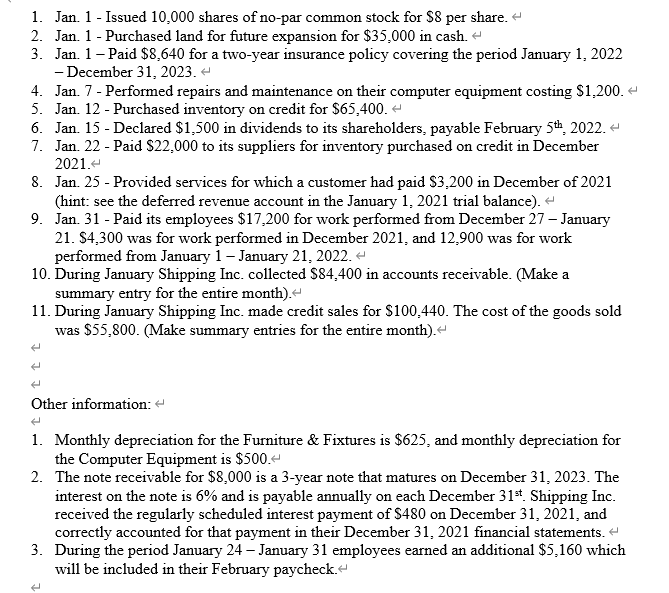

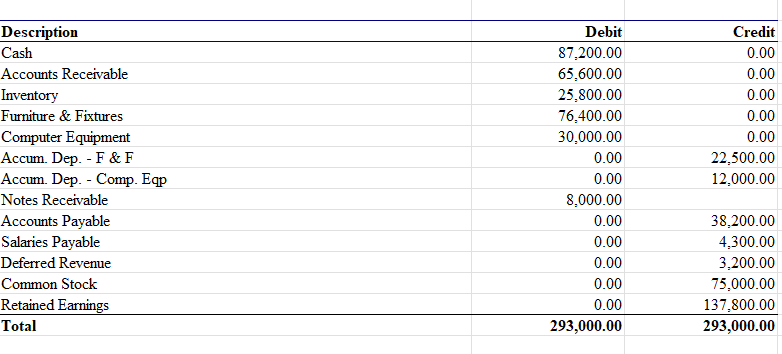

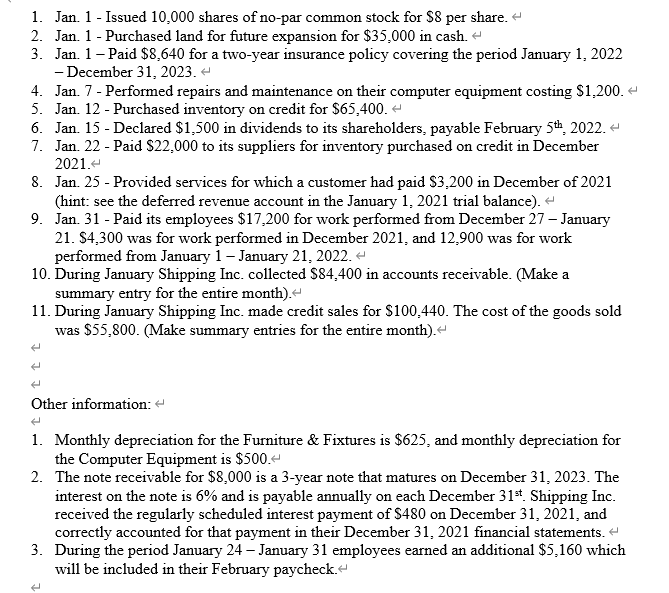

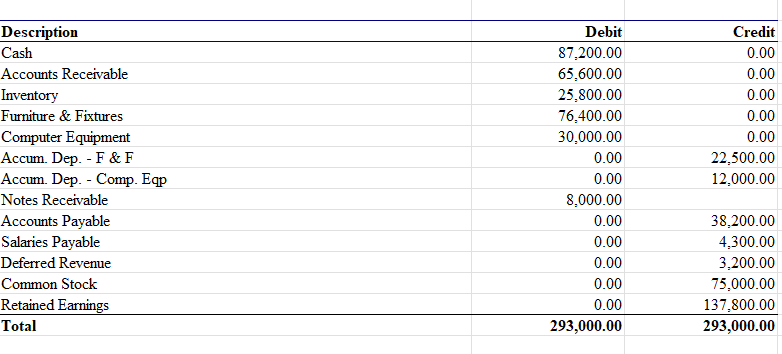

1. Prepare journal entries for each of the attached transactions. 2. Post each of the journal entries to related T-accounts. 3. Prepare a trial balance at the end of the month. 4. Prepare any necessary adjusting entries. 5. Prepare an adjusted trial balance. 6. Prepare Shipping Inc.'s Income Statement for the month ended January 31, 2022.- 7. Prepare Shipping Inc.'s January 31 closing entries. 8. Prepare Shipping Inc.'s January 31 post-closing trial balance. 9. Prepare Shipping Inc.'s Statement of Retained Earnings for the month ended January 31, 2022, and their Balance Sheet as of January 31, 2022.- 1. Jan. 1 - Issued 10,000 shares of no-par common stock for $8 per share. 2. Jan. 1 - Purchased land for future expansion for $35,000 in cash. + 3. Jan. 1 - Paid $8.640 for a two-year insurance policy covering the period January 1, 2022 - December 31, 2023. 4. Jan. 7 - Performed repairs and maintenance on their computer equipment costing $1,200. 5. Jan. 12 - Purchased inventory on credit for $65,400. 6. Jan. 15 - Declared $1,500 in dividends to its shareholders, payable February 5th, 2022. 7. Jan 22 - Paid $22,000 to its suppliers for inventory purchased on credit in December 2021.4 8. Jan. 25 - Provided services for which a customer had paid $3,200 in December of 2021 (hint: see the deferred revenue account in the January 1, 2021 trial balance). 9. Jan. 31 - Paid its employees $17,200 for work performed from December 27 January 21. $4,300 was for work performed in December 2021, and 12,900 was for work performed from January 1 - January 21, 2022. 10. During January Shipping Inc. collected $84,400 in accounts receivable. (Make a summary entry for the entire month). 11. During January Shipping Inc. made credit sales for $100,440. The cost of the goods sold was $55,800. (Make summary entries for the entire month). Other information: 1. Monthly depreciation for the Furniture & Fixtures is $625, and monthly depreciation for the Computer Equipment is $500.- 2. The note receivable for $8,000 is a 3-year note that matures on December 31, 2023. The interest on the note is 6% and is payable annually on each December 31st Shipping Inc. received the regularly scheduled interest payment of $480 on December 31, 2021, and correctly accounted for that payment in their December 31, 2021 financial statements. 3. During the period January 24 - January 31 employees earned an additional $5,160 which will be included in their February paycheck. Description Cash Accounts Receivable Inventory Furniture & Fixtures Computer Equipment Accum. Dep. - F&F Accum. Dep. - Comp. Eqp Notes Receivable Accounts Payable Salaries Payable Deferred Revenue Common Stock Retained Earnings Total Debit 87,200.00 65,600.00 25,800.00 76.400.00 30,000.00 0.00 0.00 8,000.00 0.00 0.00 0.00 0.00 0.00 293,000.00 Credit 0.00 0.00 0.00 0.00 0.00 22,500.00 12,000.00 38,200.00 4,300.00 3,200.00 75,000.00 137.800.00 293,000.00