Question

1. Prepare journal entries necessary for Upham to record the preceding transactions. If a transaction does not require a journal entry, select No entry required

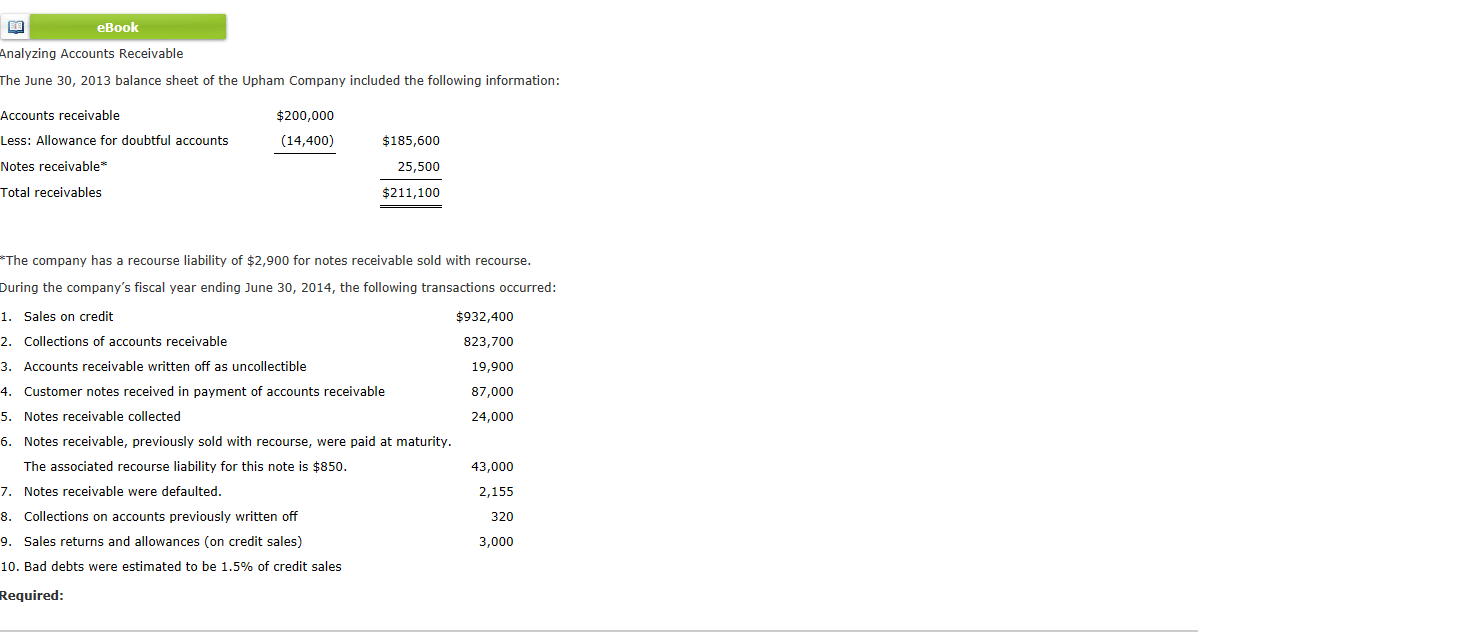

1. Prepare journal entries necessary for Upham to record the preceding transactions. If a transaction does not require a journal entry, select "No entry required" and leave the amount input box blank. For a compound transaction, if an amount box does not require an entry, leave it blank or enter "0". 2.Prepare an analysis and schedule that shows allowance for doubtful accounts. 3.Prepare an analysis and schedule that shows notes receivable. 4.Prepare an analysis and schedule that shows notes receivable dishonored accounts that will be disclosed on Upham's June 30, 2014 balance sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started