On Dec. 1, 2014 Pete Fiore opened Flore Consulting Services, Inc. He provides marketing seminars guaranteed to increase sales by SK. The first fiscal

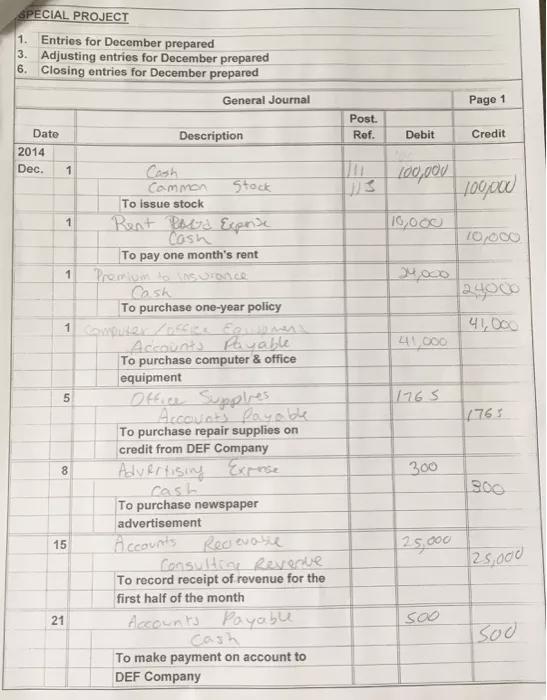

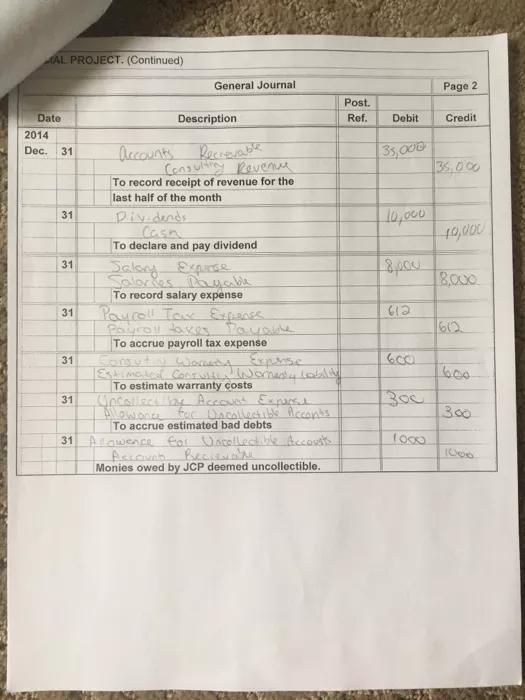

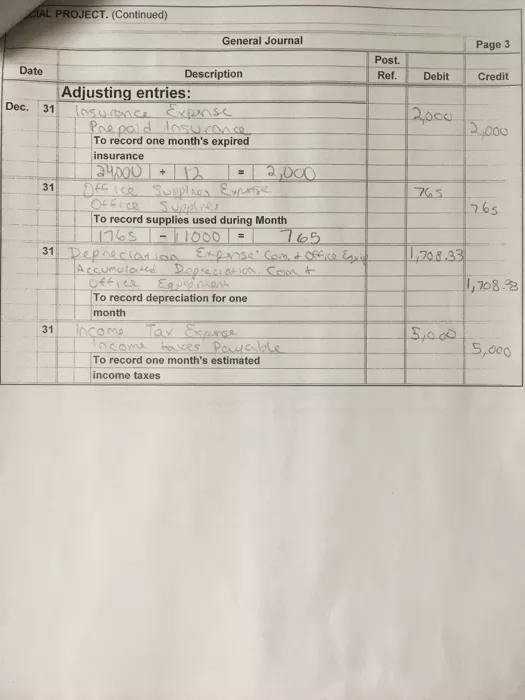

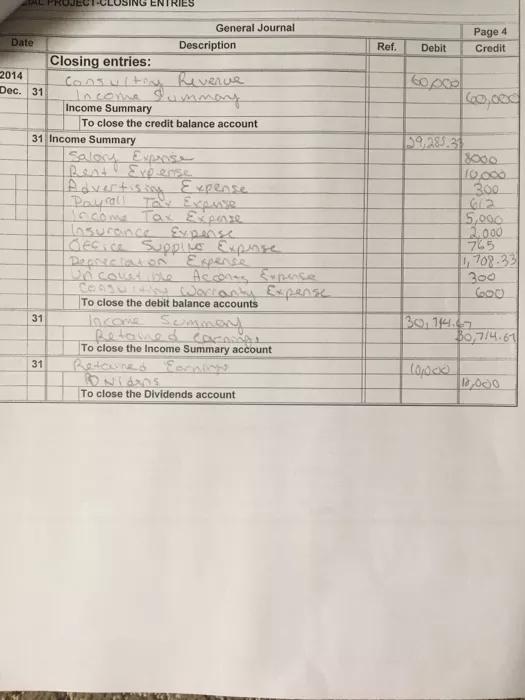

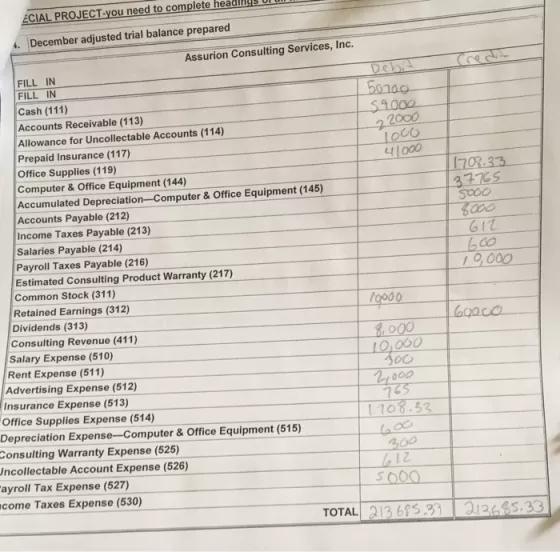

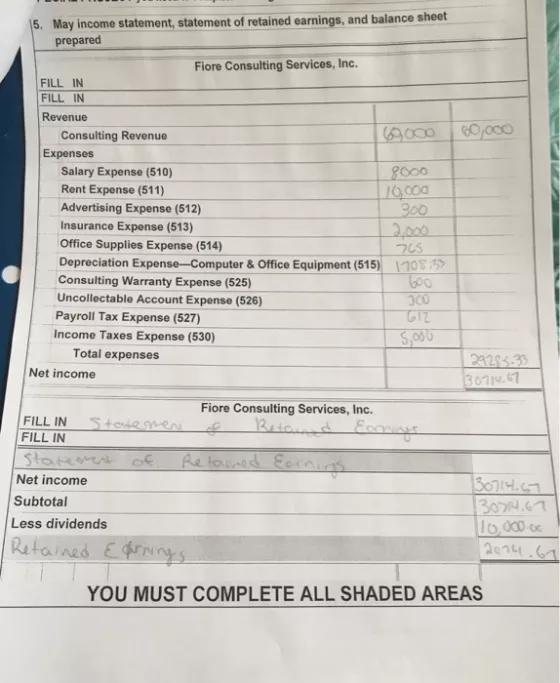

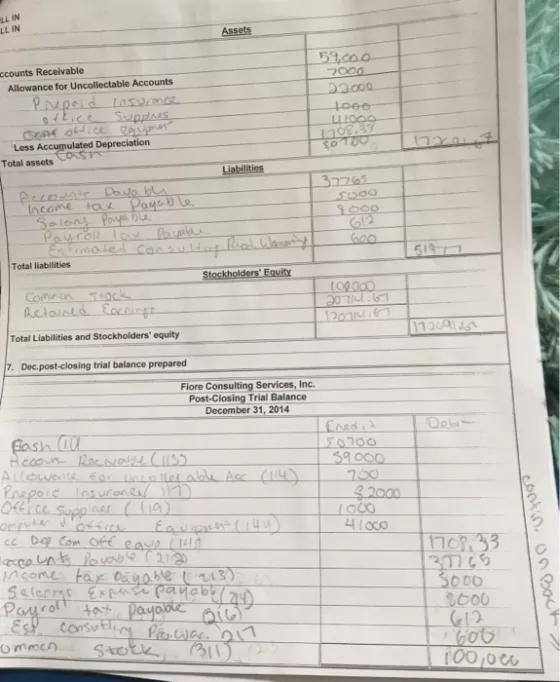

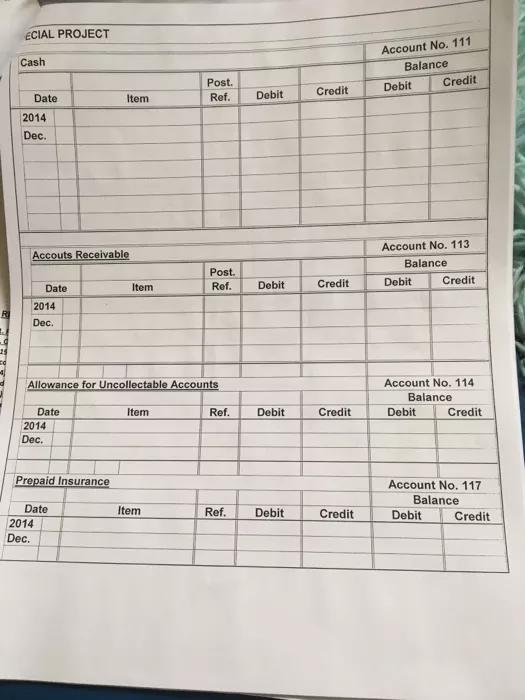

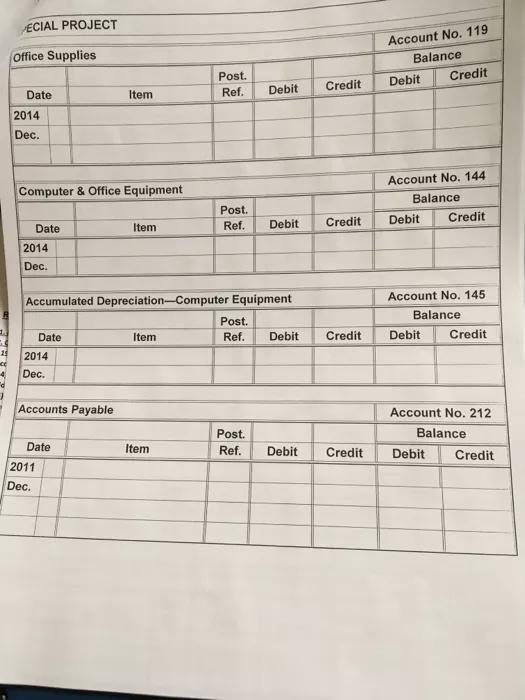

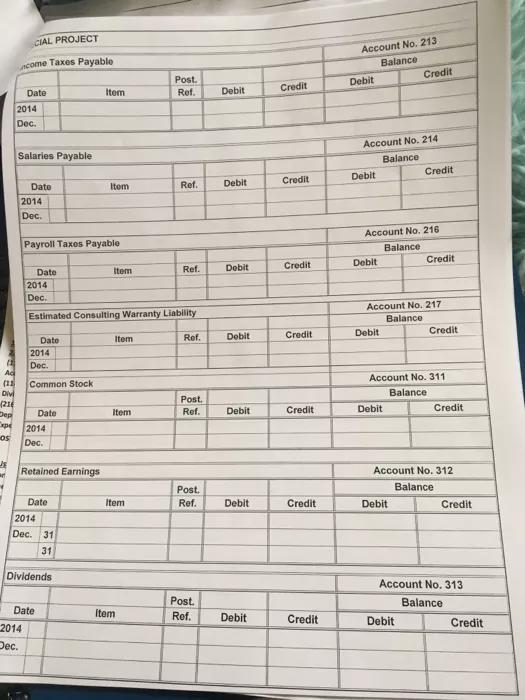

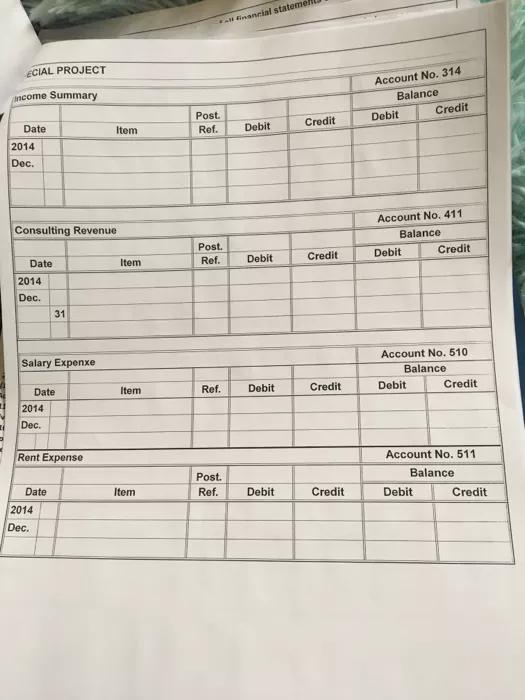

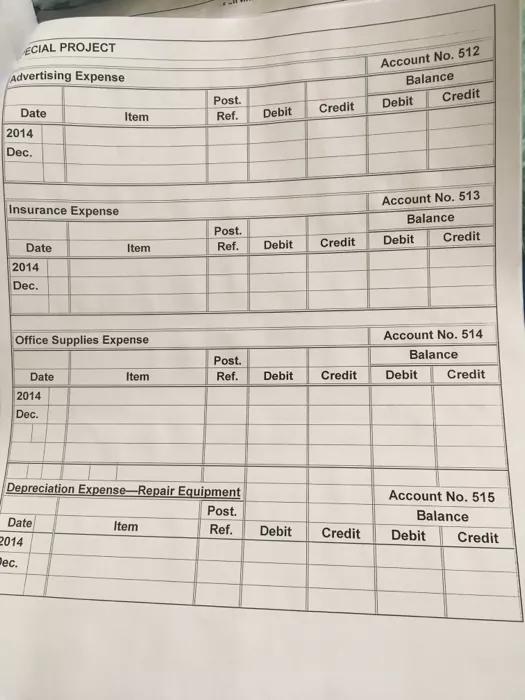

On Dec. 1, 2014 Pete Fiore opened Flore Consulting Services, Inc. He provides marketing seminars guaranteed to increase sales by SK. The first fiscal (calendar) year will end December 31, 2014. One salaried employee was hired on December 1, 2014. No benefits accrue for six months. Mr. Fiore does not take a salary at this time. During the month, he completed the following transactions for the company: Dec. 1 Began business by depositing $100,000 in a bank account in the name of the company in exchange for 100,000 shares of $1 par value common stock. Paid the rent for his office store for current month, $10.000. 1 Pald the premlum on a one-year insurance policy. $24,000. 1 Purchased computer & office equipment on credit for $41,000. S Purchased office supplies from DEF Company on credit, $1,765. 8 Paid cash for an advertisement in a local newspaper, $300. 15 Billed consulting revenue for the first half of the month, $25,000. 21 Pald DEF Company on account, $s00. 31 Billed consulting revenue for the second half of July, $35,000. 31 Declared and paid a cash dividend, $10,000. 31 Accrue one (1)month salary for sole employee pald on January 3, 2015-S8,000. 31 Accrue one (1)month payroll tas for sole employee paid on January 3, 2015-7.65% of Salary Expense. 31 Industry history indicates 1% of sales must be accrued as provided as expense to cover expected warranty costs. The company experienced a cean munth in Dec. 2014. Journallae this expense. 31 Mr. Flore expects that uncollectible account expense will amount to SX. (1/2 of 1%). Journallse. 31 IICP In., customer declares bankruptcy necessitating writing off the amount owed by them from A/R-S1,000. REQUIRED FOR DECEMBER 1.Prepare Joumalentries to record the December transactions. Explanations supplied. 2. Open the following accounts: Cash (111); Accounts Recelvable (113): Prepaid Insurance (117): Office Supplies (119): Computer & Office Equipment (144): Accumulated Depreciation-Computer &Office Equipment (145: Accounts Payable (212), Income Taes Payable (213 Salaries Payable (214); Allowance for Uncollectable Acceunts (114); Estimated Conulting Waranty Liability (217).Common Stock (311) Retained Earnings (312 Dividends (113): Income Summary (314): Consulting Revenue (411) Salary Expense (S30JPayroll Taxes Payable (216): Rent Expense (511); Advertising Expense (512), Insurance Expense (513,office Supplies Expense (514); Depreciation Expense-Computer & Office Equipment (515); Income Taxes Expense (530); Consulting Warranty Expense (525); Uncollectable Account Expense (526). Payroll Tax Expense (527): Salary Expense (510). Post the DECEMBER entries to the to the general ledger accounts. 3Using the following information, recerd adjusting entries in the journal and post to the ledger accounts: (a) one month's insurance has expired: (b) remaining inventory of unused repair supplies, $1,000; (eThe computer & office equipment purchased on Dec. 1 has a useful life of four (4) years eand a salvage value of $1,000. You must complete the depreciation schedule and divide the first years calculated by twelve (12). Reord journal entry. Use double decling method. Worksheet supplied. (d) estimated income taaes for the month, $5,000. 4. From the accounts in the ledger, prepare an adjusted trial balance. (Note: Normally a trial balance is prepared before adjustments but is omitted here to save time.) 5. From the adjusted trial balance, prepare an income statement, a statement of retained earnings, and a balance sheet for December. Income Taxes is to be shown as part of total expenses. 6. Prepare and post dasing entries. Explanations required. 7. Prepare a post-dosing trial balance. SPECIAL PROJECT 1. Entries for December prepared 3. Adjusting entries for December prepared 6. Closing entries for December prepared General Journal Page 1 Post. Date Description Ref. Debit Credit 2014 Cash Common Dec. Stock To issue stock Rent Para Expre Cosh 16,000 10,000 To pay one month's rent Promium ko AS Orance Co sh To purchase one-year policy 24,000 2400 4,000 Payable 41,000 Accounts To purchase computer & office equipment Accouats Paya ble 1765 1765 To purchase repair supplies on credit from DEF Company Exprie Advertising Cash To purchase newspaper advertisement 300 300 Accaunts Consultrnn Reverdde To record receipt of revenue for the first half of the month 25,000 25,000 Recevase 15 Payable cash To make payment on account to 21 Accounts Soo DEF Company 00 AL PROJECT. (Continued) General Journal Page 2 Post. Date Description Ref. Debit Credit 2014 Aecounts Recsable 35,000 35,0 00 Dec. 31 Censutiy Revenue To record receipt of revenue for the last half of the month Div.dends Casm To declare and pay dividend 10,000 31 31 Salac&es ucabe To record salary expense 612 Paycoll Tawe Eapanes Payroll takes Pavode To accrue payroll tax expense Corgut 31 62 31 600 To estimate warranty costs Uncollect bay Accouet Eaparst fur Dacallect bs Acconts 130c 300 31 To accrue estimated bad debts 31 Aowence foi Uncellec We Accouts Monies owed by JCP deemed uncollectible. AL PROJECT. (Continued) General Journal Page 3 Post. Date Description Ref. Debit Credit Adjusting entries: losurance Expnse Pre paid Iosu.comce Dec. 31 2000 2,000 To record one month's expired insurance 31 765. 765 To record supplies used during Month 16s -|1000 = 31 Pepneciat in Expnse Com, + Off ca Eguie A ccumutosed Dopieie ion Com t Equidnent To record depreciation for one 765 %3! 208.33 Dffice month Income Tav Ence 5,000 5,000 31 ncome taker Rawable To record one month's estimated income taxes SING ENTRIES General Journal Page 4 Date Description Ref. Debit Credit Closing entries: Consultig Income ummany 2014 Dec. 31 Reverve C0,000 Income Summary To close the credit balance account 31 Income Summary 199,281.31 8000 10,00. 300 612 5,000 000 765 708.33 300 Salary Evpns pestl Evp ense Advertision Expense. Payall Ta Expuse lo come Tax Espnse losuranceExpnse decice Suppl E Expnse Depseciaion uncousde Ceaguidi warranty Espense To close the debit balance accounts E spense As cones Eupense Income Summay Retained carn To close the Income Summary account 130,14.67 B0,7/4.61 31 31 To close the Dividends account ECIAL PROJECT-you need to complete . December adjusted trial balance prepared Assurion Consulting Services, Inc. FILL IN Credit Debit 50700 $9000 22000 FILL IN Cash (111) Accounts Receivable (113) Allowance for Uncollectable Accounts (114) Prepaid Insurance (117) 41000 Office Supplies (119) Computer & Office Equipment (144) Accumulated Depreciation-Computer & Office Equipment (145) Accounts Payable (212) Income Taxes Payable (213) 708.33 37765 G17 600 19,000 Salaries Payable (214) Payroll Taxes Payable (216) Estimated Consulting Product Warranty (217) Common Stock (311) Retained Earnings (312) Dividends (313) 6ooca Consulting Revenue (411) Salary Expense (510) Rent Expense (511) 8000 1,000 Advertising Expense (512) Insurance Expense (513) 2,000 765 1108.53 Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515) Consulting Warranty Expense (525) Uncollectable Account Expense (526) 300 "ayroll Tax Expense (527) m xpense (530) 217 5000 TOTAL 213 69S 39| 212685.33 5. May income statement, statement of retained earnings, and balance sheet prepared Fiore Consulting Services, Inc. FILL IN FILL IN Revenue Consulting Revenue 888 60 000 Expenses go00 19,000 300 2,000 Salary Expense (510) Rent Expense (511) Advertising Expense (512) Insurance Expense (513) Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515) 10 Consulting Warranty Expense (525) Uncollectable Account Expense (526) Payroll Tax Expense (527) Income Taxes Expense (530) 300 212 S,000 Total expenses 24285-33 367N.47 Net income FILL IN FILL IN Fiore Consulting Services, Inc. 1Briand 5tovemen Statemet of Re tainid Ecinis Net income Subtotal 304.67 10,000 oc 2074.67 Less dividends Retained E qprnings YOU MUST COMPLETE ALL SHADED AREAS L IN LL IN Assets ccounts Receivable Allowance for Uncolectable Accounts 59.000 7000 Piupeid Lasme Supplaes Less Accumulated Depreciation Total assets Liabilities 37765 Income tax Payab le Selong Paye hla Payro lov Buphe mated cocslut 2000 603 519- 7 Total liabilities Stockholders' Equity Actointd Eocoingt 120746 Total Liabilities and Stockholders' equity 112A 7. Dec.post-closing trial balance prepared Fiore Consulting Services, Inc. Post-Closing Trial Balance December 31, 2014 Dela fash l ALlowente Eo llet able Acc (14) Prepoie Ins vrener 7) Oel.ce suppiner (lia) 50700 59000 700 $2000 c De Com Of eaue Ld income tax oEgoble ( 13) Selerms Expense payaby 24) l Payrol tat payoble ais 37765 3000 Es consutling PizWar. or Stokk B11 612 ommen. 100,0e0 contin. onBock ECIAL PROJECT Account No. 111 Balance Cash Post. Credit Debit Debit Credit Date Item Ref. 2014 Dec. Account No. 113 Accouts Receivable Balance Post. Item Ref. Debit Credit Debit Credit Date 2014 RI Dec. Allowance for Uncollectable Accounts Account No. 114 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Prepaid Insurance Account No. 117 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. ECIAL PROJECT Account No. 119 Office Supplies Balance Post. Credit Credit Debit Ref. Debit Date Item 2014 Dec. Account No. 144 Computer & Office Equipment Balance Post. Credit Debit Credit Date Item Ref. Debit 2014 Dec. Account No. 145 Accumulated Depreciation-Computer Equipment Balance Post. Ref. Date Item Debit Credit Debit Credit 2014 Dec. Accounts Payable Account No. 212 Post. Balance Date Item Ref. Debit Credit Debit Credit 2011 Dec. Account No. 213 Balance CIAL PROJECT ncome Taxes Payable Credit Post. Debit Item Ref. Debit Credit Date 2014 Dec. Account No. 214 Salaries Payable Balance Debit Credit Debit Credit Date Item Ref. 2014 Dec. Account No. 216 Payroll Taxes Payable Balance Debit Credit Ref. Debit Credit Date Item 2014 Dec. Account No. 217 Estimated Consulting Warranty Liablity Balance Debit Credit Item Ref. Debit Credit Date 2014 Dec. Ad Common Stock Div (216 Dep Account No. 311 Balance Post. Item Ref. Debit Credit Debit Credit Date 2014 Dec. Retained Earnings Account No. 312 Post. Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. 31 31 Dividends Account No. 313 Post. Ref. Balance Date Item Debit Credit Debit Credit 2014 Dec. N inanrial stateme ECIAL PROJECT Account No. 314 ncome Summary Balance Post. Credit Debit Date Item Ref. Debit Credit 2014 Dec. Account No. 411 Consulting Revenue Balance Post. Debit Credit Date Item Ref. Debit Credit 2014 Dec. 31 Salary Expenxe Account No. 510 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Rent Expense Account No. 511 Post. Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. ECIAL PROJECT Account No. 512 Advertising Expense Balance Credit Post. Debit Credit Date Item Ref. Debit 2014 Dec. Account No. 513 Insurance Expense Balance Post. Credit Debit Credit Date Item Ref. Debit 2014 Dec. Office Supplies Expense Account No. 514 Balance Post. Date Item Ref. Debit Credit Debit Credit 2014 Dec. Depreciation Expense-Repair Equipment Account No. 515 Post. Balance Date Item Ref. Debit Credit Debit 2014 Pec. Credit CIAL PROJECT Account No. 525 Balance Credit consulting Warranty Expense Post. Debit Date Credit Item Ref. Debit 2014 Dec. Account No. 526 Balance Credit Uncollectable Account Expense Credit Debit Date 2014 Item Ref. Debit Dec. Payroll Tax Expense Account No. 527 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Income Tax Expense Account No. 530 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. On Dec. 1, 2014 Pete Fiore opened Flore Consulting Services, Inc. He provides marketing seminars guaranteed to increase sales by SK. The first fiscal (calendar) year will end December 31, 2014. One salaried employee was hired on December 1, 2014. No benefits accrue for six months. Mr. Fiore does not take a salary at this time. During the month, he completed the following transactions for the company: Dec. 1 Began business by depositing $100,000 in a bank account in the name of the company in exchange for 100,000 shares of $1 par value common stock. Paid the rent for his office store for current month, $10.000. 1 Pald the premlum on a one-year insurance policy. $24,000. 1 Purchased computer & office equipment on credit for $41,000. S Purchased office supplies from DEF Company on credit, $1,765. 8 Paid cash for an advertisement in a local newspaper, $300. 15 Billed consulting revenue for the first half of the month, $25,000. 21 Pald DEF Company on account, $s00. 31 Billed consulting revenue for the second half of July, $35,000. 31 Declared and paid a cash dividend, $10,000. 31 Accrue one (1)month salary for sole employee pald on January 3, 2015-S8,000. 31 Accrue one (1)month payroll tas for sole employee paid on January 3, 2015-7.65% of Salary Expense. 31 Industry history indicates 1% of sales must be accrued as provided as expense to cover expected warranty costs. The company experienced a cean munth in Dec. 2014. Journallae this expense. 31 Mr. Flore expects that uncollectible account expense will amount to SX. (1/2 of 1%). Journallse. 31 IICP In., customer declares bankruptcy necessitating writing off the amount owed by them from A/R-S1,000. REQUIRED FOR DECEMBER 1.Prepare Joumalentries to record the December transactions. Explanations supplied. 2. Open the following accounts: Cash (111); Accounts Recelvable (113): Prepaid Insurance (117): Office Supplies (119): Computer & Office Equipment (144): Accumulated Depreciation-Computer &Office Equipment (145: Accounts Payable (212), Income Taes Payable (213 Salaries Payable (214); Allowance for Uncollectable Acceunts (114); Estimated Conulting Waranty Liability (217).Common Stock (311) Retained Earnings (312 Dividends (113): Income Summary (314): Consulting Revenue (411) Salary Expense (S30JPayroll Taxes Payable (216): Rent Expense (511); Advertising Expense (512), Insurance Expense (513,office Supplies Expense (514); Depreciation Expense-Computer & Office Equipment (515); Income Taxes Expense (530); Consulting Warranty Expense (525); Uncollectable Account Expense (526). Payroll Tax Expense (527): Salary Expense (510). Post the DECEMBER entries to the to the general ledger accounts. 3Using the following information, recerd adjusting entries in the journal and post to the ledger accounts: (a) one month's insurance has expired: (b) remaining inventory of unused repair supplies, $1,000; (eThe computer & office equipment purchased on Dec. 1 has a useful life of four (4) years eand a salvage value of $1,000. You must complete the depreciation schedule and divide the first years calculated by twelve (12). Reord journal entry. Use double decling method. Worksheet supplied. (d) estimated income taaes for the month, $5,000. 4. From the accounts in the ledger, prepare an adjusted trial balance. (Note: Normally a trial balance is prepared before adjustments but is omitted here to save time.) 5. From the adjusted trial balance, prepare an income statement, a statement of retained earnings, and a balance sheet for December. Income Taxes is to be shown as part of total expenses. 6. Prepare and post dasing entries. Explanations required. 7. Prepare a post-dosing trial balance. SPECIAL PROJECT 1. Entries for December prepared 3. Adjusting entries for December prepared 6. Closing entries for December prepared General Journal Page 1 Post. Date Description Ref. Debit Credit 2014 Cash Common Dec. Stock To issue stock Rent Para Expre Cosh 16,000 10,000 To pay one month's rent Promium ko AS Orance Co sh To purchase one-year policy 24,000 2400 4,000 Payable 41,000 Accounts To purchase computer & office equipment Accouats Paya ble 1765 1765 To purchase repair supplies on credit from DEF Company Exprie Advertising Cash To purchase newspaper advertisement 300 300 Accaunts Consultrnn Reverdde To record receipt of revenue for the first half of the month 25,000 25,000 Recevase 15 Payable cash To make payment on account to 21 Accounts Soo DEF Company 00 AL PROJECT. (Continued) General Journal Page 2 Post. Date Description Ref. Debit Credit 2014 Aecounts Recsable 35,000 35,0 00 Dec. 31 Censutiy Revenue To record receipt of revenue for the last half of the month Div.dends Casm To declare and pay dividend 10,000 31 31 Salac&es ucabe To record salary expense 612 Paycoll Tawe Eapanes Payroll takes Pavode To accrue payroll tax expense Corgut 31 62 31 600 To estimate warranty costs Uncollect bay Accouet Eaparst fur Dacallect bs Acconts 130c 300 31 To accrue estimated bad debts 31 Aowence foi Uncellec We Accouts Monies owed by JCP deemed uncollectible. AL PROJECT. (Continued) General Journal Page 3 Post. Date Description Ref. Debit Credit Adjusting entries: losurance Expnse Pre paid Iosu.comce Dec. 31 2000 2,000 To record one month's expired insurance 31 765. 765 To record supplies used during Month 16s -|1000 = 31 Pepneciat in Expnse Com, + Off ca Eguie A ccumutosed Dopieie ion Com t Equidnent To record depreciation for one 765 %3! 208.33 Dffice month Income Tav Ence 5,000 5,000 31 ncome taker Rawable To record one month's estimated income taxes SING ENTRIES General Journal Page 4 Date Description Ref. Debit Credit Closing entries: Consultig Income ummany 2014 Dec. 31 Reverve C0,000 Income Summary To close the credit balance account 31 Income Summary 199,281.31 8000 10,00. 300 612 5,000 000 765 708.33 300 Salary Evpns pestl Evp ense Advertision Expense. Payall Ta Expuse lo come Tax Espnse losuranceExpnse decice Suppl E Expnse Depseciaion uncousde Ceaguidi warranty Espense To close the debit balance accounts E spense As cones Eupense Income Summay Retained carn To close the Income Summary account 130,14.67 B0,7/4.61 31 31 To close the Dividends account ECIAL PROJECT-you need to complete . December adjusted trial balance prepared Assurion Consulting Services, Inc. FILL IN Credit Debit 50700 $9000 22000 FILL IN Cash (111) Accounts Receivable (113) Allowance for Uncollectable Accounts (114) Prepaid Insurance (117) 41000 Office Supplies (119) Computer & Office Equipment (144) Accumulated Depreciation-Computer & Office Equipment (145) Accounts Payable (212) Income Taxes Payable (213) 708.33 37765 G17 600 19,000 Salaries Payable (214) Payroll Taxes Payable (216) Estimated Consulting Product Warranty (217) Common Stock (311) Retained Earnings (312) Dividends (313) 6ooca Consulting Revenue (411) Salary Expense (510) Rent Expense (511) 8000 1,000 Advertising Expense (512) Insurance Expense (513) 2,000 765 1108.53 Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515) Consulting Warranty Expense (525) Uncollectable Account Expense (526) 300 "ayroll Tax Expense (527) m xpense (530) 217 5000 TOTAL 213 69S 39| 212685.33 5. May income statement, statement of retained earnings, and balance sheet prepared Fiore Consulting Services, Inc. FILL IN FILL IN Revenue Consulting Revenue 888 60 000 Expenses go00 19,000 300 2,000 Salary Expense (510) Rent Expense (511) Advertising Expense (512) Insurance Expense (513) Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515) 10 Consulting Warranty Expense (525) Uncollectable Account Expense (526) Payroll Tax Expense (527) Income Taxes Expense (530) 300 212 S,000 Total expenses 24285-33 367N.47 Net income FILL IN FILL IN Fiore Consulting Services, Inc. 1Briand 5tovemen Statemet of Re tainid Ecinis Net income Subtotal 304.67 10,000 oc 2074.67 Less dividends Retained E qprnings YOU MUST COMPLETE ALL SHADED AREAS L IN LL IN Assets ccounts Receivable Allowance for Uncolectable Accounts 59.000 7000 Piupeid Lasme Supplaes Less Accumulated Depreciation Total assets Liabilities 37765 Income tax Payab le Selong Paye hla Payro lov Buphe mated cocslut 2000 603 519- 7 Total liabilities Stockholders' Equity Actointd Eocoingt 120746 Total Liabilities and Stockholders' equity 112A 7. Dec.post-closing trial balance prepared Fiore Consulting Services, Inc. Post-Closing Trial Balance December 31, 2014 Dela fash l ALlowente Eo llet able Acc (14) Prepoie Ins vrener 7) Oel.ce suppiner (lia) 50700 59000 700 $2000 c De Com Of eaue Ld income tax oEgoble ( 13) Selerms Expense payaby 24) l Payrol tat payoble ais 37765 3000 Es consutling PizWar. or Stokk B11 612 ommen. 100,0e0 contin. onBock ECIAL PROJECT Account No. 111 Balance Cash Post. Credit Debit Debit Credit Date Item Ref. 2014 Dec. Account No. 113 Accouts Receivable Balance Post. Item Ref. Debit Credit Debit Credit Date 2014 RI Dec. Allowance for Uncollectable Accounts Account No. 114 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Prepaid Insurance Account No. 117 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. ECIAL PROJECT Account No. 119 Office Supplies Balance Post. Credit Credit Debit Ref. Debit Date Item 2014 Dec. Account No. 144 Computer & Office Equipment Balance Post. Credit Debit Credit Date Item Ref. Debit 2014 Dec. Account No. 145 Accumulated Depreciation-Computer Equipment Balance Post. Ref. Date Item Debit Credit Debit Credit 2014 Dec. Accounts Payable Account No. 212 Post. Balance Date Item Ref. Debit Credit Debit Credit 2011 Dec. Account No. 213 Balance CIAL PROJECT ncome Taxes Payable Credit Post. Debit Item Ref. Debit Credit Date 2014 Dec. Account No. 214 Salaries Payable Balance Debit Credit Debit Credit Date Item Ref. 2014 Dec. Account No. 216 Payroll Taxes Payable Balance Debit Credit Ref. Debit Credit Date Item 2014 Dec. Account No. 217 Estimated Consulting Warranty Liablity Balance Debit Credit Item Ref. Debit Credit Date 2014 Dec. Ad Common Stock Div (216 Dep Account No. 311 Balance Post. Item Ref. Debit Credit Debit Credit Date 2014 Dec. Retained Earnings Account No. 312 Post. Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. 31 31 Dividends Account No. 313 Post. Ref. Balance Date Item Debit Credit Debit Credit 2014 Dec. N inanrial stateme ECIAL PROJECT Account No. 314 ncome Summary Balance Post. Credit Debit Date Item Ref. Debit Credit 2014 Dec. Account No. 411 Consulting Revenue Balance Post. Debit Credit Date Item Ref. Debit Credit 2014 Dec. 31 Salary Expenxe Account No. 510 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Rent Expense Account No. 511 Post. Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. ECIAL PROJECT Account No. 512 Advertising Expense Balance Credit Post. Debit Credit Date Item Ref. Debit 2014 Dec. Account No. 513 Insurance Expense Balance Post. Credit Debit Credit Date Item Ref. Debit 2014 Dec. Office Supplies Expense Account No. 514 Balance Post. Date Item Ref. Debit Credit Debit Credit 2014 Dec. Depreciation Expense-Repair Equipment Account No. 515 Post. Balance Date Item Ref. Debit Credit Debit 2014 Pec. Credit CIAL PROJECT Account No. 525 Balance Credit consulting Warranty Expense Post. Debit Date Credit Item Ref. Debit 2014 Dec. Account No. 526 Balance Credit Uncollectable Account Expense Credit Debit Date 2014 Item Ref. Debit Dec. Payroll Tax Expense Account No. 527 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Income Tax Expense Account No. 530 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. On Dec. 1, 2014 Pete Fiore opened Flore Consulting Services, Inc. He provides marketing seminars guaranteed to increase sales by SK. The first fiscal (calendar) year will end December 31, 2014. One salaried employee was hired on December 1, 2014. No benefits accrue for six months. Mr. Fiore does not take a salary at this time. During the month, he completed the following transactions for the company: Dec. 1 Began business by depositing $100,000 in a bank account in the name of the company in exchange for 100,000 shares of $1 par value common stock. Paid the rent for his office store for current month, $10.000. 1 Pald the premlum on a one-year insurance policy. $24,000. 1 Purchased computer & office equipment on credit for $41,000. S Purchased office supplies from DEF Company on credit, $1,765. 8 Paid cash for an advertisement in a local newspaper, $300. 15 Billed consulting revenue for the first half of the month, $25,000. 21 Pald DEF Company on account, $s00. 31 Billed consulting revenue for the second half of July, $35,000. 31 Declared and paid a cash dividend, $10,000. 31 Accrue one (1)month salary for sole employee pald on January 3, 2015-S8,000. 31 Accrue one (1)month payroll tas for sole employee paid on January 3, 2015-7.65% of Salary Expense. 31 Industry history indicates 1% of sales must be accrued as provided as expense to cover expected warranty costs. The company experienced a cean munth in Dec. 2014. Journallae this expense. 31 Mr. Flore expects that uncollectible account expense will amount to SX. (1/2 of 1%). Journallse. 31 IICP In., customer declares bankruptcy necessitating writing off the amount owed by them from A/R-S1,000. REQUIRED FOR DECEMBER 1.Prepare Joumalentries to record the December transactions. Explanations supplied. 2. Open the following accounts: Cash (111); Accounts Recelvable (113): Prepaid Insurance (117): Office Supplies (119): Computer & Office Equipment (144): Accumulated Depreciation-Computer &Office Equipment (145: Accounts Payable (212), Income Taes Payable (213 Salaries Payable (214); Allowance for Uncollectable Acceunts (114); Estimated Conulting Waranty Liability (217).Common Stock (311) Retained Earnings (312 Dividends (113): Income Summary (314): Consulting Revenue (411) Salary Expense (S30JPayroll Taxes Payable (216): Rent Expense (511); Advertising Expense (512), Insurance Expense (513,office Supplies Expense (514); Depreciation Expense-Computer & Office Equipment (515); Income Taxes Expense (530); Consulting Warranty Expense (525); Uncollectable Account Expense (526). Payroll Tax Expense (527): Salary Expense (510). Post the DECEMBER entries to the to the general ledger accounts. 3Using the following information, recerd adjusting entries in the journal and post to the ledger accounts: (a) one month's insurance has expired: (b) remaining inventory of unused repair supplies, $1,000; (eThe computer & office equipment purchased on Dec. 1 has a useful life of four (4) years eand a salvage value of $1,000. You must complete the depreciation schedule and divide the first years calculated by twelve (12). Reord journal entry. Use double decling method. Worksheet supplied. (d) estimated income taaes for the month, $5,000. 4. From the accounts in the ledger, prepare an adjusted trial balance. (Note: Normally a trial balance is prepared before adjustments but is omitted here to save time.) 5. From the adjusted trial balance, prepare an income statement, a statement of retained earnings, and a balance sheet for December. Income Taxes is to be shown as part of total expenses. 6. Prepare and post dasing entries. Explanations required. 7. Prepare a post-dosing trial balance. SPECIAL PROJECT 1. Entries for December prepared 3. Adjusting entries for December prepared 6. Closing entries for December prepared General Journal Page 1 Post. Date Description Ref. Debit Credit 2014 Cash Common Dec. Stock To issue stock Rent Para Expre Cosh 16,000 10,000 To pay one month's rent Promium ko AS Orance Co sh To purchase one-year policy 24,000 2400 4,000 Payable 41,000 Accounts To purchase computer & office equipment Accouats Paya ble 1765 1765 To purchase repair supplies on credit from DEF Company Exprie Advertising Cash To purchase newspaper advertisement 300 300 Accaunts Consultrnn Reverdde To record receipt of revenue for the first half of the month 25,000 25,000 Recevase 15 Payable cash To make payment on account to 21 Accounts Soo DEF Company 00 AL PROJECT. (Continued) General Journal Page 2 Post. Date Description Ref. Debit Credit 2014 Aecounts Recsable 35,000 35,0 00 Dec. 31 Censutiy Revenue To record receipt of revenue for the last half of the month Div.dends Casm To declare and pay dividend 10,000 31 31 Salac&es ucabe To record salary expense 612 Paycoll Tawe Eapanes Payroll takes Pavode To accrue payroll tax expense Corgut 31 62 31 600 To estimate warranty costs Uncollect bay Accouet Eaparst fur Dacallect bs Acconts 130c 300 31 To accrue estimated bad debts 31 Aowence foi Uncellec We Accouts Monies owed by JCP deemed uncollectible. AL PROJECT. (Continued) General Journal Page 3 Post. Date Description Ref. Debit Credit Adjusting entries: losurance Expnse Pre paid Iosu.comce Dec. 31 2000 2,000 To record one month's expired insurance 31 765. 765 To record supplies used during Month 16s -|1000 = 31 Pepneciat in Expnse Com, + Off ca Eguie A ccumutosed Dopieie ion Com t Equidnent To record depreciation for one 765 %3! 208.33 Dffice month Income Tav Ence 5,000 5,000 31 ncome taker Rawable To record one month's estimated income taxes SING ENTRIES General Journal Page 4 Date Description Ref. Debit Credit Closing entries: Consultig Income ummany 2014 Dec. 31 Reverve C0,000 Income Summary To close the credit balance account 31 Income Summary 199,281.31 8000 10,00. 300 612 5,000 000 765 708.33 300 Salary Evpns pestl Evp ense Advertision Expense. Payall Ta Expuse lo come Tax Espnse losuranceExpnse decice Suppl E Expnse Depseciaion uncousde Ceaguidi warranty Espense To close the debit balance accounts E spense As cones Eupense Income Summay Retained carn To close the Income Summary account 130,14.67 B0,7/4.61 31 31 To close the Dividends account ECIAL PROJECT-you need to complete . December adjusted trial balance prepared Assurion Consulting Services, Inc. FILL IN Credit Debit 50700 $9000 22000 FILL IN Cash (111) Accounts Receivable (113) Allowance for Uncollectable Accounts (114) Prepaid Insurance (117) 41000 Office Supplies (119) Computer & Office Equipment (144) Accumulated Depreciation-Computer & Office Equipment (145) Accounts Payable (212) Income Taxes Payable (213) 708.33 37765 G17 600 19,000 Salaries Payable (214) Payroll Taxes Payable (216) Estimated Consulting Product Warranty (217) Common Stock (311) Retained Earnings (312) Dividends (313) 6ooca Consulting Revenue (411) Salary Expense (510) Rent Expense (511) 8000 1,000 Advertising Expense (512) Insurance Expense (513) 2,000 765 1108.53 Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515) Consulting Warranty Expense (525) Uncollectable Account Expense (526) 300 "ayroll Tax Expense (527) m xpense (530) 217 5000 TOTAL 213 69S 39| 212685.33 5. May income statement, statement of retained earnings, and balance sheet prepared Fiore Consulting Services, Inc. FILL IN FILL IN Revenue Consulting Revenue 888 60 000 Expenses go00 19,000 300 2,000 Salary Expense (510) Rent Expense (511) Advertising Expense (512) Insurance Expense (513) Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515) 10 Consulting Warranty Expense (525) Uncollectable Account Expense (526) Payroll Tax Expense (527) Income Taxes Expense (530) 300 212 S,000 Total expenses 24285-33 367N.47 Net income FILL IN FILL IN Fiore Consulting Services, Inc. 1Briand 5tovemen Statemet of Re tainid Ecinis Net income Subtotal 304.67 10,000 oc 2074.67 Less dividends Retained E qprnings YOU MUST COMPLETE ALL SHADED AREAS L IN LL IN Assets ccounts Receivable Allowance for Uncolectable Accounts 59.000 7000 Piupeid Lasme Supplaes Less Accumulated Depreciation Total assets Liabilities 37765 Income tax Payab le Selong Paye hla Payro lov Buphe mated cocslut 2000 603 519- 7 Total liabilities Stockholders' Equity Actointd Eocoingt 120746 Total Liabilities and Stockholders' equity 112A 7. Dec.post-closing trial balance prepared Fiore Consulting Services, Inc. Post-Closing Trial Balance December 31, 2014 Dela fash l ALlowente Eo llet able Acc (14) Prepoie Ins vrener 7) Oel.ce suppiner (lia) 50700 59000 700 $2000 c De Com Of eaue Ld income tax oEgoble ( 13) Selerms Expense payaby 24) l Payrol tat payoble ais 37765 3000 Es consutling PizWar. or Stokk B11 612 ommen. 100,0e0 contin. onBock ECIAL PROJECT Account No. 111 Balance Cash Post. Credit Debit Debit Credit Date Item Ref. 2014 Dec. Account No. 113 Accouts Receivable Balance Post. Item Ref. Debit Credit Debit Credit Date 2014 RI Dec. Allowance for Uncollectable Accounts Account No. 114 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Prepaid Insurance Account No. 117 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. ECIAL PROJECT Account No. 119 Office Supplies Balance Post. Credit Credit Debit Ref. Debit Date Item 2014 Dec. Account No. 144 Computer & Office Equipment Balance Post. Credit Debit Credit Date Item Ref. Debit 2014 Dec. Account No. 145 Accumulated Depreciation-Computer Equipment Balance Post. Ref. Date Item Debit Credit Debit Credit 2014 Dec. Accounts Payable Account No. 212 Post. Balance Date Item Ref. Debit Credit Debit Credit 2011 Dec. Account No. 213 Balance CIAL PROJECT ncome Taxes Payable Credit Post. Debit Item Ref. Debit Credit Date 2014 Dec. Account No. 214 Salaries Payable Balance Debit Credit Debit Credit Date Item Ref. 2014 Dec. Account No. 216 Payroll Taxes Payable Balance Debit Credit Ref. Debit Credit Date Item 2014 Dec. Account No. 217 Estimated Consulting Warranty Liablity Balance Debit Credit Item Ref. Debit Credit Date 2014 Dec. Ad Common Stock Div (216 Dep Account No. 311 Balance Post. Item Ref. Debit Credit Debit Credit Date 2014 Dec. Retained Earnings Account No. 312 Post. Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. 31 31 Dividends Account No. 313 Post. Ref. Balance Date Item Debit Credit Debit Credit 2014 Dec. N inanrial stateme ECIAL PROJECT Account No. 314 ncome Summary Balance Post. Credit Debit Date Item Ref. Debit Credit 2014 Dec. Account No. 411 Consulting Revenue Balance Post. Debit Credit Date Item Ref. Debit Credit 2014 Dec. 31 Salary Expenxe Account No. 510 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Rent Expense Account No. 511 Post. Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. ECIAL PROJECT Account No. 512 Advertising Expense Balance Credit Post. Debit Credit Date Item Ref. Debit 2014 Dec. Account No. 513 Insurance Expense Balance Post. Credit Debit Credit Date Item Ref. Debit 2014 Dec. Office Supplies Expense Account No. 514 Balance Post. Date Item Ref. Debit Credit Debit Credit 2014 Dec. Depreciation Expense-Repair Equipment Account No. 515 Post. Balance Date Item Ref. Debit Credit Debit 2014 Pec. Credit CIAL PROJECT Account No. 525 Balance Credit consulting Warranty Expense Post. Debit Date Credit Item Ref. Debit 2014 Dec. Account No. 526 Balance Credit Uncollectable Account Expense Credit Debit Date 2014 Item Ref. Debit Dec. Payroll Tax Expense Account No. 527 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Income Tax Expense Account No. 530 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. On Dec. 1, 2014 Pete Fiore opened Flore Consulting Services, Inc. He provides marketing seminars guaranteed to increase sales by SK. The first fiscal (calendar) year will end December 31, 2014. One salaried employee was hired on December 1, 2014. No benefits accrue for six months. Mr. Fiore does not take a salary at this time. During the month, he completed the following transactions for the company: Dec. 1 Began business by depositing $100,000 in a bank account in the name of the company in exchange for 100,000 shares of $1 par value common stock. Paid the rent for his office store for current month, $10.000. 1 Pald the premlum on a one-year insurance policy. $24,000. 1 Purchased computer & office equipment on credit for $41,000. S Purchased office supplies from DEF Company on credit, $1,765. 8 Paid cash for an advertisement in a local newspaper, $300. 15 Billed consulting revenue for the first half of the month, $25,000. 21 Pald DEF Company on account, $s00. 31 Billed consulting revenue for the second half of July, $35,000. 31 Declared and paid a cash dividend, $10,000. 31 Accrue one (1)month salary for sole employee pald on January 3, 2015-S8,000. 31 Accrue one (1)month payroll tas for sole employee paid on January 3, 2015-7.65% of Salary Expense. 31 Industry history indicates 1% of sales must be accrued as provided as expense to cover expected warranty costs. The company experienced a cean munth in Dec. 2014. Journallae this expense. 31 Mr. Flore expects that uncollectible account expense will amount to SX. (1/2 of 1%). Journallse. 31 IICP In., customer declares bankruptcy necessitating writing off the amount owed by them from A/R-S1,000. REQUIRED FOR DECEMBER 1.Prepare Joumalentries to record the December transactions. Explanations supplied. 2. Open the following accounts: Cash (111); Accounts Recelvable (113): Prepaid Insurance (117): Office Supplies (119): Computer & Office Equipment (144): Accumulated Depreciation-Computer &Office Equipment (145: Accounts Payable (212), Income Taes Payable (213 Salaries Payable (214); Allowance for Uncollectable Acceunts (114); Estimated Conulting Waranty Liability (217).Common Stock (311) Retained Earnings (312 Dividends (113): Income Summary (314): Consulting Revenue (411) Salary Expense (S30JPayroll Taxes Payable (216): Rent Expense (511); Advertising Expense (512), Insurance Expense (513,office Supplies Expense (514); Depreciation Expense-Computer & Office Equipment (515); Income Taxes Expense (530); Consulting Warranty Expense (525); Uncollectable Account Expense (526). Payroll Tax Expense (527): Salary Expense (510). Post the DECEMBER entries to the to the general ledger accounts. 3Using the following information, recerd adjusting entries in the journal and post to the ledger accounts: (a) one month's insurance has expired: (b) remaining inventory of unused repair supplies, $1,000; (eThe computer & office equipment purchased on Dec. 1 has a useful life of four (4) years eand a salvage value of $1,000. You must complete the depreciation schedule and divide the first years calculated by twelve (12). Reord journal entry. Use double decling method. Worksheet supplied. (d) estimated income taaes for the month, $5,000. 4. From the accounts in the ledger, prepare an adjusted trial balance. (Note: Normally a trial balance is prepared before adjustments but is omitted here to save time.) 5. From the adjusted trial balance, prepare an income statement, a statement of retained earnings, and a balance sheet for December. Income Taxes is to be shown as part of total expenses. 6. Prepare and post dasing entries. Explanations required. 7. Prepare a post-dosing trial balance. SPECIAL PROJECT 1. Entries for December prepared 3. Adjusting entries for December prepared 6. Closing entries for December prepared General Journal Page 1 Post. Date Description Ref. Debit Credit 2014 Cash Common Dec. Stock To issue stock Rent Para Expre Cosh 16,000 10,000 To pay one month's rent Promium ko AS Orance Co sh To purchase one-year policy 24,000 2400 4,000 Payable 41,000 Accounts To purchase computer & office equipment Accouats Paya ble 1765 1765 To purchase repair supplies on credit from DEF Company Exprie Advertising Cash To purchase newspaper advertisement 300 300 Accaunts Consultrnn Reverdde To record receipt of revenue for the first half of the month 25,000 25,000 Recevase 15 Payable cash To make payment on account to 21 Accounts Soo DEF Company 00 AL PROJECT. (Continued) General Journal Page 2 Post. Date Description Ref. Debit Credit 2014 Aecounts Recsable 35,000 35,0 00 Dec. 31 Censutiy Revenue To record receipt of revenue for the last half of the month Div.dends Casm To declare and pay dividend 10,000 31 31 Salac&es ucabe To record salary expense 612 Paycoll Tawe Eapanes Payroll takes Pavode To accrue payroll tax expense Corgut 31 62 31 600 To estimate warranty costs Uncollect bay Accouet Eaparst fur Dacallect bs Acconts 130c 300 31 To accrue estimated bad debts 31 Aowence foi Uncellec We Accouts Monies owed by JCP deemed uncollectible. AL PROJECT. (Continued) General Journal Page 3 Post. Date Description Ref. Debit Credit Adjusting entries: losurance Expnse Pre paid Iosu.comce Dec. 31 2000 2,000 To record one month's expired insurance 31 765. 765 To record supplies used during Month 16s -|1000 = 31 Pepneciat in Expnse Com, + Off ca Eguie A ccumutosed Dopieie ion Com t Equidnent To record depreciation for one 765 %3! 208.33 Dffice month Income Tav Ence 5,000 5,000 31 ncome taker Rawable To record one month's estimated income taxes SING ENTRIES General Journal Page 4 Date Description Ref. Debit Credit Closing entries: Consultig Income ummany 2014 Dec. 31 Reverve C0,000 Income Summary To close the credit balance account 31 Income Summary 199,281.31 8000 10,00. 300 612 5,000 000 765 708.33 300 Salary Evpns pestl Evp ense Advertision Expense. Payall Ta Expuse lo come Tax Espnse losuranceExpnse decice Suppl E Expnse Depseciaion uncousde Ceaguidi warranty Espense To close the debit balance accounts E spense As cones Eupense Income Summay Retained carn To close the Income Summary account 130,14.67 B0,7/4.61 31 31 To close the Dividends account ECIAL PROJECT-you need to complete . December adjusted trial balance prepared Assurion Consulting Services, Inc. FILL IN Credit Debit 50700 $9000 22000 FILL IN Cash (111) Accounts Receivable (113) Allowance for Uncollectable Accounts (114) Prepaid Insurance (117) 41000 Office Supplies (119) Computer & Office Equipment (144) Accumulated Depreciation-Computer & Office Equipment (145) Accounts Payable (212) Income Taxes Payable (213) 708.33 37765 G17 600 19,000 Salaries Payable (214) Payroll Taxes Payable (216) Estimated Consulting Product Warranty (217) Common Stock (311) Retained Earnings (312) Dividends (313) 6ooca Consulting Revenue (411) Salary Expense (510) Rent Expense (511) 8000 1,000 Advertising Expense (512) Insurance Expense (513) 2,000 765 1108.53 Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515) Consulting Warranty Expense (525) Uncollectable Account Expense (526) 300 "ayroll Tax Expense (527) m xpense (530) 217 5000 TOTAL 213 69S 39| 212685.33 5. May income statement, statement of retained earnings, and balance sheet prepared Fiore Consulting Services, Inc. FILL IN FILL IN Revenue Consulting Revenue 888 60 000 Expenses go00 19,000 300 2,000 Salary Expense (510) Rent Expense (511) Advertising Expense (512) Insurance Expense (513) Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515) 10 Consulting Warranty Expense (525) Uncollectable Account Expense (526) Payroll Tax Expense (527) Income Taxes Expense (530) 300 212 S,000 Total expenses 24285-33 367N.47 Net income FILL IN FILL IN Fiore Consulting Services, Inc. 1Briand 5tovemen Statemet of Re tainid Ecinis Net income Subtotal 304.67 10,000 oc 2074.67 Less dividends Retained E qprnings YOU MUST COMPLETE ALL SHADED AREAS L IN LL IN Assets ccounts Receivable Allowance for Uncolectable Accounts 59.000 7000 Piupeid Lasme Supplaes Less Accumulated Depreciation Total assets Liabilities 37765 Income tax Payab le Selong Paye hla Payro lov Buphe mated cocslut 2000 603 519- 7 Total liabilities Stockholders' Equity Actointd Eocoingt 120746 Total Liabilities and Stockholders' equity 112A 7. Dec.post-closing trial balance prepared Fiore Consulting Services, Inc. Post-Closing Trial Balance December 31, 2014 Dela fash l ALlowente Eo llet able Acc (14) Prepoie Ins vrener 7) Oel.ce suppiner (lia) 50700 59000 700 $2000 c De Com Of eaue Ld income tax oEgoble ( 13) Selerms Expense payaby 24) l Payrol tat payoble ais 37765 3000 Es consutling PizWar. or Stokk B11 612 ommen. 100,0e0 contin. onBock ECIAL PROJECT Account No. 111 Balance Cash Post. Credit Debit Debit Credit Date Item Ref. 2014 Dec. Account No. 113 Accouts Receivable Balance Post. Item Ref. Debit Credit Debit Credit Date 2014 RI Dec. Allowance for Uncollectable Accounts Account No. 114 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Prepaid Insurance Account No. 117 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. ECIAL PROJECT Account No. 119 Office Supplies Balance Post. Credit Credit Debit Ref. Debit Date Item 2014 Dec. Account No. 144 Computer & Office Equipment Balance Post. Credit Debit Credit Date Item Ref. Debit 2014 Dec. Account No. 145 Accumulated Depreciation-Computer Equipment Balance Post. Ref. Date Item Debit Credit Debit Credit 2014 Dec. Accounts Payable Account No. 212 Post. Balance Date Item Ref. Debit Credit Debit Credit 2011 Dec. Account No. 213 Balance CIAL PROJECT ncome Taxes Payable Credit Post. Debit Item Ref. Debit Credit Date 2014 Dec. Account No. 214 Salaries Payable Balance Debit Credit Debit Credit Date Item Ref. 2014 Dec. Account No. 216 Payroll Taxes Payable Balance Debit Credit Ref. Debit Credit Date Item 2014 Dec. Account No. 217 Estimated Consulting Warranty Liablity Balance Debit Credit Item Ref. Debit Credit Date 2014 Dec. Ad Common Stock Div (216 Dep Account No. 311 Balance Post. Item Ref. Debit Credit Debit Credit Date 2014 Dec. Retained Earnings Account No. 312 Post. Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. 31 31 Dividends Account No. 313 Post. Ref. Balance Date Item Debit Credit Debit Credit 2014 Dec. N inanrial stateme ECIAL PROJECT Account No. 314 ncome Summary Balance Post. Credit Debit Date Item Ref. Debit Credit 2014 Dec. Account No. 411 Consulting Revenue Balance Post. Debit Credit Date Item Ref. Debit Credit 2014 Dec. 31 Salary Expenxe Account No. 510 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Rent Expense Account No. 511 Post. Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. ECIAL PROJECT Account No. 512 Advertising Expense Balance Credit Post. Debit Credit Date Item Ref. Debit 2014 Dec. Account No. 513 Insurance Expense Balance Post. Credit Debit Credit Date Item Ref. Debit 2014 Dec. Office Supplies Expense Account No. 514 Balance Post. Date Item Ref. Debit Credit Debit Credit 2014 Dec. Depreciation Expense-Repair Equipment Account No. 515 Post. Balance Date Item Ref. Debit Credit Debit 2014 Pec. Credit CIAL PROJECT Account No. 525 Balance Credit consulting Warranty Expense Post. Debit Date Credit Item Ref. Debit 2014 Dec. Account No. 526 Balance Credit Uncollectable Account Expense Credit Debit Date 2014 Item Ref. Debit Dec. Payroll Tax Expense Account No. 527 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Income Tax Expense Account No. 530 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. On Dec. 1, 2014 Pete Fiore opened Flore Consulting Services, Inc. He provides marketing seminars guaranteed to increase sales by SK. The first fiscal (calendar) year will end December 31, 2014. One salaried employee was hired on December 1, 2014. No benefits accrue for six months. Mr. Fiore does not take a salary at this time. During the month, he completed the following transactions for the company: Dec. 1 Began business by depositing $100,000 in a bank account in the name of the company in exchange for 100,000 shares of $1 par value common stock. Paid the rent for his office store for current month, $10.000. 1 Pald the premlum on a one-year insurance policy. $24,000. 1 Purchased computer & office equipment on credit for $41,000. S Purchased office supplies from DEF Company on credit, $1,765. 8 Paid cash for an advertisement in a local newspaper, $300. 15 Billed consulting revenue for the first half of the month, $25,000. 21 Pald DEF Company on account, $s00. 31 Billed consulting revenue for the second half of July, $35,000. 31 Declared and paid a cash dividend, $10,000. 31 Accrue one (1)month salary for sole employee pald on January 3, 2015-S8,000. 31 Accrue one (1)month payroll tas for sole employee paid on January 3, 2015-7.65% of Salary Expense. 31 Industry history indicates 1% of sales must be accrued as provided as expense to cover expected warranty costs. The company experienced a cean munth in Dec. 2014. Journallae this expense. 31 Mr. Flore expects that uncollectible account expense will amount to SX. (1/2 of 1%). Journallse. 31 IICP In., customer declares bankruptcy necessitating writing off the amount owed by them from A/R-S1,000. REQUIRED FOR DECEMBER 1.Prepare Joumalentries to record the December transactions. Explanations supplied. 2. Open the following accounts: Cash (111); Accounts Recelvable (113): Prepaid Insurance (117): Office Supplies (119): Computer & Office Equipment (144): Accumulated Depreciation-Computer &Office Equipment (145: Accounts Payable (212), Income Taes Payable (213 Salaries Payable (214); Allowance for Uncollectable Acceunts (114); Estimated Conulting Waranty Liability (217).Common Stock (311) Retained Earnings (312 Dividends (113): Income Summary (314): Consulting Revenue (411) Salary Expense (S30JPayroll Taxes Payable (216): Rent Expense (511); Advertising Expense (512), Insurance Expense (513,office Supplies Expense (514); Depreciation Expense-Computer & Office Equipment (515); Income Taxes Expense (530); Consulting Warranty Expense (525); Uncollectable Account Expense (526). Payroll Tax Expense (527): Salary Expense (510). Post the DECEMBER entries to the to the general ledger accounts. 3Using the following information, recerd adjusting entries in the journal and post to the ledger accounts: (a) one month's insurance has expired: (b) remaining inventory of unused repair supplies, $1,000; (eThe computer & office equipment purchased on Dec. 1 has a useful life of four (4) years eand a salvage value of $1,000. You must complete the depreciation schedule and divide the first years calculated by twelve (12). Reord journal entry. Use double decling method. Worksheet supplied. (d) estimated income taaes for the month, $5,000. 4. From the accounts in the ledger, prepare an adjusted trial balance. (Note: Normally a trial balance is prepared before adjustments but is omitted here to save time.) 5. From the adjusted trial balance, prepare an income statement, a statement of retained earnings, and a balance sheet for December. Income Taxes is to be shown as part of total expenses. 6. Prepare and post dasing entries. Explanations required. 7. Prepare a post-dosing trial balance. SPECIAL PROJECT 1. Entries for December prepared 3. Adjusting entries for December prepared 6. Closing entries for December prepared General Journal Page 1 Post. Date Description Ref. Debit Credit 2014 Cash Common Dec. Stock To issue stock Rent Para Expre Cosh 16,000 10,000 To pay one month's rent Promium ko AS Orance Co sh To purchase one-year policy 24,000 2400 4,000 Payable 41,000 Accounts To purchase computer & office equipment Accouats Paya ble 1765 1765 To purchase repair supplies on credit from DEF Company Exprie Advertising Cash To purchase newspaper advertisement 300 300 Accaunts Consultrnn Reverdde To record receipt of revenue for the first half of the month 25,000 25,000 Recevase 15 Payable cash To make payment on account to 21 Accounts Soo DEF Company 00 AL PROJECT. (Continued) General Journal Page 2 Post. Date Description Ref. Debit Credit 2014 Aecounts Recsable 35,000 35,0 00 Dec. 31 Censutiy Revenue To record receipt of revenue for the last half of the month Div.dends Casm To declare and pay dividend 10,000 31 31 Salac&es ucabe To record salary expense 612 Paycoll Tawe Eapanes Payroll takes Pavode To accrue payroll tax expense Corgut 31 62 31 600 To estimate warranty costs Uncollect bay Accouet Eaparst fur Dacallect bs Acconts 130c 300 31 To accrue estimated bad debts 31 Aowence foi Uncellec We Accouts Monies owed by JCP deemed uncollectible. AL PROJECT. (Continued) General Journal Page 3 Post. Date Description Ref. Debit Credit Adjusting entries: losurance Expnse Pre paid Iosu.comce Dec. 31 2000 2,000 To record one month's expired insurance 31 765. 765 To record supplies used during Month 16s -|1000 = 31 Pepneciat in Expnse Com, + Off ca Eguie A ccumutosed Dopieie ion Com t Equidnent To record depreciation for one 765 %3! 208.33 Dffice month Income Tav Ence 5,000 5,000 31 ncome taker Rawable To record one month's estimated income taxes SING ENTRIES General Journal Page 4 Date Description Ref. Debit Credit Closing entries: Consultig Income ummany 2014 Dec. 31 Reverve C0,000 Income Summary To close the credit balance account 31 Income Summary 199,281.31 8000 10,00. 300 612 5,000 000 765 708.33 300 Salary Evpns pestl Evp ense Advertision Expense. Payall Ta Expuse lo come Tax Espnse losuranceExpnse decice Suppl E Expnse Depseciaion uncousde Ceaguidi warranty Espense To close the debit balance accounts E spense As cones Eupense Income Summay Retained carn To close the Income Summary account 130,14.67 B0,7/4.61 31 31 To close the Dividends account ECIAL PROJECT-you need to complete . December adjusted trial balance prepared Assurion Consulting Services, Inc. FILL IN Credit Debit 50700 $9000 22000 FILL IN Cash (111) Accounts Receivable (113) Allowance for Uncollectable Accounts (114) Prepaid Insurance (117) 41000 Office Supplies (119) Computer & Office Equipment (144) Accumulated Depreciation-Computer & Office Equipment (145) Accounts Payable (212) Income Taxes Payable (213) 708.33 37765 G17 600 19,000 Salaries Payable (214) Payroll Taxes Payable (216) Estimated Consulting Product Warranty (217) Common Stock (311) Retained Earnings (312) Dividends (313) 6ooca Consulting Revenue (411) Salary Expense (510) Rent Expense (511) 8000 1,000 Advertising Expense (512) Insurance Expense (513) 2,000 765 1108.53 Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515) Consulting Warranty Expense (525) Uncollectable Account Expense (526) 300 "ayroll Tax Expense (527) m xpense (530) 217 5000 TOTAL 213 69S 39| 212685.33 5. May income statement, statement of retained earnings, and balance sheet prepared Fiore Consulting Services, Inc. FILL IN FILL IN Revenue Consulting Revenue 888 60 000 Expenses go00 19,000 300 2,000 Salary Expense (510) Rent Expense (511) Advertising Expense (512) Insurance Expense (513) Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515) 10 Consulting Warranty Expense (525) Uncollectable Account Expense (526) Payroll Tax Expense (527) Income Taxes Expense (530) 300 212 S,000 Total expenses 24285-33 367N.47 Net income FILL IN FILL IN Fiore Consulting Services, Inc. 1Briand 5tovemen Statemet of Re tainid Ecinis Net income Subtotal 304.67 10,000 oc 2074.67 Less dividends Retained E qprnings YOU MUST COMPLETE ALL SHADED AREAS L IN LL IN Assets ccounts Receivable Allowance for Uncolectable Accounts 59.000 7000 Piupeid Lasme Supplaes Less Accumulated Depreciation Total assets Liabilities 37765 Income tax Payab le Selong Paye hla Payro lov Buphe mated cocslut 2000 603 519- 7 Total liabilities Stockholders' Equity Actointd Eocoingt 120746 Total Liabilities and Stockholders' equity 112A 7. Dec.post-closing trial balance prepared Fiore Consulting Services, Inc. Post-Closing Trial Balance December 31, 2014 Dela fash l ALlowente Eo llet able Acc (14) Prepoie Ins vrener 7) Oel.ce suppiner (lia) 50700 59000 700 $2000 c De Com Of eaue Ld income tax oEgoble ( 13) Selerms Expense payaby 24) l Payrol tat payoble ais 37765 3000 Es consutling PizWar. or Stokk B11 612 ommen. 100,0e0 contin. onBock ECIAL PROJECT Account No. 111 Balance Cash Post. Credit Debit Debit Credit Date Item Ref. 2014 Dec. Account No. 113 Accouts Receivable Balance Post. Item Ref. Debit Credit Debit Credit Date 2014 RI Dec. Allowance for Uncollectable Accounts Account No. 114 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Prepaid Insurance Account No. 117 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. ECIAL PROJECT Account No. 119 Office Supplies Balance Post. Credit Credit Debit Ref. Debit Date Item 2014 Dec. Account No. 144 Computer & Office Equipment Balance Post. Credit Debit Credit Date Item Ref. Debit 2014 Dec. Account No. 145 Accumulated Depreciation-Computer Equipment Balance Post. Ref. Date Item Debit Credit Debit Credit 2014 Dec. Accounts Payable Account No. 212 Post. Balance Date Item Ref. Debit Credit Debit Credit 2011 Dec. Account No. 213 Balance CIAL PROJECT ncome Taxes Payable Credit Post. Debit Item Ref. Debit Credit Date 2014 Dec. Account No. 214 Salaries Payable Balance Debit Credit Debit Credit Date Item Ref. 2014 Dec. Account No. 216 Payroll Taxes Payable Balance Debit Credit Ref. Debit Credit Date Item 2014 Dec. Account No. 217 Estimated Consulting Warranty Liablity Balance Debit Credit Item Ref. Debit Credit Date 2014 Dec. Ad Common Stock Div (216 Dep Account No. 311 Balance Post. Item Ref. Debit Credit Debit Credit Date 2014 Dec. Retained Earnings Account No. 312 Post. Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. 31 31 Dividends Account No. 313 Post. Ref. Balance Date Item Debit Credit Debit Credit 2014 Dec. N inanrial stateme ECIAL PROJECT Account No. 314 ncome Summary Balance Post. Credit Debit Date Item Ref. Debit Credit 2014 Dec. Account No. 411 Consulting Revenue Balance Post. Debit Credit Date Item Ref. Debit Credit 2014 Dec. 31 Salary Expenxe Account No. 510 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Rent Expense Account No. 511 Post. Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. ECIAL PROJECT Account No. 512 Advertising Expense Balance Credit Post. Debit Credit Date Item Ref. Debit 2014 Dec. Account No. 513 Insurance Expense Balance Post. Credit Debit Credit Date Item Ref. Debit 2014 Dec. Office Supplies Expense Account No. 514 Balance Post. Date Item Ref. Debit Credit Debit Credit 2014 Dec. Depreciation Expense-Repair Equipment Account No. 515 Post. Balance Date Item Ref. Debit Credit Debit 2014 Pec. Credit CIAL PROJECT Account No. 525 Balance Credit consulting Warranty Expense Post. Debit Date Credit Item Ref. Debit 2014 Dec. Account No. 526 Balance Credit Uncollectable Account Expense Credit Debit Date 2014 Item Ref. Debit Dec. Payroll Tax Expense Account No. 527 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Income Tax Expense Account No. 530 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. On Dec. 1, 2014 Pete Fiore opened Flore Consulting Services, Inc. He provides marketing seminars guaranteed to increase sales by SK. The first fiscal (calendar) year will end December 31, 2014. One salaried employee was hired on December 1, 2014. No benefits accrue for six months. Mr. Fiore does not take a salary at this time. During the month, he completed the following transactions for the company: Dec. 1 Began business by depositing $100,000 in a bank account in the name of the company in exchange for 100,000 shares of $1 par value common stock. Paid the rent for his office store for current month, $10.000. 1 Pald the premlum on a one-year insurance policy. $24,000. 1 Purchased computer & office equipment on credit for $41,000. S Purchased office supplies from DEF Company on credit, $1,765. 8 Paid cash for an advertisement in a local newspaper, $300. 15 Billed consulting revenue for the first half of the month, $25,000. 21 Pald DEF Company on account, $s00. 31 Billed consulting revenue for the second half of July, $35,000. 31 Declared and paid a cash dividend, $10,000. 31 Accrue one (1)month salary for sole employee pald on January 3, 2015-S8,000. 31 Accrue one (1)month payroll tas for sole employee paid on January 3, 2015-7.65% of Salary Expense. 31 Industry history indicates 1% of sales must be accrued as provided as expense to cover expected warranty costs. The company experienced a cean munth in Dec. 2014. Journallae this expense. 31 Mr. Flore expects that uncollectible account expense will amount to SX. (1/2 of 1%). Journallse. 31 IICP In., customer declares bankruptcy necessitating writing off the amount owed by them from A/R-S1,000. REQUIRED FOR DECEMBER 1.Prepare Joumalentries to record the December transactions. Explanations supplied. 2. Open the following accounts: Cash (111); Accounts Recelvable (113): Prepaid Insurance (117): Office Supplies (119): Computer & Office Equipment (144): Accumulated Depreciation-Computer &Office Equipment (145: Accounts Payable (212), Income Taes Payable (213 Salaries Payable (214); Allowance for Uncollectable Acceunts (114); Estimated Conulting Waranty Liability (217).Common Stock (311) Retained Earnings (312 Dividends (113): Income Summary (314): Consulting Revenue (411) Salary Expense (S30JPayroll Taxes Payable (216): Rent Expense (511); Advertising Expense (512), Insurance Expense (513,office Supplies Expense (514); Depreciation Expense-Computer & Office Equipment (515); Income Taxes Expense (530); Consulting Warranty Expense (525); Uncollectable Account Expense (526). Payroll Tax Expense (527): Salary Expense (510). Post the DECEMBER entries to the to the general ledger accounts. 3Using the following information, recerd adjusting entries in the journal and post to the ledger accounts: (a) one month's insurance has expired: (b) remaining inventory of unused repair supplies, $1,000; (eThe computer & office equipment purchased on Dec. 1 has a useful life of four (4) years eand a salvage value of $1,000. You must complete the depreciation schedule and divide the first years calculated by twelve (12). Reord journal entry. Use double decling method. Worksheet supplied. (d) estimated income taaes for the month, $5,000. 4. From the accounts in the ledger, prepare an adjusted trial balance. (Note: Normally a trial balance is prepared before adjustments but is omitted here to save time.) 5. From the adjusted trial balance, prepare an income statement, a statement of retained earnings, and a balance sheet for December. Income Taxes is to be shown as part of total expenses. 6. Prepare and post dasing entries. Explanations required. 7. Prepare a post-dosing trial balance. SPECIAL PROJECT 1. Entries for December prepared 3. Adjusting entries for December prepared 6. Closing entries for December prepared General Journal Page 1 Post. Date Description Ref. Debit Credit 2014 Cash Common Dec. Stock To issue stock Rent Para Expre Cosh 16,000 10,000 To pay one month's rent Promium ko AS Orance Co sh To purchase one-year policy 24,000 2400 4,000 Payable 41,000 Accounts To purchase computer & office equipment Accouats Paya ble 1765 1765 To purchase repair supplies on credit from DEF Company Exprie Advertising Cash To purchase newspaper advertisement 300 300 Accaunts Consultrnn Reverdde To record receipt of revenue for the first half of the month 25,000 25,000 Recevase 15 Payable cash To make payment on account to 21 Accounts Soo DEF Company 00 AL PROJECT. (Continued) General Journal Page 2 Post. Date Description Ref. Debit Credit 2014 Aecounts Recsable 35,000 35,0 00 Dec. 31 Censutiy Revenue To record receipt of revenue for the last half of the month Div.dends Casm To declare and pay dividend 10,000 31 31 Salac&es ucabe To record salary expense 612 Paycoll Tawe Eapanes Payroll takes Pavode To accrue payroll tax expense Corgut 31 62 31 600 To estimate warranty costs Uncollect bay Accouet Eaparst fur Dacallect bs Acconts 130c 300 31 To accrue estimated bad debts 31 Aowence foi Uncellec We Accouts Monies owed by JCP deemed uncollectible. AL PROJECT. (Continued) General Journal Page 3 Post. Date Description Ref. Debit Credit Adjusting entries: losurance Expnse Pre paid Iosu.comce Dec. 31 2000 2,000 To record one month's expired insurance 31 765. 765 To record supplies used during Month 16s -|1000 = 31 Pepneciat in Expnse Com, + Off ca Eguie A ccumutosed Dopieie ion Com t Equidnent To record depreciation for one 765 %3! 208.33 Dffice month Income Tav Ence 5,000 5,000 31 ncome taker Rawable To record one month's estimated income taxes SING ENTRIES General Journal Page 4 Date Description Ref. Debit Credit Closing entries: Consultig Income ummany 2014 Dec. 31 Reverve C0,000 Income Summary To close the credit balance account 31 Income Summary 199,281.31 8000 10,00. 300 612 5,000 000 765 708.33 300 Salary Evpns pestl Evp ense Advertision Expense. Payall Ta Expuse lo come Tax Espnse losuranceExpnse decice Suppl E Expnse Depseciaion uncousde Ceaguidi warranty Espense To close the debit balance accounts E spense As cones Eupense Income Summay Retained carn To close the Income Summary account 130,14.67 B0,7/4.61 31 31 To close the Dividends account ECIAL PROJECT-you need to complete . December adjusted trial balance prepared Assurion Consulting Services, Inc. FILL IN Credit Debit 50700 $9000 22000 FILL IN Cash (111) Accounts Receivable (113) Allowance for Uncollectable Accounts (114) Prepaid Insurance (117) 41000 Office Supplies (119) Computer & Office Equipment (144) Accumulated Depreciation-Computer & Office Equipment (145) Accounts Payable (212) Income Taxes Payable (213) 708.33 37765 G17 600 19,000 Salaries Payable (214) Payroll Taxes Payable (216) Estimated Consulting Product Warranty (217) Common Stock (311) Retained Earnings (312) Dividends (313) 6ooca Consulting Revenue (411) Salary Expense (510) Rent Expense (511) 8000 1,000 Advertising Expense (512) Insurance Expense (513) 2,000 765 1108.53 Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515) Consulting Warranty Expense (525) Uncollectable Account Expense (526) 300 "ayroll Tax Expense (527) m xpense (530) 217 5000 TOTAL 213 69S 39| 212685.33 5. May income statement, statement of retained earnings, and balance sheet prepared Fiore Consulting Services, Inc. FILL IN FILL IN Revenue Consulting Revenue 888 60 000 Expenses go00 19,000 300 2,000 Salary Expense (510) Rent Expense (511) Advertising Expense (512) Insurance Expense (513) Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515) 10 Consulting Warranty Expense (525) Uncollectable Account Expense (526) Payroll Tax Expense (527) Income Taxes Expense (530) 300 212 S,000 Total expenses 24285-33 367N.47 Net income FILL IN FILL IN Fiore Consulting Services, Inc. 1Briand 5tovemen Statemet of Re tainid Ecinis Net income Subtotal 304.67 10,000 oc 2074.67 Less dividends Retained E qprnings YOU MUST COMPLETE ALL SHADED AREAS L IN LL IN Assets ccounts Receivable Allowance for Uncolectable Accounts 59.000 7000 Piupeid Lasme Supplaes Less Accumulated Depreciation Total assets Liabilities 37765 Income tax Payab le Selong Paye hla Payro lov Buphe mated cocslut 2000 603 519- 7 Total liabilities Stockholders' Equity Actointd Eocoingt 120746 Total Liabilities and Stockholders' equity 112A 7. Dec.post-closing trial balance prepared Fiore Consulting Services, Inc. Post-Closing Trial Balance December 31, 2014 Dela fash l ALlowente Eo llet able Acc (14) Prepoie Ins vrener 7) Oel.ce suppiner (lia) 50700 59000 700 $2000 c De Com Of eaue Ld income tax oEgoble ( 13) Selerms Expense payaby 24) l Payrol tat payoble ais 37765 3000 Es consutling PizWar. or Stokk B11 612 ommen. 100,0e0 contin. onBock ECIAL PROJECT Account No. 111 Balance Cash Post. Credit Debit Debit Credit Date Item Ref. 2014 Dec. Account No. 113 Accouts Receivable Balance Post. Item Ref. Debit Credit Debit Credit Date 2014 RI Dec. Allowance for Uncollectable Accounts Account No. 114 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Prepaid Insurance Account No. 117 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. ECIAL PROJECT Account No. 119 Office Supplies Balance Post. Credit Credit Debit Ref. Debit Date Item 2014 Dec. Account No. 144 Computer & Office Equipment Balance Post. Credit Debit Credit Date Item Ref. Debit 2014 Dec. Account No. 145 Accumulated Depreciation-Computer Equipment Balance Post. Ref. Date Item Debit Credit Debit Credit 2014 Dec. Accounts Payable Account No. 212 Post. Balance Date Item Ref. Debit Credit Debit Credit 2011 Dec. Account No. 213 Balance CIAL PROJECT ncome Taxes Payable Credit Post. Debit Item Ref. Debit Credit Date 2014 Dec. Account No. 214 Salaries Payable Balance Debit Credit Debit Credit Date Item Ref. 2014 Dec. Account No. 216 Payroll Taxes Payable Balance Debit Credit Ref. Debit Credit Date Item 2014 Dec. Account No. 217 Estimated Consulting Warranty Liablity Balance Debit Credit Item Ref. Debit Credit Date 2014 Dec. Ad Common Stock Div (216 Dep Account No. 311 Balance Post. Item Ref. Debit Credit Debit Credit Date 2014 Dec. Retained Earnings Account No. 312 Post. Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. 31 31 Dividends Account No. 313 Post. Ref. Balance Date Item Debit Credit Debit Credit 2014 Dec. N inanrial stateme ECIAL PROJECT Account No. 314 ncome Summary Balance Post. Credit Debit Date Item Ref. Debit Credit 2014 Dec. Account No. 411 Consulting Revenue Balance Post. Debit Credit Date Item Ref. Debit Credit 2014 Dec. 31 Salary Expenxe Account No. 510 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Rent Expense Account No. 511 Post. Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. ECIAL PROJECT Account No. 512 Advertising Expense Balance Credit Post. Debit Credit Date Item Ref. Debit 2014 Dec. Account No. 513 Insurance Expense Balance Post. Credit Debit Credit Date Item Ref. Debit 2014 Dec. Office Supplies Expense Account No. 514 Balance Post. Date Item Ref. Debit Credit Debit Credit 2014 Dec. Depreciation Expense-Repair Equipment Account No. 515 Post. Balance Date Item Ref. Debit Credit Debit 2014 Pec. Credit CIAL PROJECT Account No. 525 Balance Credit consulting Warranty Expense Post. Debit Date Credit Item Ref. Debit 2014 Dec. Account No. 526 Balance Credit Uncollectable Account Expense Credit Debit Date 2014 Item Ref. Debit Dec. Payroll Tax Expense Account No. 527 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec. Income Tax Expense Account No. 530 Balance Date Item Ref. Debit Credit Debit Credit 2014 Dec.

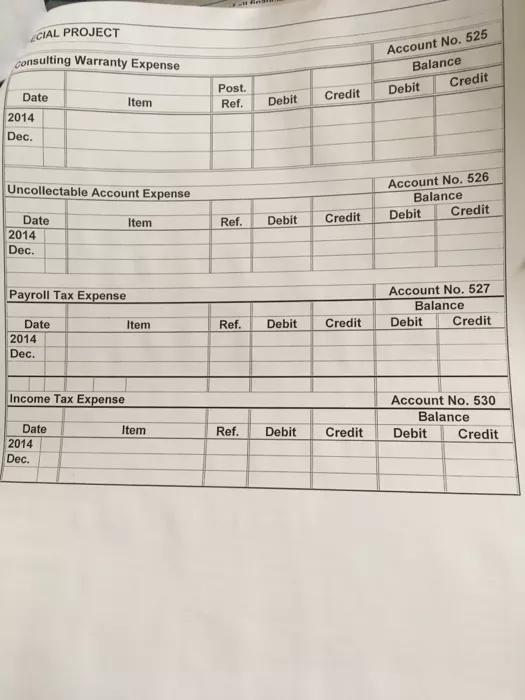

Step by Step Solution

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 In Adjusting EntriesDepreciation 4100010004 112 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started

![On Dec. 1, 2014, Pete Fiore opened Fiore Consulting Services, Inc. He provides marketing seminars guaranteed to increase sales by 5%. The first fiscal (calendar) year will end December 31, 2014 salaried employee was hired on December 1, 2014. No benefits accrue for six months Mr. Fiore does not take a salary at this time. During the month, he completed the following transactions for the company: Dec. 1 Began business by depositing $100,000 In a bank account in the name of the company in exchange for 100,000 shares of $1 par value common stock. 1Paid the rent for his office store for current month, $10,000. 1 Paid the premium on a one-year insurance policy, $24,000. 1 Purchased computer& office equipment on credit for $41,000. S Purchased office supplies from DEF Company on credit, $1,765. 8 Paid cash for an advertisement in a local newspaper, $300. 15 Billed consulting revenue for the first half of the month, $25,000. 21 Paid DEF Company on account, $s00. 31 Billed consulting revenue for the second half of July, $35,000. 31 Declared and paid a cash dividend, $10,000. 31 Accrue one (1)month salary for sole employee paid on January 3, 2015-$8,000. 31 Accrue one (1)month payroll taxes for sole employee paid on January 3, 2015-7.65% of Salary Expense. 31 Industry history indicates 1% of sales must be accrued as provided as expense to cover expected warranty costs. The company experienced a clean month in Dec. 2014. Journalize this expense. 31 Mr. Fiore expects that uncollectible account expense will amount to .5%. (1/2 of 1%). Journalize. 31 IJCP Inc., a customer declares bankruptcy necessitating writing off the amount owed by them from A/R-$1,000. 2. Open the following accounts: Cash (111); Accounts Receivable (113); Prepaid Insurance (117); Office Supplies (119]: Computer & Office Equipment (144); Accumulated Depreciation-Computer & Office Equipment (145) Accounts Payable (212); Income Taxes Payable (213); Salaries Payable (214): Allowance for Uncollectable Accounts (114); Estimated Consulting warranty Liability (217)Common Stock (311); Retained Earnings (312); Dividends (313); Income Summary (314); Consulting Revenue (411); Salary Expense (S10)Payroll Taxes Payable (216): Rent Expense (511): Advertising Expense (512); Insurance Expense (513)-Office Supplies Expense (514) Depreciation Expense-Computer & Office Equipment (515); Income Taxes Expense (530);Consulting Warranty Expense (525); Uncollectable Account Expense (526). Payroll Tax Expense (527); Salary Expense (510). Post the DECEMBER entries to the to the general ledger accounts... ournal and 3. Using the (a) one months insurance has expired; (b) remaining inventory of unused repair supplies, $1,000 (c)The computer& office equipment purchased on Dec. 1 has a useful life of four (4) years and a salvage value of $1,000. You must complete the depreciation schedule and divide the first years calculated by twelve (12) Reord journal entry. Use double decling method. Worksheet supplied. (d) estimated income taxes for the month, $5,000 4. From the accounts in the ledger, prepare an adjusted trial balance. (Note: Normally a trial balance is prepared before adjustments but is omitted here to save time.) 5. From the adjusted trial balance, prepare an income statement, a statement of retained earnings, and a balance sheet for December. Income Taxes is to be shown as part of total expenses 6. Prepare and post cosing entries. Explanations required. 7. Prepare a post dasing trial balance.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/01/61dfbc903ade6_1642052742939.jpg)