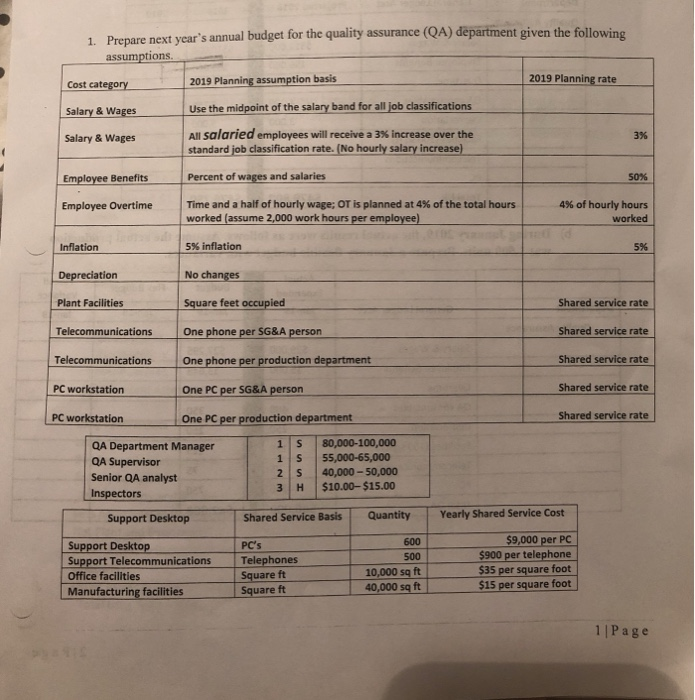

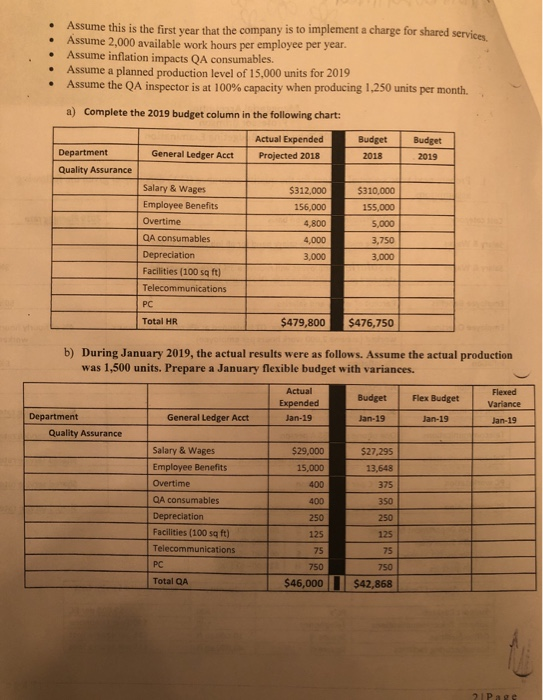

1. Prepare next year's annual budget for the quality assurance (QA) department given the following assumptions 2019 Planning rate 2019 Planning assumption basis Cost category Use the midpoint of the salary band for all job classifications Salary & Wages All salaried employees will receive a 3 % increase over the standard job classification rate. (No hourly salary increase) 3% Salary & Wages Percent of wages and salaries 50 % Employee Benefits Time and a half of hourly wage; OT is planned at 4 % of the total hours worked (assume 2,000 work hours per employee) 4% of hourly hours Employee Overtime worked 5% inflation Inflation 5% Depreciation No changes Plant Facilities Square feet occupied Shared service rate Shared service rate Telecommunications One phone per SG&A person Shared service rate Telecommunications One phone per production department Shared service rate PC workstation One PC per SG&A person PC workstation Shared service rate One PC per production department 80,000-100,000 55,000-65,000 40,000-50,000 $10.00-$15.00 1 S QA Department Manager QA Supervisor Senior QA analyst S 2 S H 3 Inspectors Yearly Shared Service Cost Quantity Support Desktop Shared Service Basis $9,000 per PC $900 per telephone $35 per square foot 600 Support Desktop PC's 500 Telephones Square ft Square ft Support Telecommunications 10,000 sq ft Office facilities $15 per square foot 40,000 sq ft Manufacturing facilities 1 | Page nnnI Assume this is the first year that the company is to implement a charge for shared services Assume 2,000 available work hours per employee per year. Assume inflation impacts QA consumables. Assume a planned production level of 15,000 units for 2019 Assume the QA inspector is at 100% capacity when producing 1,250 units per month. a) Complete the 2019 budget column in the following chart: Actual Expended Budget Budget Department General Ledger Acct Projected 2018 2018 2019 Quality Assurance Salary & Wages $312,000 $310,000 Employee Benefits 156,000 155,000 Overtime 4,800 5,000 QA consumables 4,000 3,750 Depreciation 3,000 3,000 Facilities (100 sq ft) Telecommunications PC Total HR $479,800 $476,750 b) During January 2019, the actual results were as follows. Assume the actual production was 1,500 units. Prepare a January flexible budget with variances. Actual Flexed Budget Flex Budget Expended Variance Department General Ledger Acct Jan-19 Jan-19 Jan-19 Jan-19 Quality Assurance Salary & Wages $29,000 $27,295 Employee Benefits 15,000 13,648 Overtime 400 375 QA consumables 400 350 Depreciation 250 250 Facilities (100 sq ft) 125 125 Telecommunications 75 75 PC 750 750 Total QA $46,000 $42,868 21Page 1. Prepare next year's annual budget for the quality assurance (QA) department given the following assumptions 2019 Planning rate 2019 Planning assumption basis Cost category Use the midpoint of the salary band for all job classifications Salary & Wages All salaried employees will receive a 3 % increase over the standard job classification rate. (No hourly salary increase) 3% Salary & Wages Percent of wages and salaries 50 % Employee Benefits Time and a half of hourly wage; OT is planned at 4 % of the total hours worked (assume 2,000 work hours per employee) 4% of hourly hours Employee Overtime worked 5% inflation Inflation 5% Depreciation No changes Plant Facilities Square feet occupied Shared service rate Shared service rate Telecommunications One phone per SG&A person Shared service rate Telecommunications One phone per production department Shared service rate PC workstation One PC per SG&A person PC workstation Shared service rate One PC per production department 80,000-100,000 55,000-65,000 40,000-50,000 $10.00-$15.00 1 S QA Department Manager QA Supervisor Senior QA analyst S 2 S H 3 Inspectors Yearly Shared Service Cost Quantity Support Desktop Shared Service Basis $9,000 per PC $900 per telephone $35 per square foot 600 Support Desktop PC's 500 Telephones Square ft Square ft Support Telecommunications 10,000 sq ft Office facilities $15 per square foot 40,000 sq ft Manufacturing facilities 1 | Page nnnI Assume this is the first year that the company is to implement a charge for shared services Assume 2,000 available work hours per employee per year. Assume inflation impacts QA consumables. Assume a planned production level of 15,000 units for 2019 Assume the QA inspector is at 100% capacity when producing 1,250 units per month. a) Complete the 2019 budget column in the following chart: Actual Expended Budget Budget Department General Ledger Acct Projected 2018 2018 2019 Quality Assurance Salary & Wages $312,000 $310,000 Employee Benefits 156,000 155,000 Overtime 4,800 5,000 QA consumables 4,000 3,750 Depreciation 3,000 3,000 Facilities (100 sq ft) Telecommunications PC Total HR $479,800 $476,750 b) During January 2019, the actual results were as follows. Assume the actual production was 1,500 units. Prepare a January flexible budget with variances. Actual Flexed Budget Flex Budget Expended Variance Department General Ledger Acct Jan-19 Jan-19 Jan-19 Jan-19 Quality Assurance Salary & Wages $29,000 $27,295 Employee Benefits 15,000 13,648 Overtime 400 375 QA consumables 400 350 Depreciation 250 250 Facilities (100 sq ft) 125 125 Telecommunications 75 75 PC 750 750 Total QA $46,000 $42,868 21Page