Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Prepare pro forma income statement and balance sheet for next year using percent of sales method and the following information: Any new capital expenditures

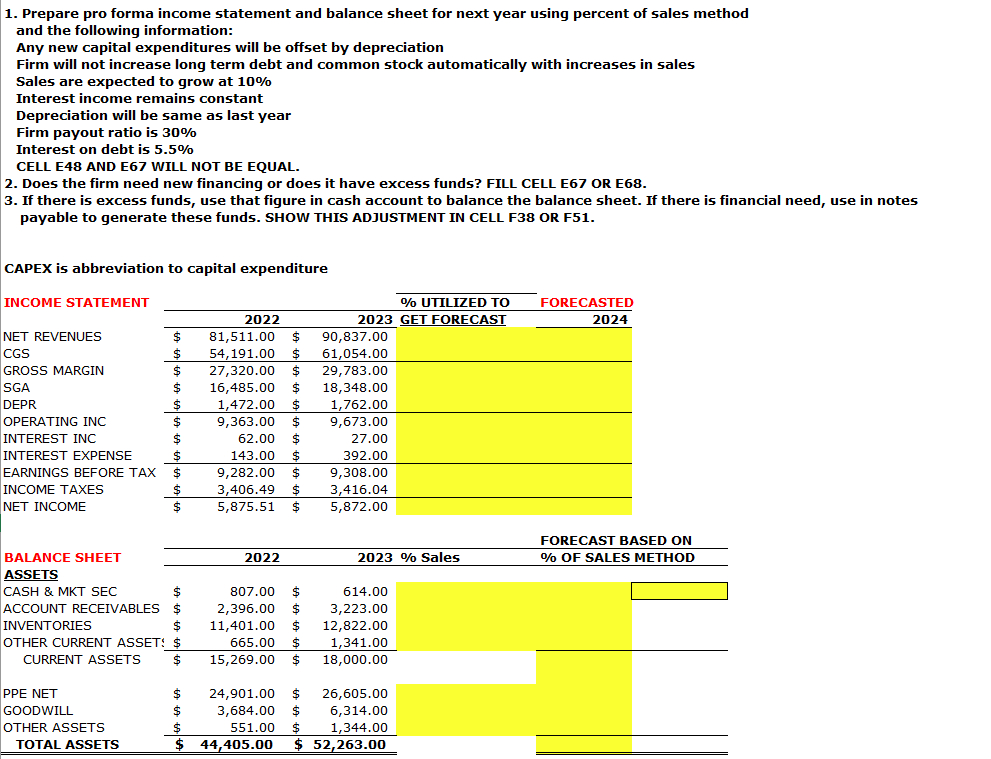

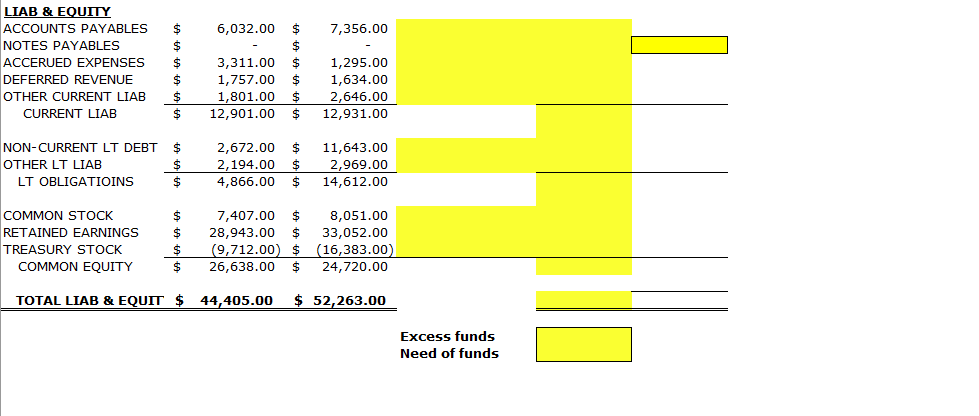

1. Prepare pro forma income statement and balance sheet for next year using percent of sales method and the following information: Any new capital expenditures will be offset by depreciation Firm will not increase long term debt and common stock automatically with increases in sales Sales are expected to grow at 10% Interest income remains constant Depreciation will be same as last year Firm payout ratio is 30% Interest on debt is 5.5% CELL E48 AND E67 WILL NOT BE EQUAL. 2. Does the firm need new financing or does it have excess funds? FILL CELL E67 OR E68. 3. If there is excess funds, use that figure in cash account to balance the balance sheet. If there is financial need, use in notes payable to generate these funds. SHOW THIS ADJUSTMENT IN CELL F38 OR F51. CAPEX is abbreviation to capital expenditure LIAB \& EQUITY Excess funds Need of funds 1. Prepare pro forma income statement and balance sheet for next year using percent of sales method and the following information: Any new capital expenditures will be offset by depreciation Firm will not increase long term debt and common stock automatically with increases in sales Sales are expected to grow at 10% Interest income remains constant Depreciation will be same as last year Firm payout ratio is 30% Interest on debt is 5.5% CELL E48 AND E67 WILL NOT BE EQUAL. 2. Does the firm need new financing or does it have excess funds? FILL CELL E67 OR E68. 3. If there is excess funds, use that figure in cash account to balance the balance sheet. If there is financial need, use in notes payable to generate these funds. SHOW THIS ADJUSTMENT IN CELL F38 OR F51. CAPEX is abbreviation to capital expenditure LIAB \& EQUITY Excess funds Need of funds

1. Prepare pro forma income statement and balance sheet for next year using percent of sales method and the following information: Any new capital expenditures will be offset by depreciation Firm will not increase long term debt and common stock automatically with increases in sales Sales are expected to grow at 10% Interest income remains constant Depreciation will be same as last year Firm payout ratio is 30% Interest on debt is 5.5% CELL E48 AND E67 WILL NOT BE EQUAL. 2. Does the firm need new financing or does it have excess funds? FILL CELL E67 OR E68. 3. If there is excess funds, use that figure in cash account to balance the balance sheet. If there is financial need, use in notes payable to generate these funds. SHOW THIS ADJUSTMENT IN CELL F38 OR F51. CAPEX is abbreviation to capital expenditure LIAB \& EQUITY Excess funds Need of funds 1. Prepare pro forma income statement and balance sheet for next year using percent of sales method and the following information: Any new capital expenditures will be offset by depreciation Firm will not increase long term debt and common stock automatically with increases in sales Sales are expected to grow at 10% Interest income remains constant Depreciation will be same as last year Firm payout ratio is 30% Interest on debt is 5.5% CELL E48 AND E67 WILL NOT BE EQUAL. 2. Does the firm need new financing or does it have excess funds? FILL CELL E67 OR E68. 3. If there is excess funds, use that figure in cash account to balance the balance sheet. If there is financial need, use in notes payable to generate these funds. SHOW THIS ADJUSTMENT IN CELL F38 OR F51. CAPEX is abbreviation to capital expenditure LIAB \& EQUITY Excess funds Need of funds Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started