1. Prepare the acquisition analysis for Java Ltd's investment in Memo Ltd to calculate total goodwill and the allocation of goodwill between Java Ltd and the NCI at 30 Jun 22.

2. Prepare all consolidation journals and show all workings for Java Ltd's investment in Memo Ltd for year ended 30 Jun 22.

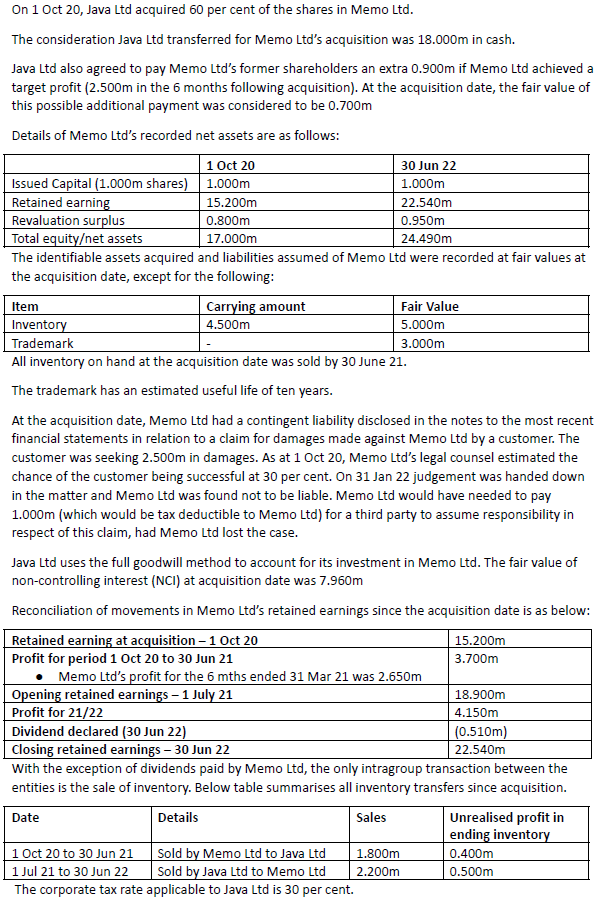

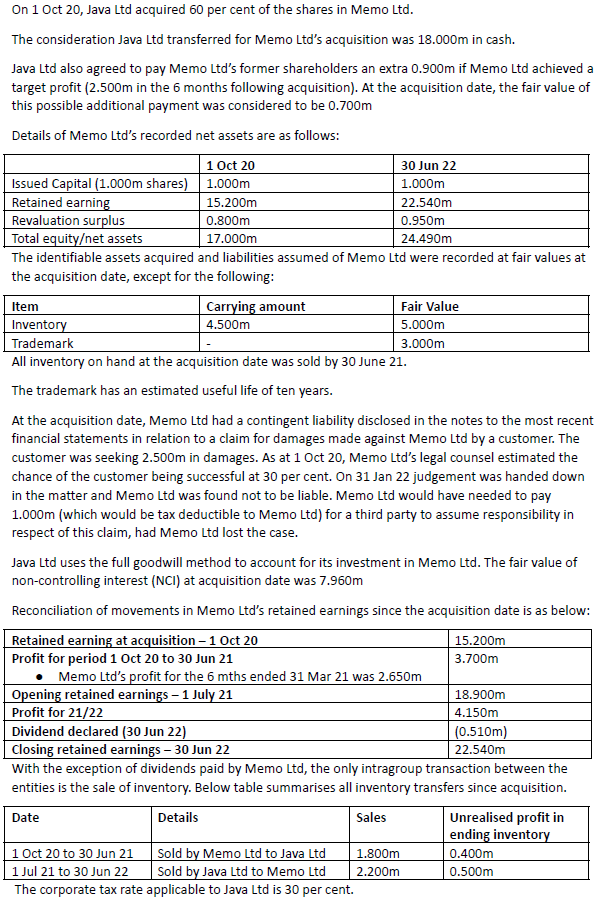

On 1 Oct 20 , Java Ltd acquired 60 per cent of the shares in Memo Ltd. The consideration Java Ltd transferred for Memo Ltd's acquisition was 18.000m in cash. Java Ltd also agreed to pay Memo Ltd's former shareholders an extra 0.900m if Memo Ltd achieved a target profit (2.500m in the 6 months following acquisition). At the acquisition date, the fair value of this possible additional payment was considered to be 0.700m Details of Memo Ltd's recorded net assets are as follows: The identifiable assets acquired and liabilities assumed of Memo Ltd were recorded at fair values at the acquisition date, except for the following: - All inventory on hand at the acquisition date was sold by 30 June 21. The trademark has an estimated useful life of ten years. At the acquisition date, Memo Ltd had a contingent liability disclosed in the notes to the most recent financial statements in relation to a claim for damages made against Memo Ltd by a customer. The customer was seeking 2.500m in damages. As at 1 Oct 20 , Memo Ltd's legal counsel estimated the chance of the customer being successful at 30 per cent. On 31 Jan 22 judgement was handed down in the matter and Memo Ltd was found not to be liable. Memo Ltd would have needed to pay 1.000m (which would be tax deductible to Memo Ltd) for a third party to assume responsibility in respect of this claim, had Memo Ltd lost the case. Java Ltd uses the full goodwill method to account for its investment in Memo Ltd. The fair value of non-controlling interest (NCl) at acquisition date was 7.960m Reconciliation of movements in Memo Ltd's retained earnings since the acquisition date is as below: With the exception of dividends paid by Memo Ltd, the only intragroup transaction between the entities is the sale of inventory. Below table summarises all inventory transfers since acquisition. On 1 Oct 20 , Java Ltd acquired 60 per cent of the shares in Memo Ltd. The consideration Java Ltd transferred for Memo Ltd's acquisition was 18.000m in cash. Java Ltd also agreed to pay Memo Ltd's former shareholders an extra 0.900m if Memo Ltd achieved a target profit (2.500m in the 6 months following acquisition). At the acquisition date, the fair value of this possible additional payment was considered to be 0.700m Details of Memo Ltd's recorded net assets are as follows: The identifiable assets acquired and liabilities assumed of Memo Ltd were recorded at fair values at the acquisition date, except for the following: - All inventory on hand at the acquisition date was sold by 30 June 21. The trademark has an estimated useful life of ten years. At the acquisition date, Memo Ltd had a contingent liability disclosed in the notes to the most recent financial statements in relation to a claim for damages made against Memo Ltd by a customer. The customer was seeking 2.500m in damages. As at 1 Oct 20 , Memo Ltd's legal counsel estimated the chance of the customer being successful at 30 per cent. On 31 Jan 22 judgement was handed down in the matter and Memo Ltd was found not to be liable. Memo Ltd would have needed to pay 1.000m (which would be tax deductible to Memo Ltd) for a third party to assume responsibility in respect of this claim, had Memo Ltd lost the case. Java Ltd uses the full goodwill method to account for its investment in Memo Ltd. The fair value of non-controlling interest (NCl) at acquisition date was 7.960m Reconciliation of movements in Memo Ltd's retained earnings since the acquisition date is as below: With the exception of dividends paid by Memo Ltd, the only intragroup transaction between the entities is the sale of inventory. Below table summarises all inventory transfers since acquisition