Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Prepare the entry PSU made to record the acquisition on January 1, 2013. 2) Prepare a schedule calculating the original goodwill for this acquisition.

1) Prepare the entry PSU made to record the acquisition on January 1, 2013.

2) Prepare a schedule calculating the original goodwill for this acquisition.

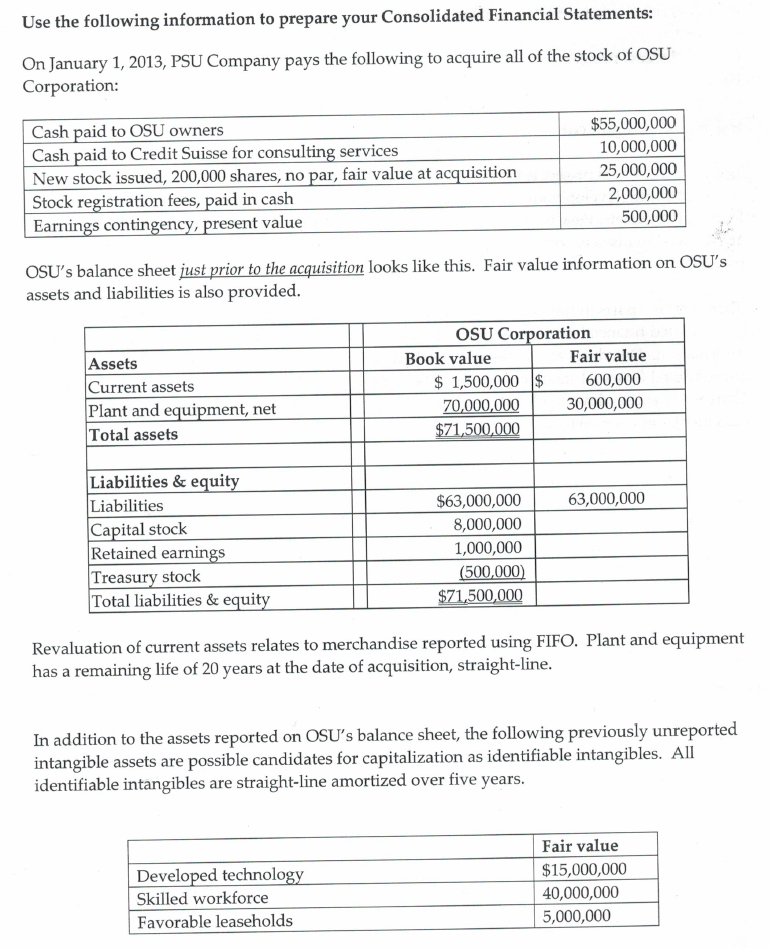

Use the following information to prepare your Consolidated Financial Statements OSU On January 1, 2013, PSU Company pays the following to acquire all of the stock of Corporation: Cash paid to OSU owners Cash paid to Credit Suisse for consulting services New stock issued, 200,000 shares, no par, fair value at acquisition Stock registration fees, paid in cash Earnings contingency, present value $55,000,000 10,000,000 25,000,000 2,000,000 500,000 cquisition looks like this. Fair value information on OSU's OSU's balance sheet just prior t assets and liabilities is also provided OSU Corporation Fair value 600,000 70,000,000 30,000,000 Book value Assets Current assets Plant and equipment, net Total assets $1,500,000 $ Liabilities & equit Liabilities Capital stock Retained earnings Treasury stock Total liabilities & equit 63,000,000 $63,000,000 8,000,000 1,000,000 (500,000) Revaluation of current assets relates to merchandise reported using FIFO. Plant and equipment has a remaining life of 20 years at the date of acquisition, straight-line In addition to the assets reported on OSU's balance sheet, the following previously unreported intangible assets are possible candidates for capitalization as identifiable intangibles. All identifiable intangibles are straight-line amortized over five years. Developed technolo Skilled workforce Favorable leaseholds Fair value $15,000,000 40,000,000 5,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started