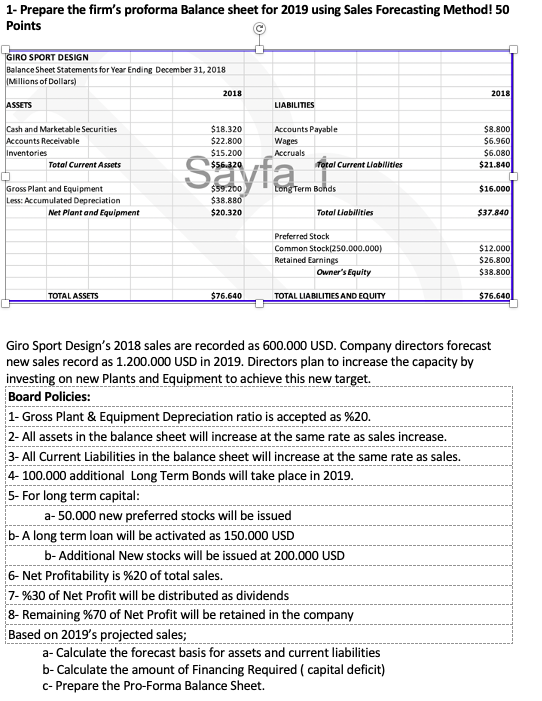

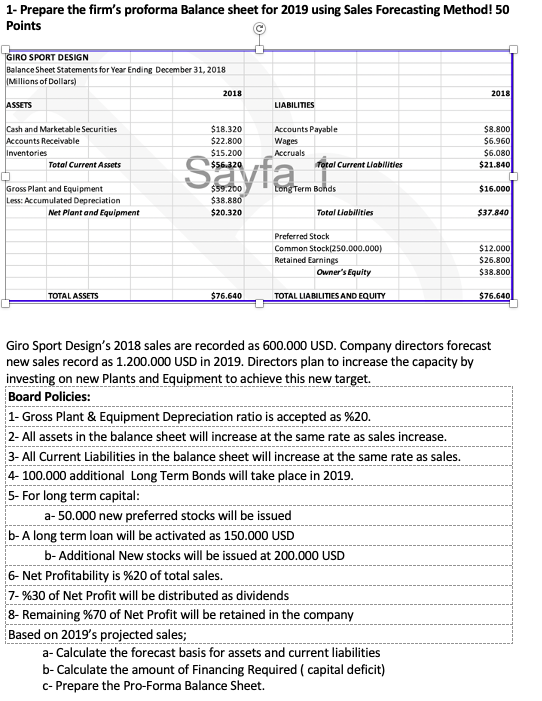

1- Prepare the firm's proforma Balance sheet for 2019 using Sales Forecasting Method! 50 Points GIRO SPORT DESIGN Balance Sheet Statements for Year Ending December 31, 2018 Millions of Dollars) 2018 2018 ASSETS LIABILITIES Cash and Marketable Securities Accounts Receivable Inventories Total Current Assets $18.320 $22.800 $15.200 $56.320 Accounts Payable Wages Accruals Total Current Liabilities $8.800 $6.960 $6.080 $21.840 $16.000 Gross Plant and Equipment Less: Accumulated Depreciation Net Plant and Equipment $59.200 $38.880 $20.320 Total Liabilities $37.840 Preferred Stock Common Stock/250.000.000) Retained Earnings Owner's Equity $12.000 $26.800 $38.800 TOTAL ASSETS $76.640 TOTAL LIABILITIES AND EQUITY $76.640 Giro Sport Design's 2018 sales are recorded as 600.000 USD. Company directors forecast new sales record as 1.200.000 USD in 2019. Directors plan to increase the capacity by investing on new Plants and Equipment to achieve this new target. Board Policies: 1- Gross Plant & Equipment Depreciation ratio is accepted as %20. 2- All assets in the balance sheet will increase at the same rate as sales increase 3- All Current Liabilities in the balance sheet will increase at the same rate as sales. 4- 100.000 additional Long Term Bonds will take place in 2019. 5- For long term capital: a-50.000 new preferred stocks will be issued b-A long term loan will be activated as 150.000 USD b-Additional New stocks will be issued at 200.000 USD 6- Net Profitability is %20 of total sales. 7-%30 of Net Profit will be distributed as dividends 8- Remaining %70 of Net Profit will be retained in the company Based on 2019's projected sales; a- Calculate the forecast basis for assets and current liabilities b- Calculate the amount of Financing Required ( capital deficit) C- Prepare the Pro-Forma Balance Sheet. 1- Prepare the firm's proforma Balance sheet for 2019 using Sales Forecasting Method! 50 Points GIRO SPORT DESIGN Balance Sheet Statements for Year Ending December 31, 2018 Millions of Dollars) 2018 2018 ASSETS LIABILITIES Cash and Marketable Securities Accounts Receivable Inventories Total Current Assets $18.320 $22.800 $15.200 $56.320 Accounts Payable Wages Accruals Total Current Liabilities $8.800 $6.960 $6.080 $21.840 $16.000 Gross Plant and Equipment Less: Accumulated Depreciation Net Plant and Equipment $59.200 $38.880 $20.320 Total Liabilities $37.840 Preferred Stock Common Stock/250.000.000) Retained Earnings Owner's Equity $12.000 $26.800 $38.800 TOTAL ASSETS $76.640 TOTAL LIABILITIES AND EQUITY $76.640 Giro Sport Design's 2018 sales are recorded as 600.000 USD. Company directors forecast new sales record as 1.200.000 USD in 2019. Directors plan to increase the capacity by investing on new Plants and Equipment to achieve this new target. Board Policies: 1- Gross Plant & Equipment Depreciation ratio is accepted as %20. 2- All assets in the balance sheet will increase at the same rate as sales increase 3- All Current Liabilities in the balance sheet will increase at the same rate as sales. 4- 100.000 additional Long Term Bonds will take place in 2019. 5- For long term capital: a-50.000 new preferred stocks will be issued b-A long term loan will be activated as 150.000 USD b-Additional New stocks will be issued at 200.000 USD 6- Net Profitability is %20 of total sales. 7-%30 of Net Profit will be distributed as dividends 8- Remaining %70 of Net Profit will be retained in the company Based on 2019's projected sales; a- Calculate the forecast basis for assets and current liabilities b- Calculate the amount of Financing Required ( capital deficit) C- Prepare the Pro-Forma Balance Sheet