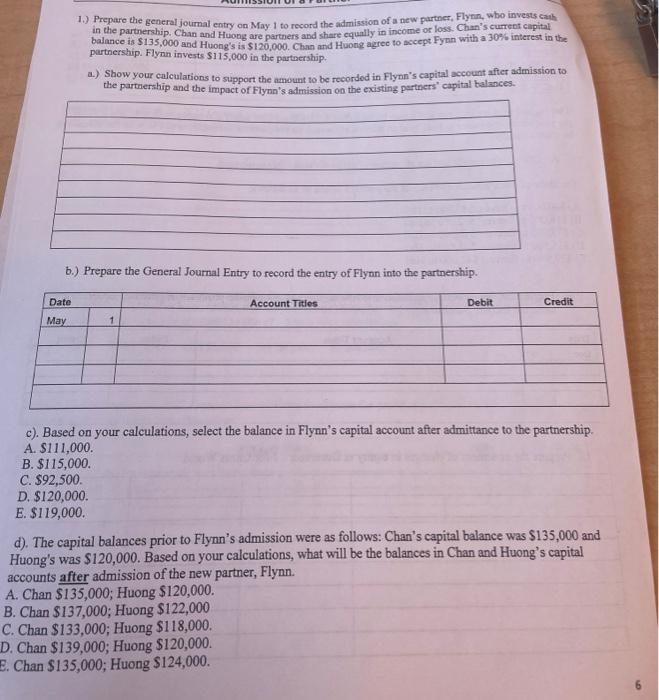

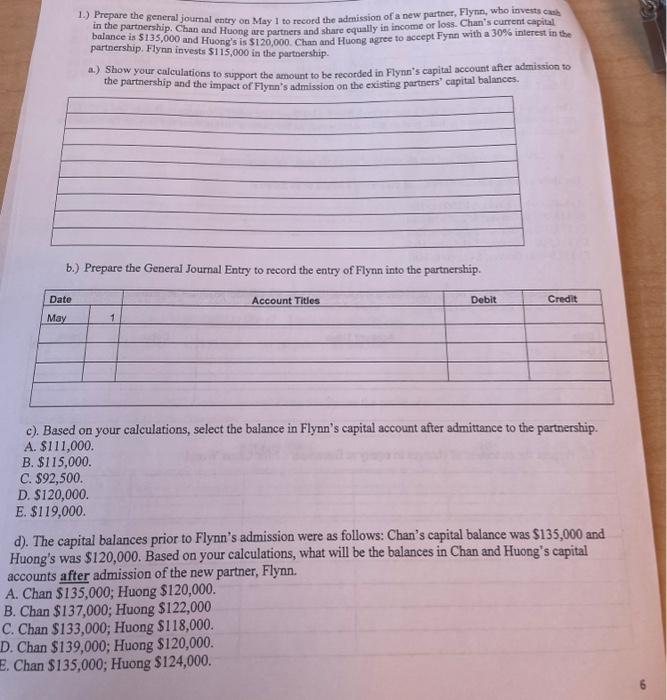

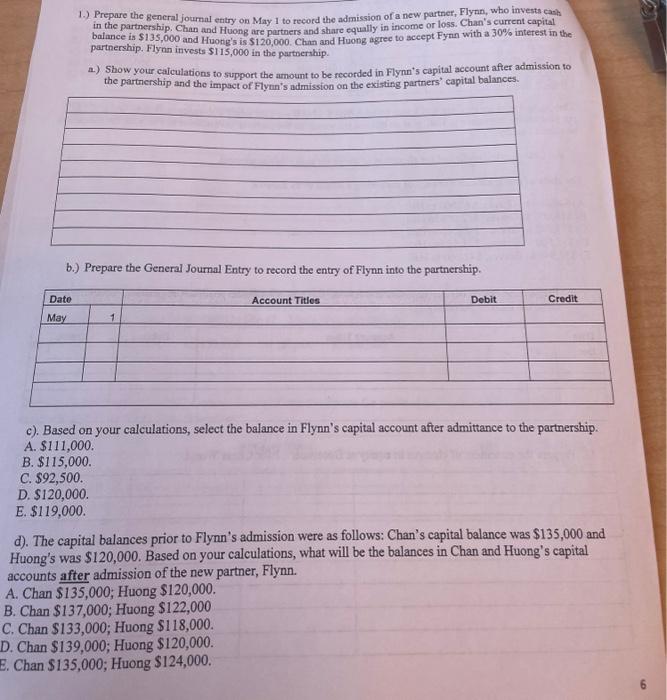

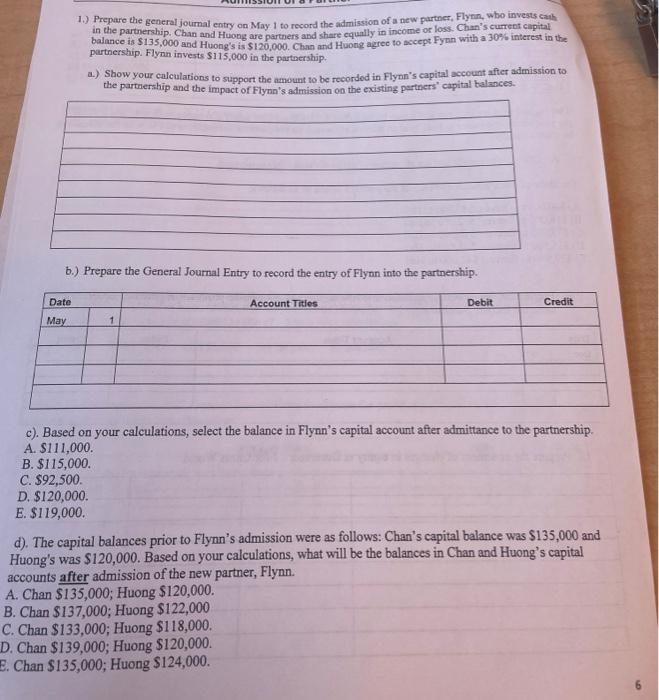

1.) Prepare the general journal entry on May 1 to record the admission of a new partner, Flynn, who invests cash in the partnership. Chan and Huong are partners and share equally in income or loss. Chan's current capital balance is $135,000 and Huong's is $120,000. Chan and Huong agree to accept Fynn with a 30% interest in the partnership. Flynn invests $115,000 in the partnership. Date May a.) Show your calculations to support the amount to be recorded in Flynn's capital account after admission to the partnership and the impact of Flynn's admission on the existing partners' capital balances. b.) Prepare the General Journal Entry to record the entry of Flynn into the partnership. 1 C. $92,500. D. $120,000. E. $119,000. Account Titles Debit c). Based on your calculations, select the balance in Flynn's capital account after admittance to the partnership. A. $111,000. B. $115,000. A. Chan $135,000; Huong $120,000. B. Chan $137,000; Huong $122,000 C. Chan $133,000; Huong $118,000. D. Chan $139,000; Huong $120,000. E. Chan $135,000; Huong $124,000. Credit d). The capital balances prior to Flynn's admission were as follows: Chan's capital balance was $135,000 and Huong's was $120,000. Based on your calculations, what will be the balances in Chan and Huong's capital accounts after admission of the new partner, Flynn. LO

1.) Prepare the general journal entry on May 1 to record the admission of a new partner, Flynn, who invests cauk in the partnership. Chan and Huong are partners and share equally in income or loss. Chan's current cipita: balance is $135,000 and Huong's is $120,000. Chan and Huong agree to accept Fynn with a 30% interest in the partnership. Flymn invests $115,000 in the partnership. a) Show your calculations to support the amount to be recorded in Flynn's capital account after admission to the partnerahip and the impact of Flynn's admission on the existing partners' capital balances. b.) Prepare the General Journal Entry to record the entry of Flynn into the partnership. c). Based on your calculations, select the balance in Flynn's capital account after admittance to the partnership. A. $111,000. B. $115,000. C. $92,500. D. $120,000. E. $119,000. d). The capital balances prior to Flynn's admission were as follows: Chan's capital balance was $135,000 and Huong's was $120,000. Based on your calculations, what will be the balances in Chan and Huong's capital accounts after admission of the new partner, Flynn. A. Chan $135,000; Huong $120,000. B. Chan $137,000; Huong $122,000 . Chan $133,000; Huong $118,000. . Chan $139,000; Huong $120,000. Chan $135,000; Huong $124,000. 1.) Prepare the general journal entry on May 1 to record the admission of a new partnet, Flynn, who invents caub in the partnership. Chan and Huong are partners and share equally in income or loss. Chan's current capital balance is $135,000 and Huong's is $120,000. Chan and Huong agree to accept. Fynn with a 30% interest in the partnership. Flynn invests $115,000 in the partnership. a.) Show your calculations to support the amount to be recorded in Flynn's capital account after admission to the partnership and the impoct of Flynn's admission on the existing partners' capital balances. b.) Prepare the General Journal Entry to record the entry of Flynn into the partnership. c). Based on your calculations, select the balance in Flynn's capital account after admittance to the partnership. A. $111,000. B. $115,000. C. $92,500. D. $120,000. E. $119,000. d). The capital balances prior to Flynn's admission were as follows: Chan's capital balance was $135,000 and Huong's was $120,000. Based on your calculations, what will be the balances in Chan and Huong's capital accounts after admission of the new partner, Flynn. 4. Chan $135,000; Huong $120,000. 3. Chan $137,000; Huong $122,000 Chan $133,000; Huong $118,000. Chan $139,000; Huong $120,000. Chan $135,000; Huong $124,000. 1.) Prepare the general journal entry on May 1 to record the admission of a new partner, Flynn, who invests cash in the partnership. Chan and Huong are partners and share equally in income or loss. Chan's current capital balance is $135,000 and Huong's is $120,000. Chan and Huong agrec to aceept Fynn with a 30% interest in the partnership. Flynn invests $115,000 in the partnership. a.) Show your calculations to support the amount to be recorded in Flynn's capital account after admission to the partnership and the impact of Flynn's admission on the existing partners' capital balances. b.) Prepare the General Journal Entry to record the entry of Flynn into the partnership. c). Based on your calculations, select the balance in Flynn's capital account after admittance to the partnership. A. $111,000. B. $115,000. C. $92,500. D. $120,000. E. $119,000. d). The capital balances prior to Flynn's admission were as follows: Chan's capital balance was $135,000 and Huong's was $120,000. Based on your calculations, what will be the balances in Chan and Huong's capital accounts after admission of the new partner, Flynn. 4. Chan $135,000; Huong $120,000. 3. Chan $137,000; Huong $122,000 Chan \$133,000; Huong \$118,000. Chan $139,000; Huong $120,000. Chan $135,000; Huong $124,000