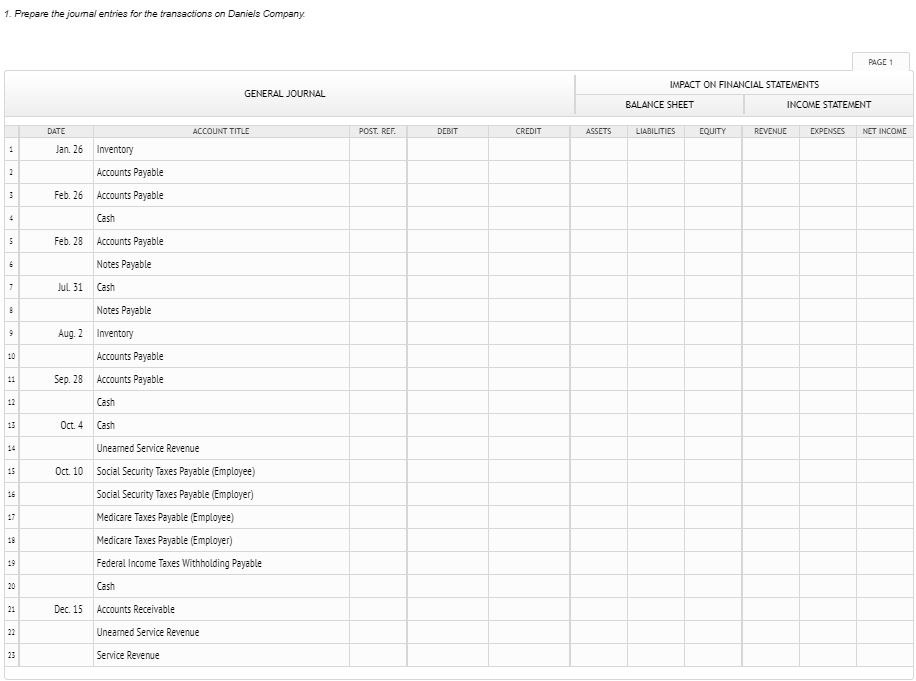

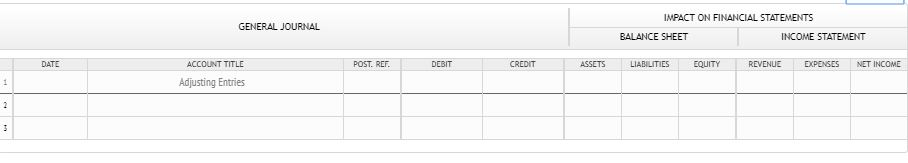

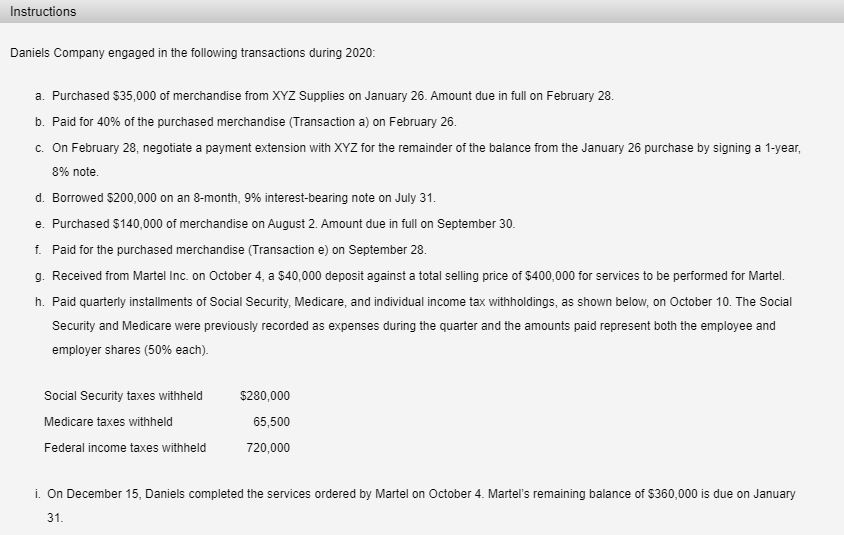

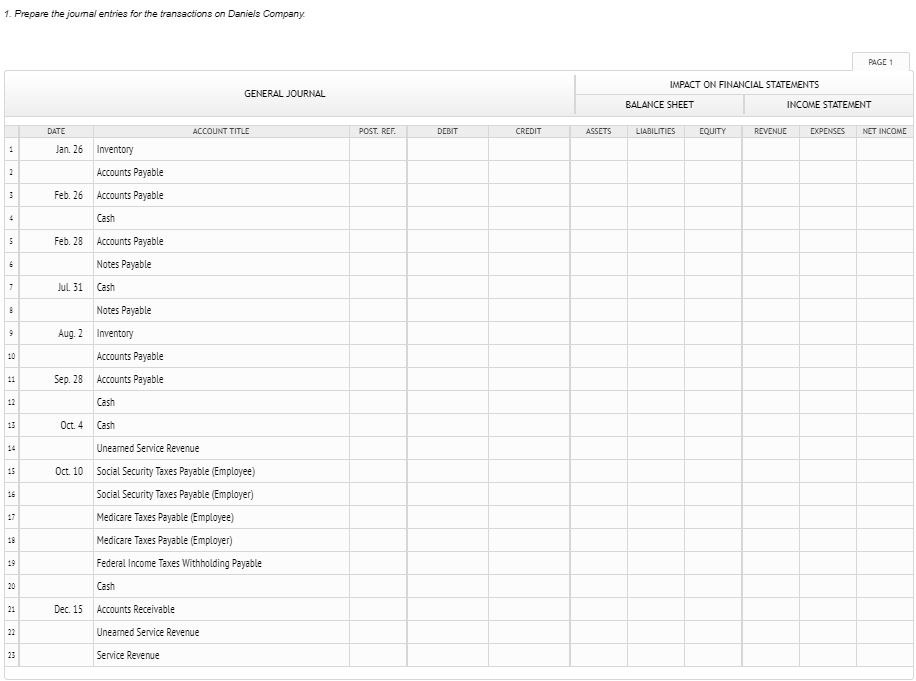

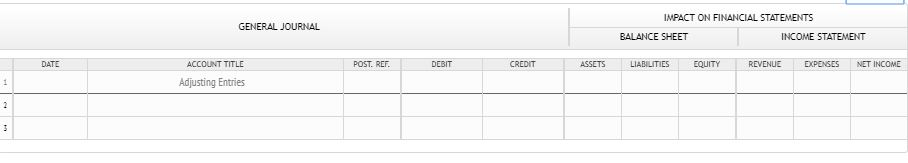

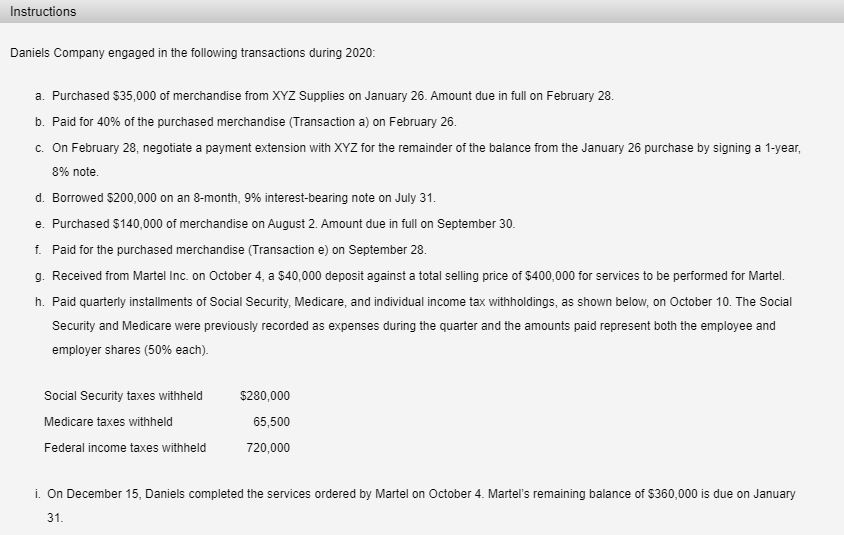

1. Prepare the journal entries for the transactions on Daniels Company PAGE 1 IMPACT ON FINANCIAL STATEMENTS GENERAL JOURNAL BALANCE SHEET INCOME STATEMENT DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY REVENUE EXPENSES NET INCOME Jan. 26 Inventory Accounts Payable Feb. 26 Accounts Payable Cash Feb. 28 Accounts Payable Notes Payable Cash Jul 31 Notes Payable Aug. 2 Inventory Accounts Payable Sep. 28 Oct. 4 Oct. 10 Accounts Payable Cash Cash Uneared Service Revenue Social Security Taxes Payable (Employee) Social Security Taxes Payable (Employer) Medicare Taxes Payable (Employee) Medicare Taxes Payable (Employer) Federal Income Taxes Withholding Payable Cash Dec. 15 Accounts Receivable Uneared Service Revenue Service Revenue GENERAL JOURNAL IMPACT ON FINANCIAL STATEMENTS BALANCE SHEET INCOME STATEMENT POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY REVENUE EXPENSES NET INCOME ACCOUNT TITLE Adjusting Entries Instructions Daniels Company engaged in the following transactions during 2020: a. Purchased $35,000 of merchandise from XYZ Supplies on January 26. Amount due in full on February 28. b. Paid for 40% of the purchased merchandise (Transaction a) on February 26 C. On February 28, negotiate a payment extension with XYZ for the remainder of the balance from the January 26 purchase by signing a 1-year, 8% note. d. Borrowed $200,000 on an 8-month, 9% interest-bearing note on July 31. e. Purchased $140,000 of merchandise on August 2. Amount due in full on September 30. f. Paid for the purchased merchandise (Transaction e) on September 28 g. Received from Martel Inc. on October 4, a $40,000 deposit against a total selling price of $400,000 for services to be performed for Martel. h. Paid quarterly installments of Social Security, Medicare, and individual income tax withholdings, as shown below, on October 10. The Social Security and Medicare were previously recorded as expenses during the quarter and the amounts paid represent both the employee and employer shares (50% each). $280,000 Social Security taxes withheld Medicare taxes withheld Federal income taxes withheld 65,500 720,000 i. On December 15, Daniels completed the services ordered by Martel on October 4. Martel's remaining balance of $360,000 is due on January 31