Question

1: Prepare the journal entry to record the share repurchase transaction. 2: Did the Company declare any dividend in fiscal year 2014? If so, compute

1: Prepare the journal entry to record the share repurchase transaction.

2: Did the Company declare any dividend in fiscal year 2014? If so, compute the amount of

dividends declared by the company.

3: Assume, that the company is considering the three following courses of actions:

Paying a $0.50 cash dividend

Distributing a 5% stock dividend

Effecting a 2-for-1 stock split.

Management would like to increase investors interest in the shares without diluting the ownership for current shareholders. At the same time, they would like to maintain their plans to expand the operations. Explain how each of the abovementioned courses of actions will affect (i.e., increase, decrease or no effect): common shares, retained earnings and market price per share. Which course of action would you recommend to management? (no points will be awarded for only providing the effect).

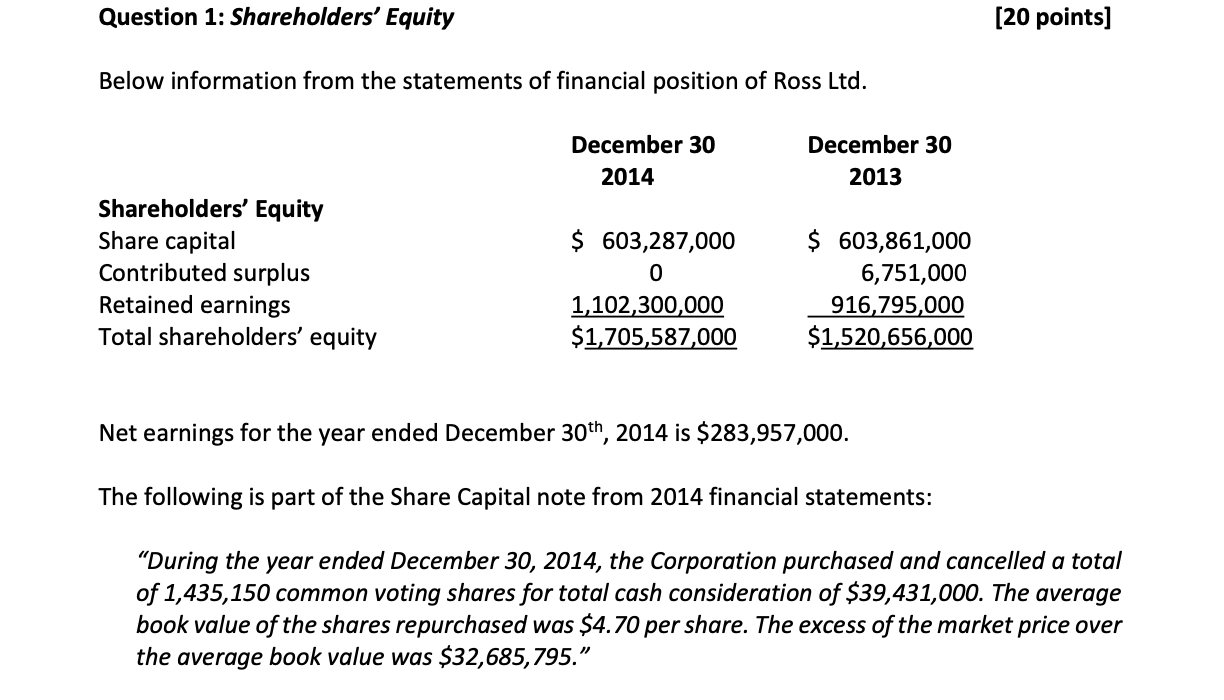

Question 1: Shareholders' Equity [20 points] Below information from the statements of financial position of Ross Ltd. Net earnings for the year ended December 30th,2014 is $283,957,000. The following is part of the Share Capital note from 2014 financial statements: "During the year ended December 30, 2014, the Corporation purchased and cancelled a total of 1,435,150 common voting shares for total cash consideration of $39,431,000. The average book value of the shares repurchased was $4.70 per share. The excess of the market price over the average book value was $32,685,795Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started