1, Prepare the statement of Financial position as at 30 June 2023. 2, prepare the statement of profit and loss and other comprehensive income for

1, Prepare the statement of Financial position as at 30 June 2023.

2, prepare the statement of profit and loss and other comprehensive income for the period ended 30 June 2023

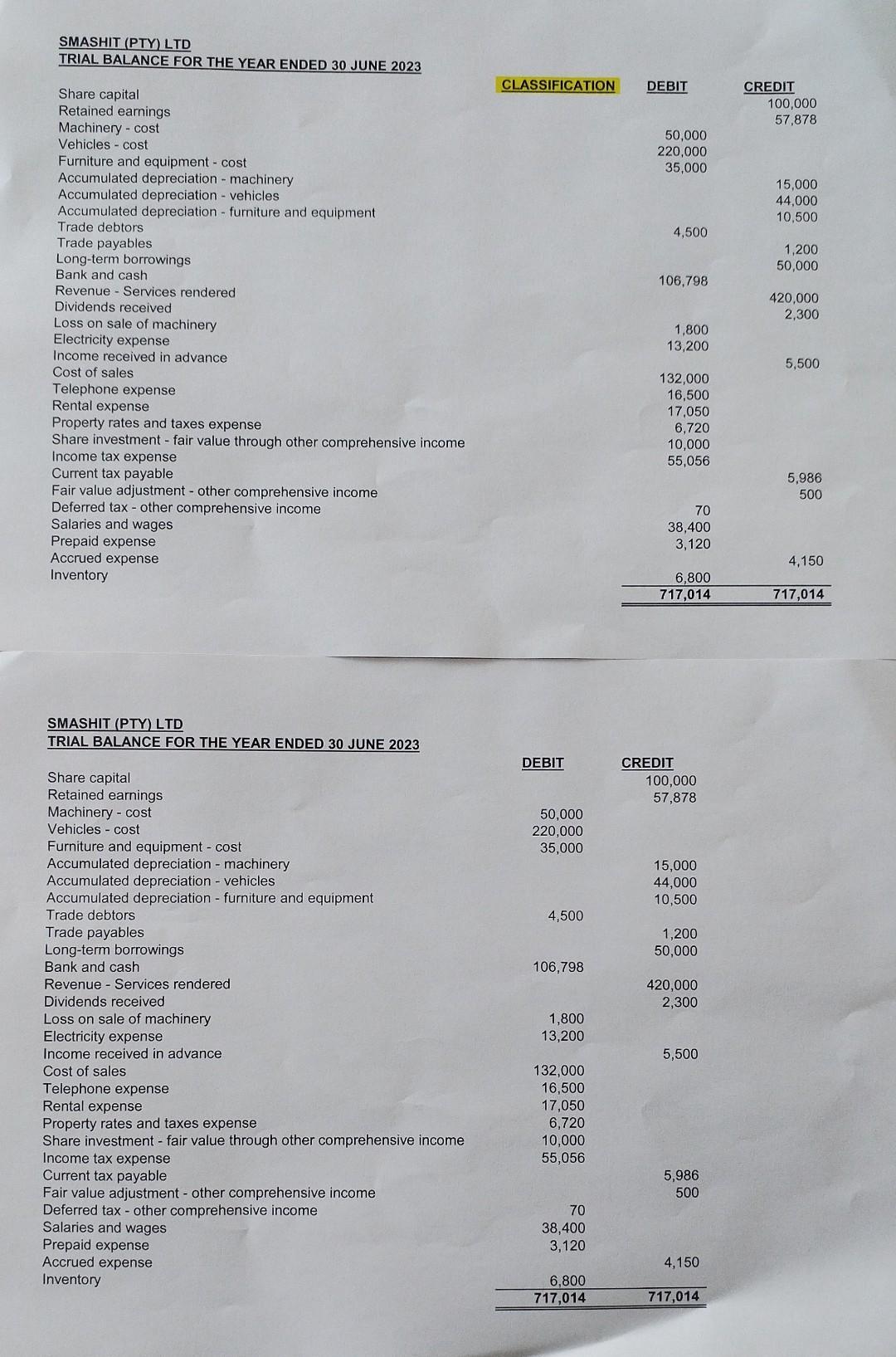

SMASHIT (PTY) LTD TRIAL BALANCE FOR THE YEAR ENDED 30 JUNE 2023 Share capital Retained earnings Machinery - cost Vehicles cost Furniture and equipment - cost Accumulated depreciation machinery Accumulated depreciation vehicles Accumulated depreciation furniture and equipment Trade debtors Trade payables Long-term borrowings Bank and cash Revenue Services rendered Dividends received Loss on sale of machinery Electricity expense CLASSIFICATION DEBIT CREDIT 100,000 57,878 50,000 220,000 35,000 15,000 44,000 10,500 4,500 1,200 50,000 106,798 420,000 2,300 1,800 13,200 Income received in advance 5,500 Cost of sales 132,000 Telephone expense 16,500 Rental expense 17,050 Property rates and taxes expense 6,720 Share investment - fair value through other comprehensive income 10,000 Income tax expense 55,056 Current tax payable 5,986 Fair value adjustment - other comprehensive income 500 Deferred tax other comprehensive income 70 Salaries and wages 38,400 Prepaid expense Accrued expense Inventory 3,120 4,150 6,800 717,014 717,014 SMASHIT (PTY) LTD TRIAL BALANCE FOR THE YEAR ENDED 30 JUNE 2023 Share capital Retained earnings DEBIT CREDIT 100,000 57,878 Machinery - cost 50,000 Vehicles cost 220,000 Furniture and equipment - cost 35,000 Accumulated depreciation - machinery 15,000 Accumulated depreciation - vehicles 44,000 Accumulated depreciation - furniture and equipment 10,500 Trade debtors 4,500 Trade payables Long-term borrowings 1,200 50,000 Bank and cash 106,798 Revenue Services rendered 420,000 Dividends received 2,300 Loss on sale of machinery Electricity expense 1,800 13,200 Income received in advance 5,500 Cost of sales 132,000 Telephone expense 16,500 Rental expense 17,050 Property rates and taxes expense 6,720 Share investment - fair value through other comprehensive income 10,000 Income tax expense 55,056 Current tax payable Fair value adjustment - other comprehensive income 5,986 500 Deferred tax other comprehensive income Salaries and wages 70 38,400 Prepaid expense 3,120 Accrued expense Inventory 4,150 6,800 717,014 717,014

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started