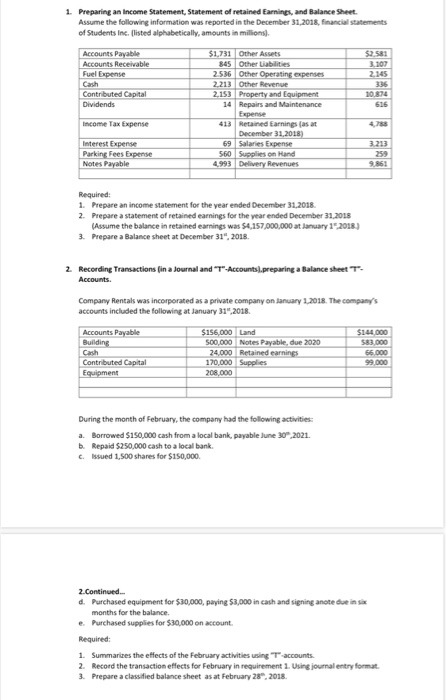

1. Preparing an Income Statement, Statement of retained Earnings, and Balance Sheet. Assume the following information was reported in the December 31,2018, financial statements of Students Inc. (listed alphabetically, amounts its in millions $2.581 3.107 2.145 Accounts Payable Accounts Receivable Fuel Expense Cash Contributed Capital Dividends 10.874 616 $1,731 Other Assets 845 Other abilities 2.536 Other Operating expenses 2.213 Other Revenue 2.153 Property and Equipment 14 Repairs and Maintenance Expense 413 Retained Earnings (as at December 31, 2018) 69 Salaries Expense 560 Supplies on Hand 4,993 Delivery Revenues Income Tax Expense Interest Expense Parking Fees Expense Notes Payable 3.213 259 9.861 Required: 1. Prepare an income statement for the year ended December 31,2018 2. Prepare a statement of retained earnings for the year ended December 31,2018 (Assume the balance in retained earnings was 54,157,000,000 at January 15, 2018 3. Prepare a Balance sheet at December 31, 2018 2. Recording Transactions (in a Journal and "T"-Accounts.preparing a Balance sheet T- Accounts. Company Rentals was incorporated as a private company on January 1, 2018. The company's accounts included the following at January 31 2018 Accounts Payable Building Cash Contributed Capital Equipment $156,000 Land 500,000 Notes Payable, due 2020 24,000 Retained earnings 170,000 Supplies 208,000 $144.000 583.000 66 000 99.000 During the month of February, the company had the following activities: 2. Borrowed $150,000 cash from a local bank, payable June 30,2021. b. Repaid $250,000 cash to a local bank c.Issued 1,500 shares for $150,000 2.Continued... d. Purchased equipment for $30,000, paying $3,000 in cash and signing anote due insi months for the balance. e Purchased supplies for $30,000 on account Required: 1. Summarizes the effects of the February activities using "Taccounts. 2. Record the transaction effects for February in requirement 1. Using journal entry format 3. Prepare a classified balance sheet as at February 28, 2018 1. Preparing an Income Statement, Statement of retained Earnings, and Balance Sheet. Assume the following information was reported in the December 31,2018, financial statements of Students Inc. (listed alphabetically, amounts its in millions $2.581 3.107 2.145 Accounts Payable Accounts Receivable Fuel Expense Cash Contributed Capital Dividends 10.874 616 $1,731 Other Assets 845 Other abilities 2.536 Other Operating expenses 2.213 Other Revenue 2.153 Property and Equipment 14 Repairs and Maintenance Expense 413 Retained Earnings (as at December 31, 2018) 69 Salaries Expense 560 Supplies on Hand 4,993 Delivery Revenues Income Tax Expense Interest Expense Parking Fees Expense Notes Payable 3.213 259 9.861 Required: 1. Prepare an income statement for the year ended December 31,2018 2. Prepare a statement of retained earnings for the year ended December 31,2018 (Assume the balance in retained earnings was 54,157,000,000 at January 15, 2018 3. Prepare a Balance sheet at December 31, 2018 2. Recording Transactions (in a Journal and "T"-Accounts.preparing a Balance sheet T- Accounts. Company Rentals was incorporated as a private company on January 1, 2018. The company's accounts included the following at January 31 2018 Accounts Payable Building Cash Contributed Capital Equipment $156,000 Land 500,000 Notes Payable, due 2020 24,000 Retained earnings 170,000 Supplies 208,000 $144.000 583.000 66 000 99.000 During the month of February, the company had the following activities: 2. Borrowed $150,000 cash from a local bank, payable June 30,2021. b. Repaid $250,000 cash to a local bank c.Issued 1,500 shares for $150,000 2.Continued... d. Purchased equipment for $30,000, paying $3,000 in cash and signing anote due insi months for the balance. e Purchased supplies for $30,000 on account Required: 1. Summarizes the effects of the February activities using "Taccounts. 2. Record the transaction effects for February in requirement 1. Using journal entry format 3. Prepare a classified balance sheet as at February 28, 2018