Answered step by step

Verified Expert Solution

Question

1 Approved Answer

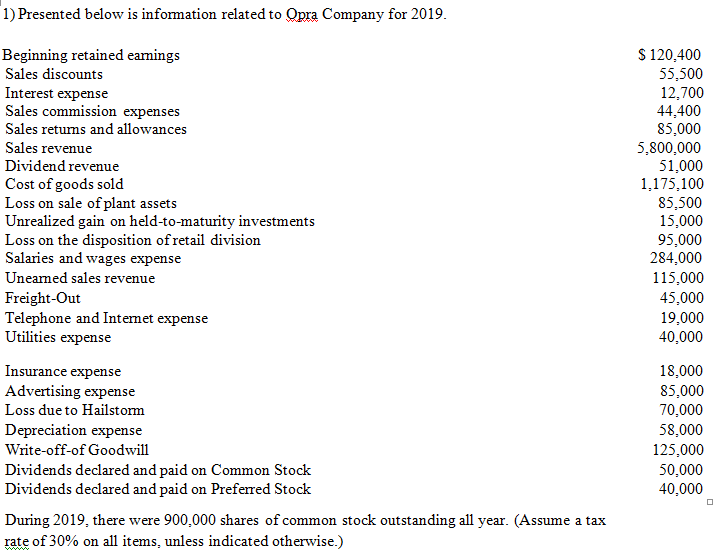

1) Presented below is information related to Opra Company for 2019. S 120,400 55,500 12,700 44,400 85,000 5,800,000 51,000 1,175,100 85,500 15,000 95,000 284,000

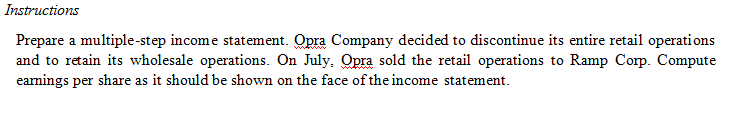

1) Presented below is information related to Opra Company for 2019. S 120,400 55,500 12,700 44,400 85,000 5,800,000 51,000 1,175,100 85,500 15,000 95,000 284,000 Beginning retained eamings Sales discounts Interest expense Sales commission expenses Sales returns and allowances Sales revenue Dividend revenue Cost of goods sold Loss on sale of plant assets Unrealized gain on held-to-maturity investments Loss on the disposition of retail division Salaries and wages expense Uneamed sales revenue 115,000 Freight-Out Telephone and Intemet expense Utilities expense 45,000 19,000 40,000 Insurance expense 18,000 Advertising expense 85,000 70,000 Loss due to Hailstorm Depreciation expense 58,000 Write-off-of Goodwill 125,000 Dividends declared and paid on Common Stock Dividends declared and paid on Preferred Stock 50,000 40,000 During 2019, there were 900,000 shares of common stock outstanding all year. (Assume a tax rate of 30% on all items, unless indicated otherwise.) ww. Instructions Prepare a multiple-step income statement. Opra Company decided to discontinue its entire retail operations and to retain its wholesale operations. On July, Opra sold the retail operations to Ramp Corp. Compute eamings per share as it should be shown on the face of the income statement.

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

pera Co INCOME STATEMENT Particulars Amount Sales Revenue 5800...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started