Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 Problem 1 1 - 5 Risk Premiums and Discount Rates ( LO 1 ) Top hedge fund manager Sally Buffit believes that a stock

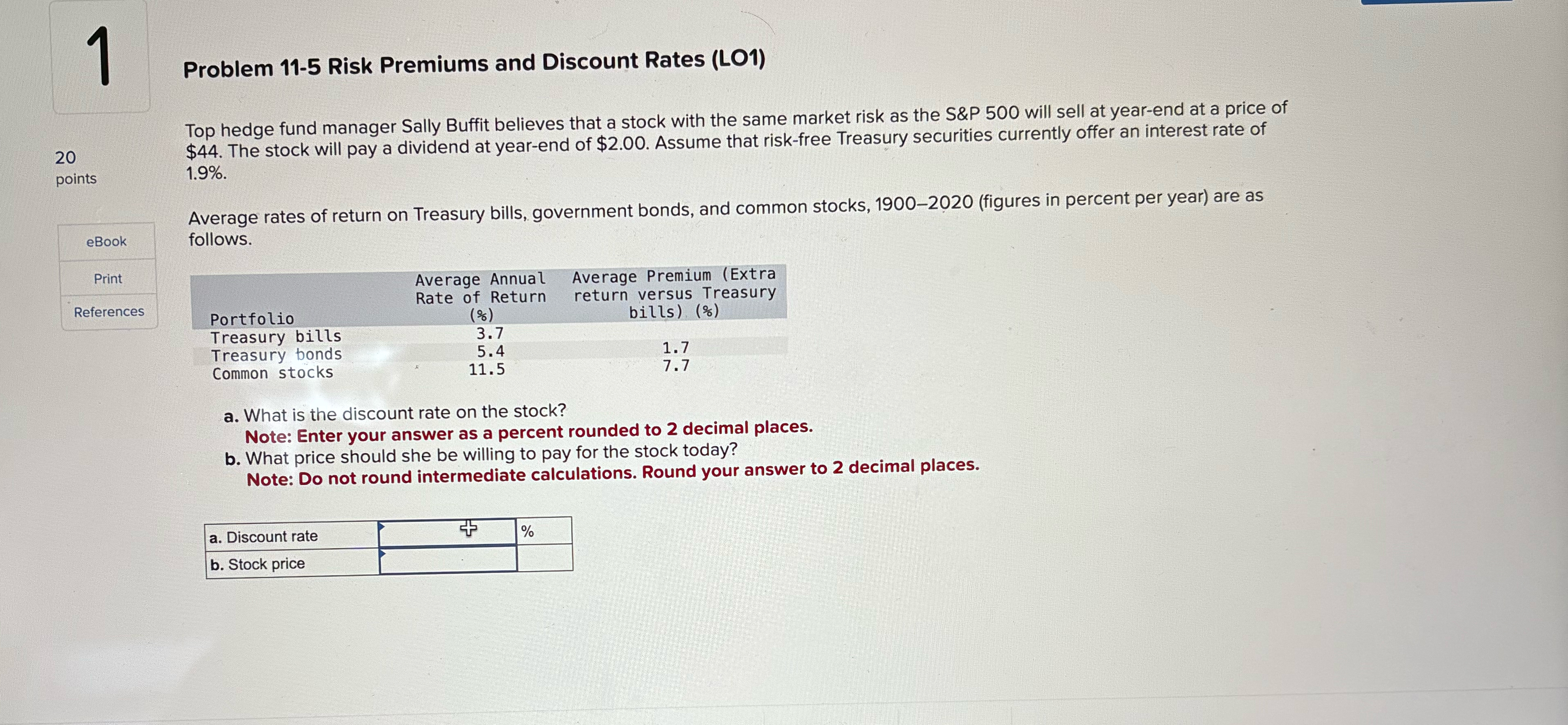

Problem Risk Premiums and Discount Rates LO

Top hedge fund manager Sally Buffit believes that a stock with the same market risk as the S&P will sell at yearend at a price of

$ The stock will pay a dividend at yearend of $ Assume that riskfree Treasury securities currently offer an interest rate of points

Average rates of return on Treasury bills, government bonds, and common stocks, figures in percent per year are as follows.

tabletableAverage AnnualRate of Return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started