1 problem 2 parts thanks

help fill in empty gray parts

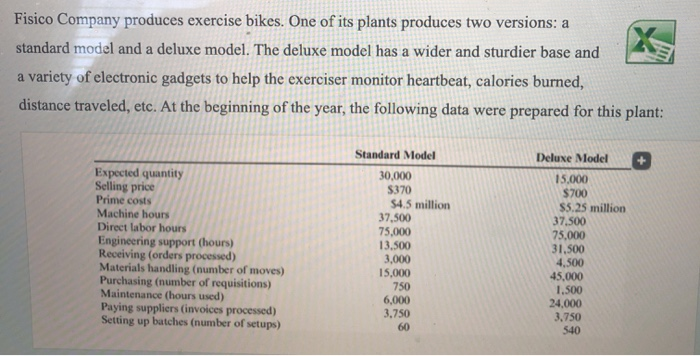

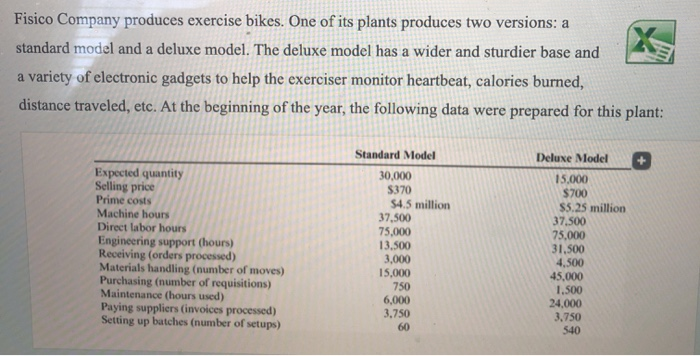

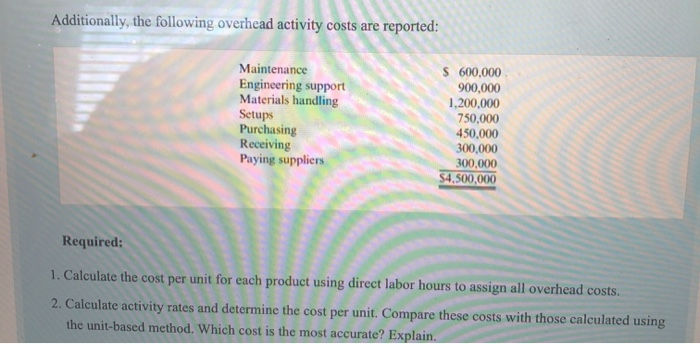

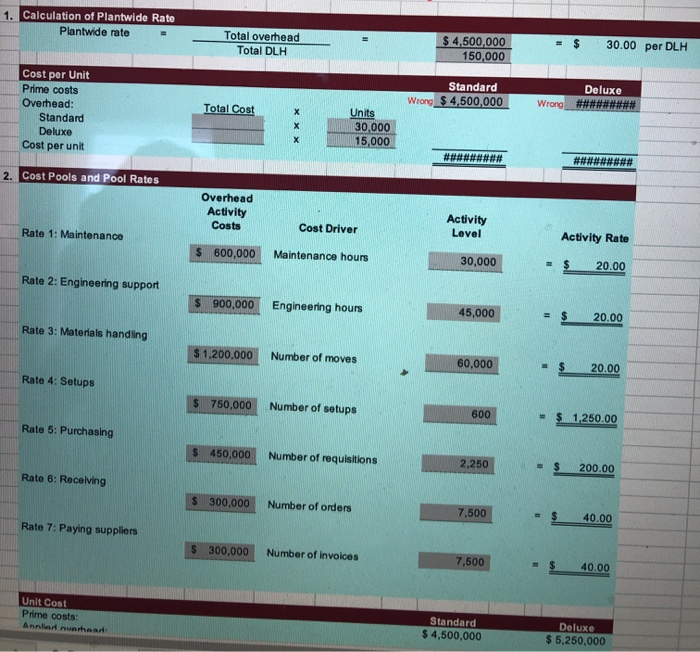

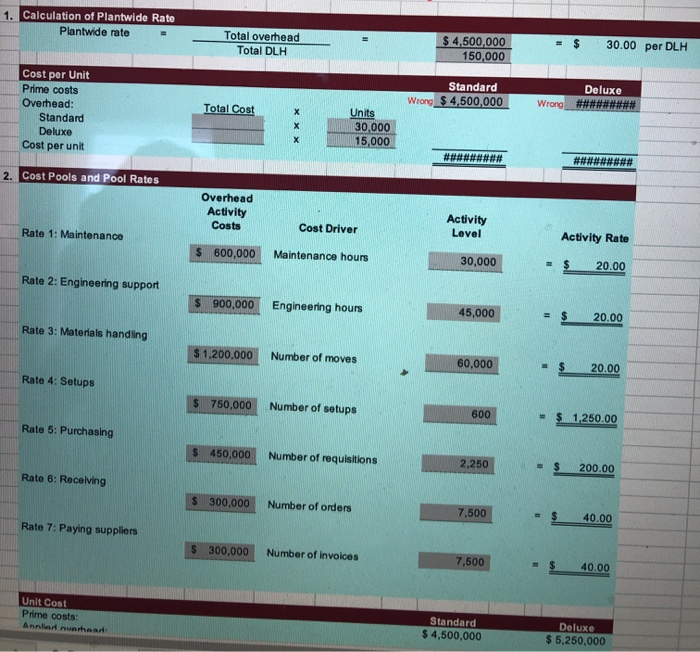

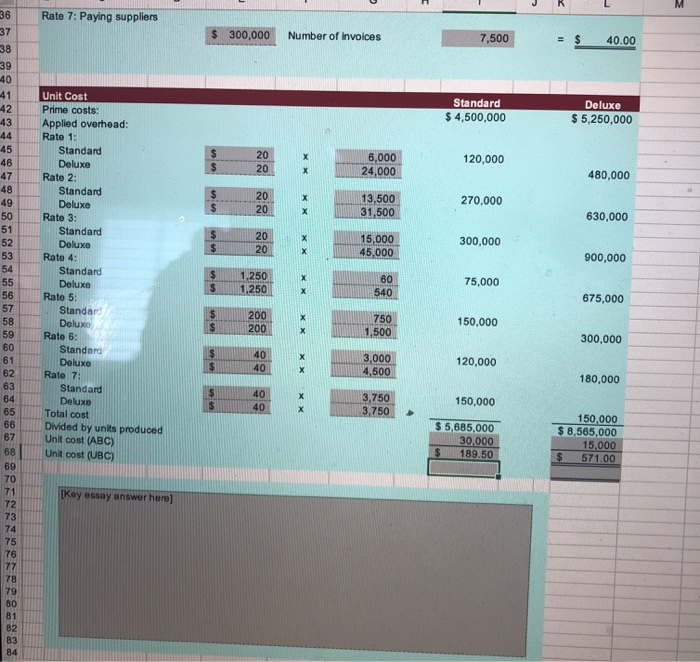

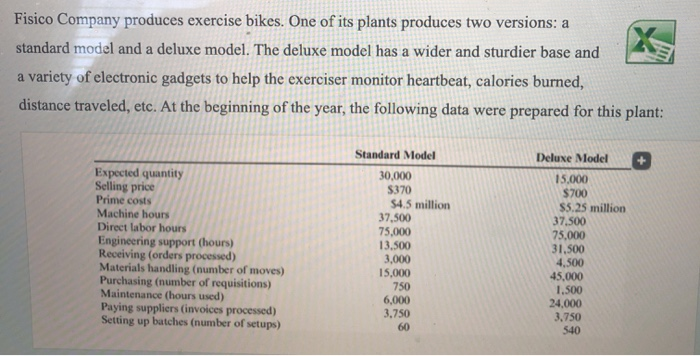

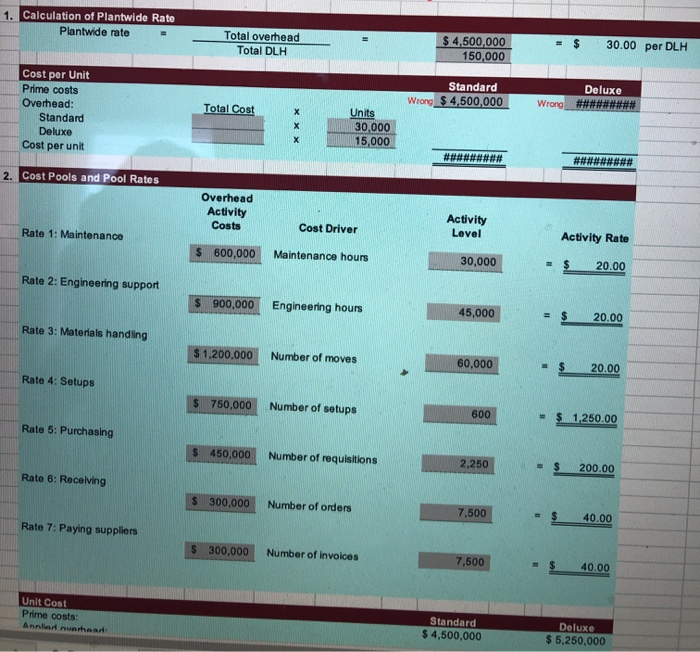

Fisico Company produces exercise bikes. One of its plants produces two versions: a standard model and a deluxe model. The deluxe model has a wider and sturdier base and a variety of electronic gadgets to help the exerciser monitor heartbeat, calories burned, distance traveled, etc. At the beginning of the year, the following data were prepared for this plant: Deluxe Model Expected quantity Selling price Prime costs Machine hours Direct labor hours Engineering support (hours) Receiving (orders processed) Materials handling (number of moves) Purchasing (number of requisitions) Maintenance (hours used) Paying suppliers (invoices processed) Setting up batches (number of setups) Standard Model 30,000 $370 $4.5 million 37,500 75,000 13.500 3,000 15,000 750 6,000 3.750 60 15.000 $700 $5.25 million 37.500 75,000 31.500 4,500 45,000 1.500 24,000 3.750 540 Additionally, the following overhead activity costs are reported: Maintenance Engineering support Materials handling Setups Purchasing Receiving Paying suppliers $ 600,000 900,000 1,200,000 750,000 450,000 300,000 300,000 54,500,000 Required: 1. Calculate the cost per unit for each product using direct labor hours to assign all overhead costs. 2. Calculate activity rates and determine the cost per unit. Compare these costs with those calculated using the unit-based method. Which cost is the most accurate? Explain. 1. Calculation of Plantwide Rato Plantwide rate Total overhead Total DLH $ 4,500,000 150,000 30.00 per DLH Standard Wrong $ 4,500,000 Cost per Unit Prime costs Overhead: Standard Deluxe Cost per unit Deluxe Wrong ######### Total Cost x Units 30,000 15,000 ######### ######### 2. Cost Pools and Pool Rates Overhead Activity Costs Activity Lovel Rate 1: Maintenance Cost Driver Activity Rate $ 600,000 Maintenance hours 30,000 $ 20.00 Rate 2: Engineering support $ 900,000 Engineering hours 45,000 = $ 20.00 Rate 3: Materials handling $ 1.200.000 Number of moves 60,000 - $ 20.00 Rate 4: Setups $ 750,000 Number of setups 600 = $ 1.250.00 Rate 5: Purchasing $ 450,000 Number of requisitions 2,250 $ 200.00 Rate 6: Receiving $ 300,000 Number of orders 7.500 40.00 Rate 7: Paying suppliers $ 300,000 Number of invoices 7,500 40.00 Unit Cost Prime costs: Annlar netheart Standard $ 4,500,000 Deluxe $ 5,250,000 M 36 Rate 7: Paying suppliers 37 $ 300,000 Number of invoices 7,500 40.00 38 39 40 Standard $ 4,500,000 Deluxe $ 5,250,000 41 42 43 44 45 46 47 48 49 $ 20 20 $ 6,000 24,000 120,000 480,000 X 20 20 13,500 31,500 270,000 X 50 630,000 $ $ 20 20 15,000 45,000 300,000 900,000 Unit Cost Prime costs: Applied overhead: Rate 1: Standard Deluxe Rate 2: Standard Deluxe Rate 3: Standard Deluxe Rate 4: Standard Deluxe Rate 5: Standard Deluxe Rate 6: Standard Deluxe Rate 7: Standard Deluxe Total cost Divided by units produced Unit cost (ABC) Unit cost (UBC) $ $ 1,250 1.250 60 540 75,000 X 675,000 on 200 200 750 $ 150,000 1,500 300,000 $ $ 40 40 3,000 4,500 120,000 180,000 $ 40 40 3,750 3,750 150,000 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 B3 84 X $ 5,685,000 30,000 $ 189.50 150,000 $ 8,565,000 15,000 $ 571.00 [Key essay answer here)