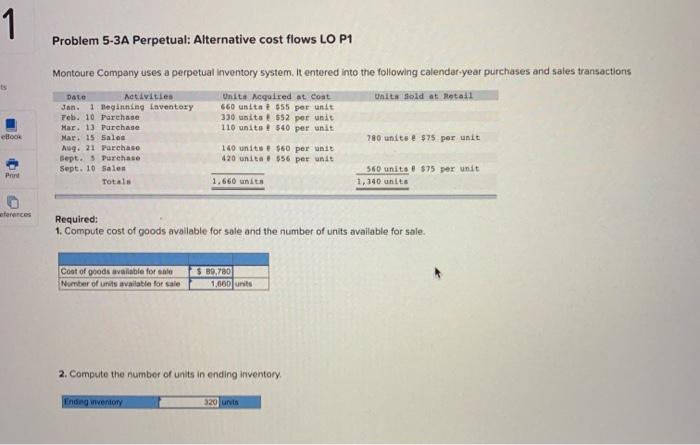

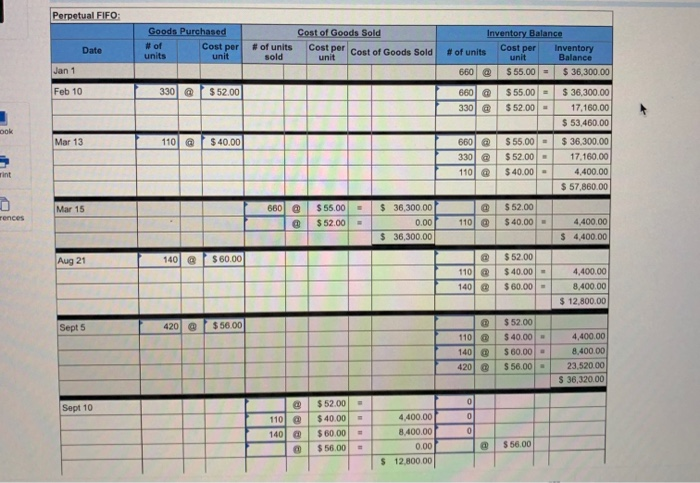

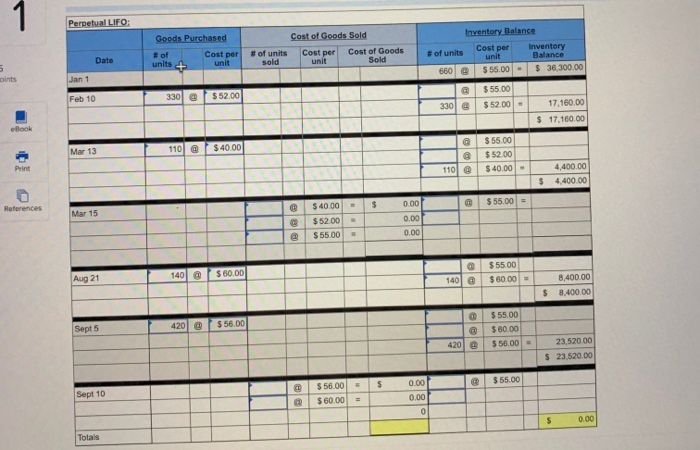

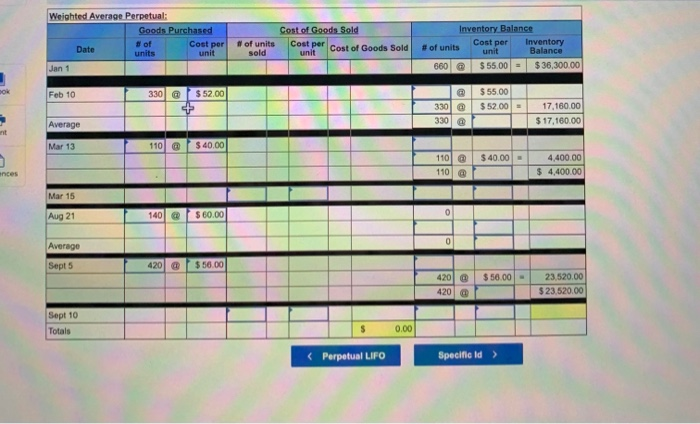

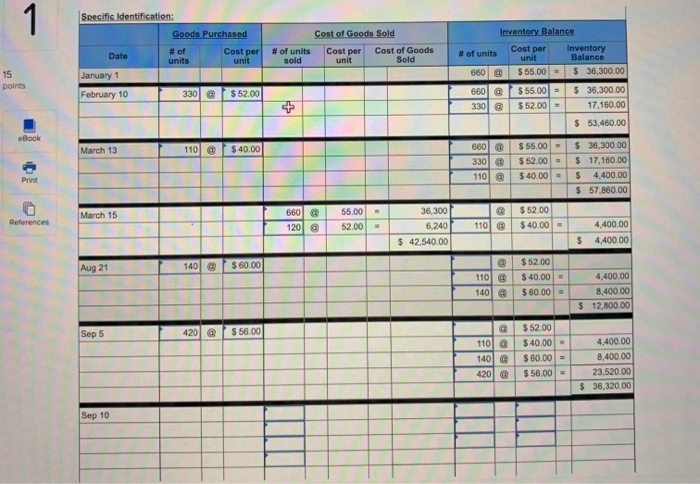

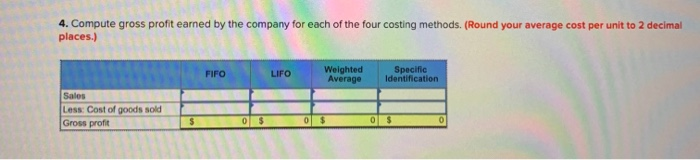

1 Problem 5-3A Perpetual: Alternative cost flows LO P1 Montoure Company uses a perpetual Inventory system. It entered into the following calendar-year purchases and sales transactions ts Units sold at Retail Units Acquired at Cost 660 units $55 per unit 330 units & $52 per unit 110 unito $40 per unit eBook Date Activities Jan. 1 Beginning inventory Feb. 10 Purchase Mar. 13 Purchase Mar. 15 Sales Aug. 21 Purchase Sept. 5 Purchase Sept. 10 Sales Totals 780 units e $75 per unit 140 units # $60 per unit 420 units $56 per unit Print 1,660 unita 560 units $75 per unit 1,340 units eferences Required: 1. Compute cost of goods available for sale and the number of units ava ble for sale Cost of goods available for sale Number of units available for sale $ 89,780 1,660 units 2. Compute the number of units in ending Inventory Ending inventory 320 units Perpetual FIFO Goods Purchased # of units unit Date Cost per Cost of Goods Sold Cost per cost of Goods Sold unit # of units sold Inventory Balance Cost per # of units Inventory unit Balance 660 $ 55.00 = $ 36,300.00 Jan 1 Feb 10 330 @ $ 52.00 660 330 @ $ 55,00 $ 52.00 - OOK Mar 13 110 @ $ 40.00 660 @ 330 @ 110 $ 55.00 $ 52.00 - $ 40,00 - $ 36,300.00 17,160.00 $ 53,400.00 $ 36,300.00 17.160.00 4,400.00 $ 57,860.00 Tint Mar 15 660 rences $55.00 $ 52.00 $ 36,300.00 0.00 $ 36,300.00 $ 52.00 $40.00 - 1101 4,400.00 $ 4,400.00 Aug 21 1401 $ 60.00 1101 1401 $ 52.00 $ 40.00 $ 60.00 - 4,400.00 8,400.00 $ 12,800.00 Sept 5 420 $56.00 110 140 420 $ 52.00 $ 40.00 - $ 60.00 - $ 56.00 - 4,400.00 8.400.00 23,520.00 $ 36,320.00 0 Sept 10 1101 0 $ 52.00 $ 40.00 $ 60.00 $ 56.00 0 140100 4,400.00 8,400.00 0.00 $ 12,800.00 B $56.00 1 Perpetual LIFO: Goods Purchased # of Cost per units + unit Cost of Goods Sold #of units Cost per Cost of Goods sold unit Sold Inventory Balance Cost per Inventory # of units unit Balance 650 $ 55.00 - $ 36,300.00 Date 5 oints Jan 1 Feb 10 330) $ 52.00 $55.00 $52.00 - 3301 17,100.00 $ 17,160.00 Block Mar 13 110 @ $40.00 $ 55,00 $ 52.00 $ 40,00 - Print 110) 4,400.00 $ 4,400.00 $ $ 55,00 References Mar 15 $ 40.00 $ 52.00 $ 55.00 0.00 0.00 0.00 $ 60.00 140 @ $55.00 $ 60.00 |Aug 21 140 @ 8.400.00 8.400.00 $ $56.00 Sept 5 420 @ $ 55.00 $ 60.00 $ 56.00 - 420 23.520.00 $ 23.520.00 $ 0.00 $ 55.00 le Sept 10 $ 56.00 $ 60.00 = 0.00 0 $ 0.00 Totais Weighted Average Perpetual: Goods Purchased Date Cost per units unit Jan 1 Cost of Goods Sold # of units Cost per cost of Goods Sold sold unit Inventory Balance Cost per Inventory # of units unit Balance 660 @ $ 55,00 = $36,300.00 DOR Feb 10 330 @ $ 52.00 $ 55.00 $ 52.00 = 330 330 17,160.00 $ 17,160.00 Average nt Mar 13 110 @ $40.00 110 @ $40.00 - 4,400.00 $ 4,400.00 ances 110 Mar 15 Aug 21 1401 0 $ 60.00 0 Average Sept 5 420 $56.00 $50.00 - 420 @ 420 @ 23,520.00 $23.520.00 Sept 10 Totals 0.00 1 Specific Identification: Goods Purchased # of units Date Cost of Goods Sold # of units Cost of Goods sold unit Sold Cost per unit Cost per 15 points January 1 February 10 Inventory Balance Cost per # of units Inventory unit Balance 660 @ $ 55,00 - $ 36,300.00 660 @ $ 55.00 = $ 36,300.00 330 $52.00 - 17,160.00 $ 53,460.00 330 @ $ 52.00 eBook March 13 110 $ 40.00 660 330 110 @ $ 55.00 - $ 52.00 = $ 40.00 $ 36,300.00 $ 17,150.00 $ 4,400.00 $ 57,860.00 Print March 15 References 660 120 @ 55.00 52.00 36,300 6.240 $ 42,540.00 $ 52.00 $ 40.00 - 110 4,400.00 4,400.00 $ Aug 21 1401 $ 60.00 110 @ $ 52,00 $ 40,00 - $ 60.00 - 140 4,400.00 8,400.00 $ 12,800.00 Sep 5 420 @ $56.00 110 @ 140 @ 420 @ $ 52.00 $ 40.00 - $ 60.00 - $ 56.00 - 4,400.00 8,400.00 23.520.00 $ 36,320.00 Sep 10 4. Compute gross profit earned by the company for each of the four costing methods. (Round your average cost per unit to 2 decimal places.) FIFO LIFO Weighted Average Specific Identification Sales Less: Cost of goods sold Gross profit $ 0 $ 0 $ $