Answered step by step

Verified Expert Solution

Question

1 Approved Answer

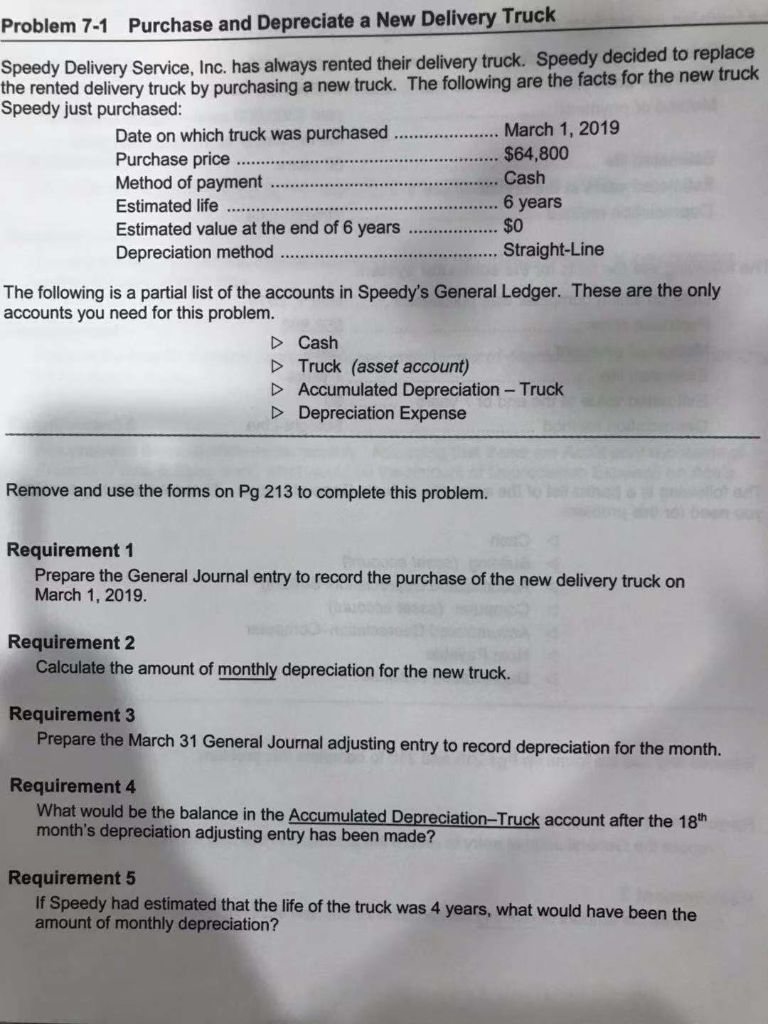

1 Problem 7-1 Purchase and Depreciate a New Delivery Truck Speedy the rented delivery truck by purchasing a new truck. The following are the facts

1

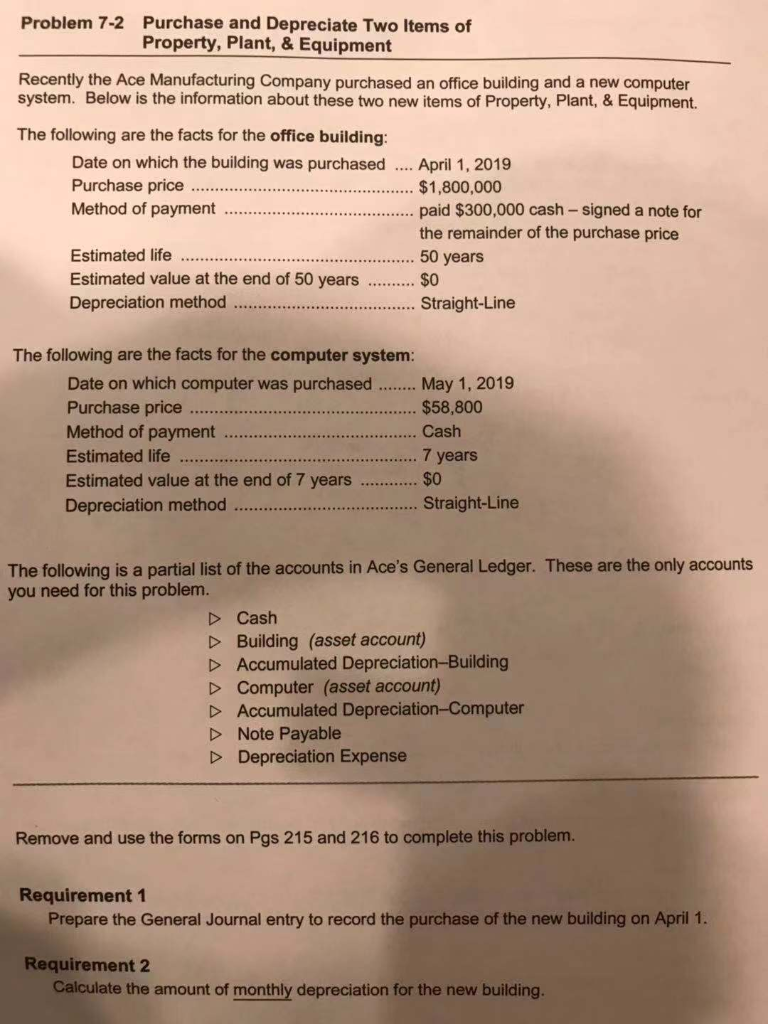

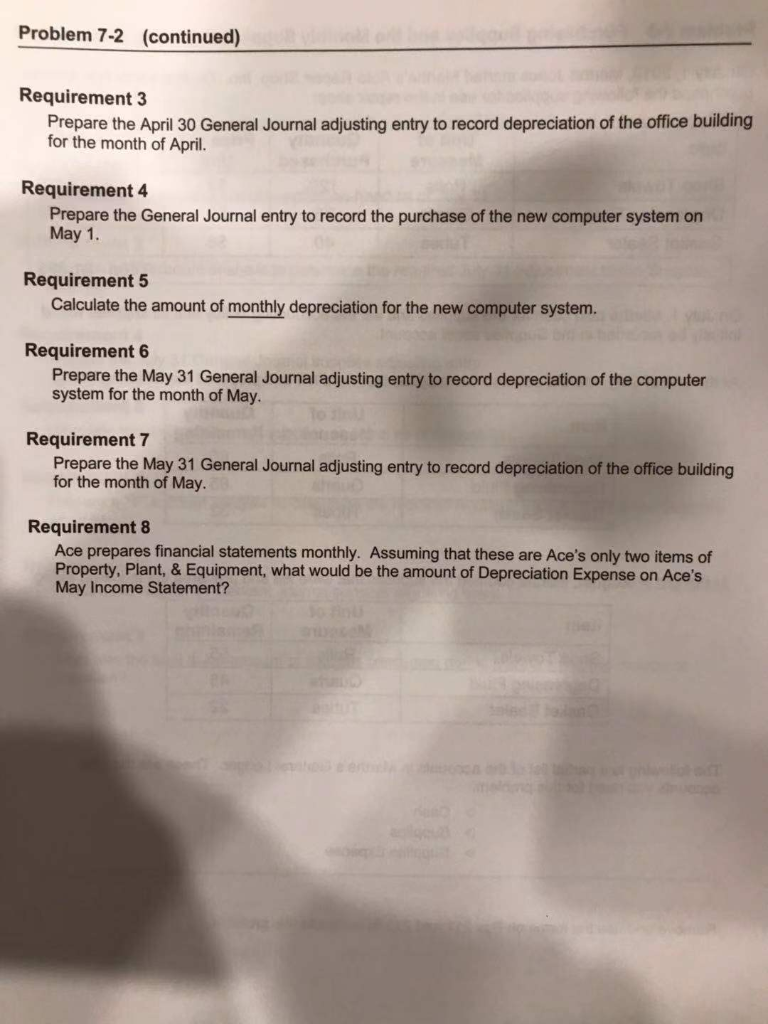

Problem 7-1 Purchase and Depreciate a New Delivery Truck Speedy the rented delivery truck by purchasing a new truck. The following are the facts for the new truck Speedy just purchased: Delivery Service, Inc. has always rented their delivery truck. Speedy decided to replace Date on which truck was purchased.March 1, 2019 Purchase price... Method of payment.Cash $64,800 ...6 years Estimated value at the end of 6 years.... $o Depreciation method .. Straight-Line The following is a partial list of the accounts in Speedy's General Ledger. These are the only accounts you need for this problem. D Cash D Truck (asset account) D Accumulated Depreciation-Truck Depreciation Expense Remove and use the forms on Pg 213 to complete this problem. Requirement 1 Prepare the General Journal entry to record the purchase of the new delivery truck on March 1, 2019. Requirement 2 Calculate the amount of monthly depreciation for the new truck. Requirement 3 Prepare the March 31 General Journal adjusting entry to record depreciation for the month. Requirement 4 What would be the balance in the Accumulated Depreciation-Truck account after the 18h month's depreciation adjusting entry has been made? Requirement 5 If Speedy had estimated that the life of the truck was 4 years, what would have been the amount of monthly depreciation? Purchase and Depreciate Two Items of Property, Plant, & Equipment Problem 7-2 Recently the Ace Manufacturing Company purchased an office building and a new computer system. Below is the information about these two new items of Property, Plant, & Equipment The following are the facts for the office building: Date on which the building was purchased... April 1, 2019 Purchase price Method of payment...paid $300,000 cash- signed a note for $1,800,000 the remainder of the purchase price Estimated life.. 50 years Estimated value at the end of 50 years .$.O0 Depreciation method.. .traight-Line The following are the facts for the computer system: May 1, 2019 $58,800 Date on which computer was purchased..M Purchase price Method of payment Estimated life. Estimated value at the end of 7 years...... $0 Depreciation method.. Straight-Line 7 years The following is a partial list of the accounts in Ace's General Ledger. These are the only accounts you need for this problem. Cash D Building (asset account) D Accumulated Depreciation-Building Computer (asset account) D Accumulated Depreciation-Computer D Note Payable Depreciation Expense Remove and use the forms on Pgs 215 and 216 to complete this problem. Requirement 1 Prepare the General Journal entry to record the purchase of the new building on April 1 Requirement 2 Calculate the amount of monthly depreciation for the new building. Problem 7-2 (continued) Requirement 3 Prepare the April 30 General Journal adjusting entry to record depreciation of the office building for the month of April. Requirement 4 Prepare the General Journal entry to record the purchase of the new computer system on May 1 Requirement 5 Calculate the amount of monthly depreciation for the new computer system. Requirement 6 Prepare the May 31 General Journal adjusting entry to record depreciation of the computer system for the month of May. Requirement 7 Prepare the May 31 General Journal adjusting entry to record depreciation of the office building for the month of May. Requirement 8 Ace prepares financial statements monthly. Assuming that these are Ace's only two items of Property, Plant, & Equipment, what would be the amount of Depreciation Expense on Ace's May Income Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started