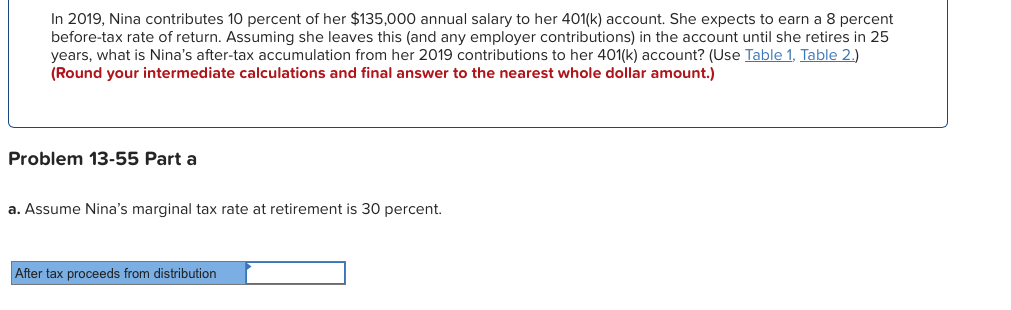

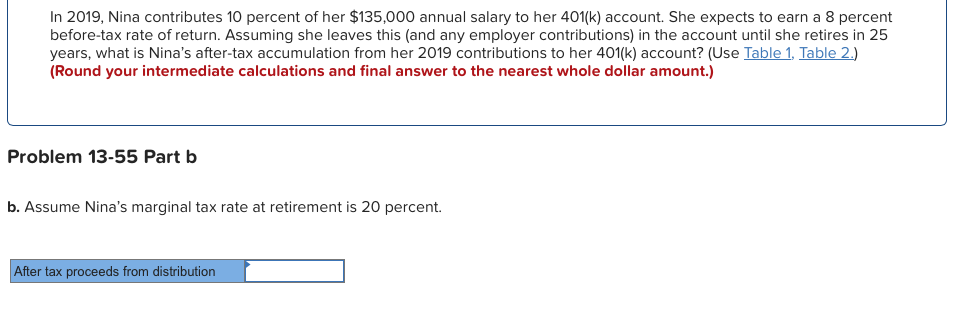

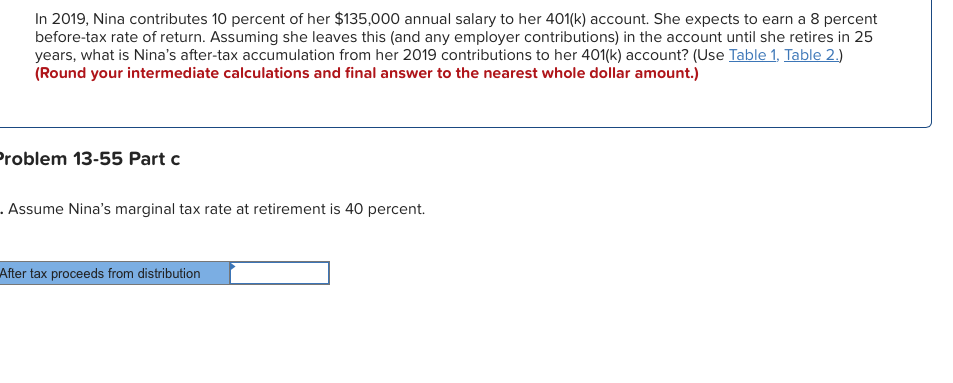

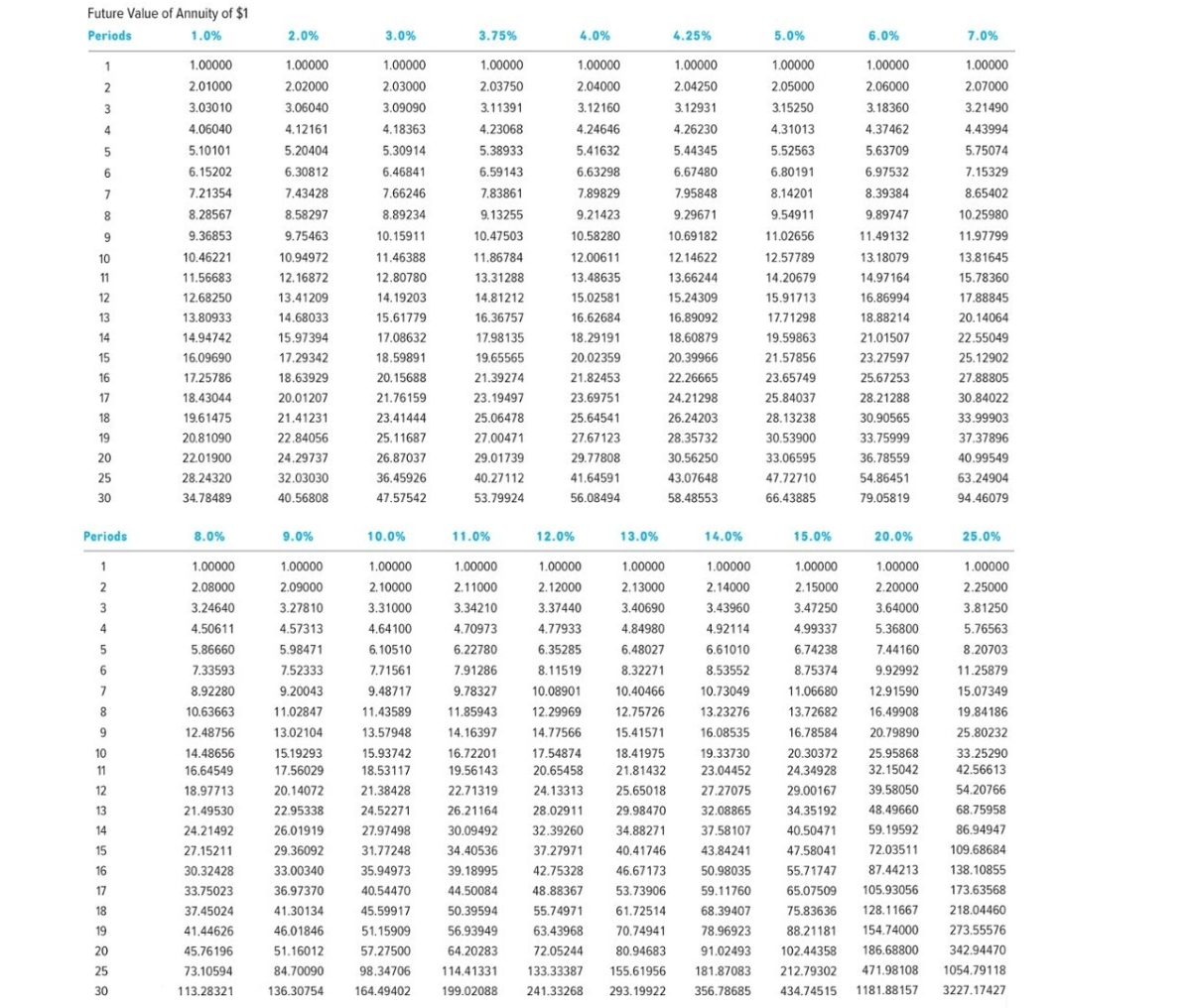

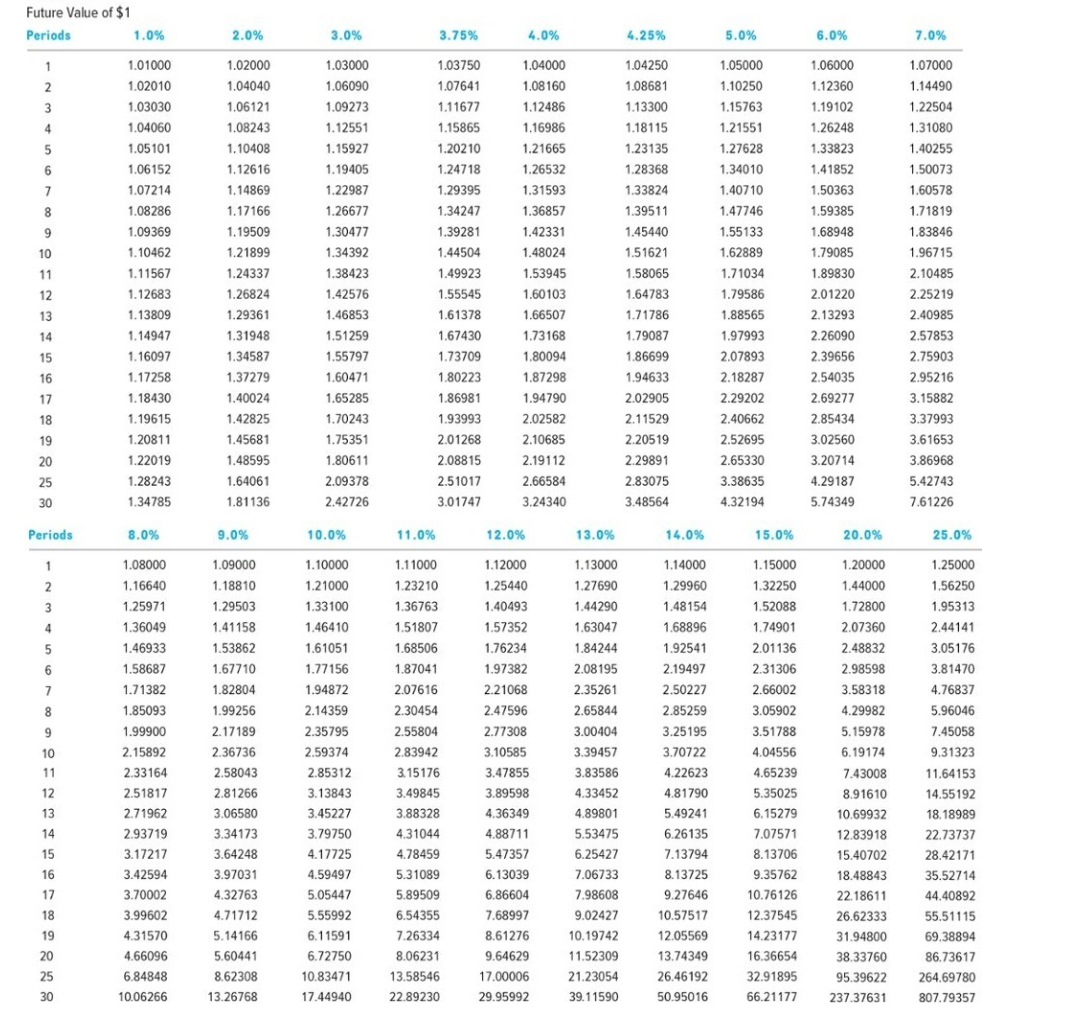

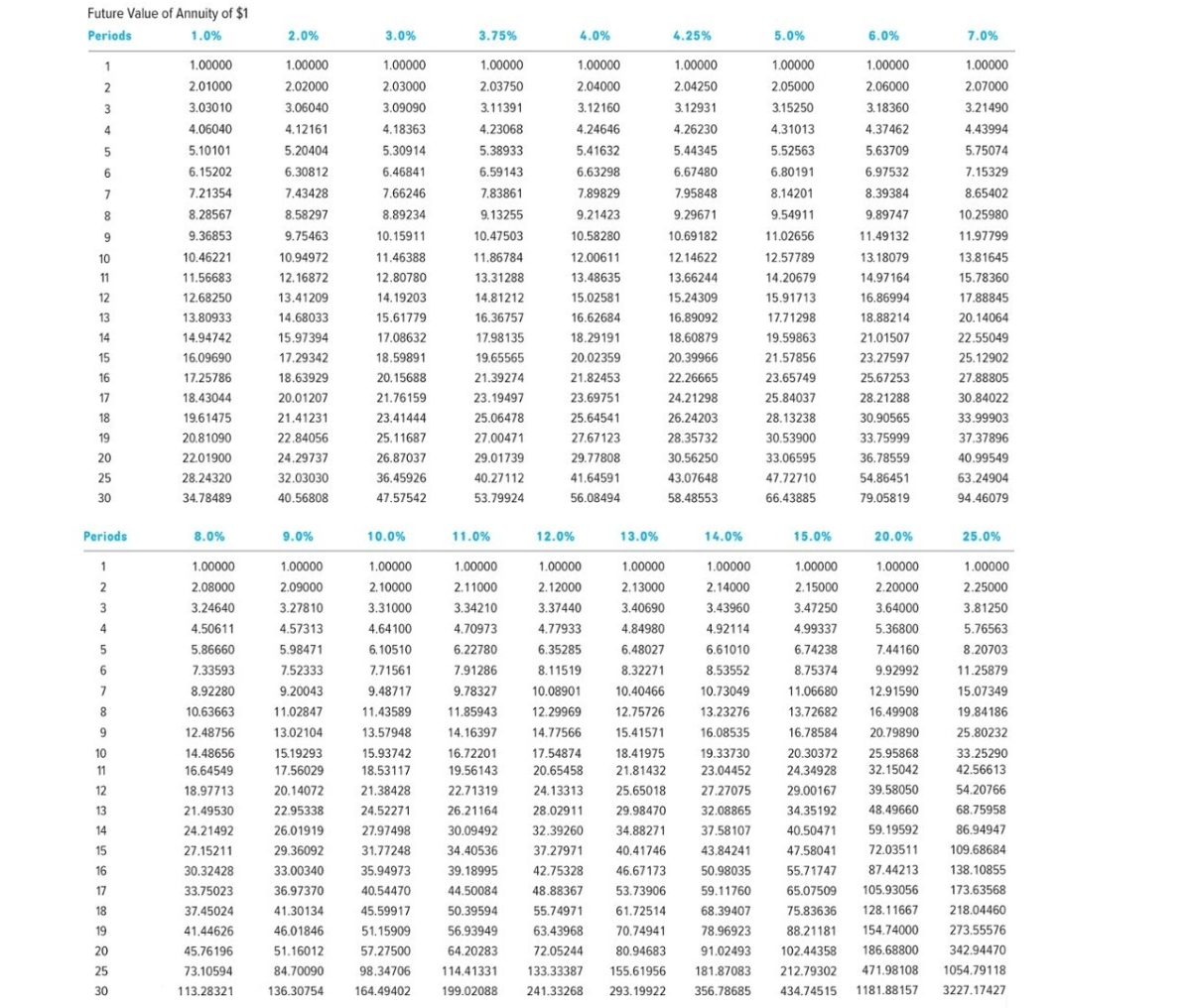

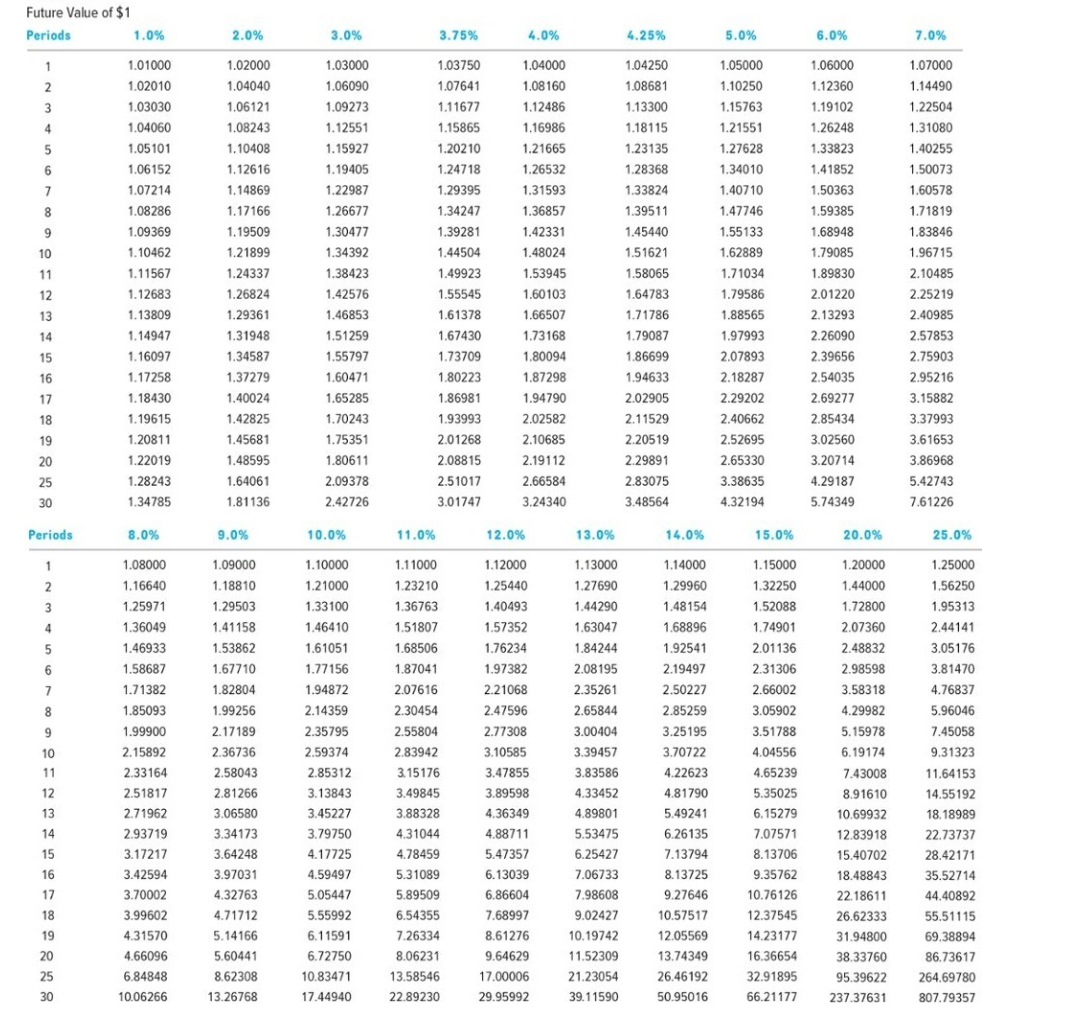

In 2019, Nina contributes 10 percent of her $135,000 annual salary to her 401(k) account. She expects to earn a 8 percent before-tax rate of return. Assuming she leaves this (and any employer contributions) in the account until she retires in 25 years, what is Nina's after-tax accumulation from her 2019 contributions to her 401(k) account? (Use Table 1, Table 2.) (Round your intermediate calculations and final answer to the nearest whole dollar amount.) Problem 13-55 Part a a. Assume Nina's marginal tax rate at retirement is 30 percent. After tax proceeds from distribution In 2019, Nina contributes 10 percent of her $135,000 annual salary to her 401(k) account. She expects to earn a 8 percent before-tax rate of return. Assuming she leaves this and any employer contributions) in the account until she retires in 25 years, what is Nina's after-tax accumulation from her 2019 contributions to her 401(k) account? (Use Table 1, Table 2.) (Round your intermediate calculations and final answer to the nearest whole dollar amount.) Problem 13-55 Part b b. Assume Nina's marginal tax rate at retirement is 20 percent. After tax proceeds from distribution In 2019, Nina contributes 10 percent of her $135,000 annual salary to her 401(k) account. She expects to earn a 8 percent before-tax rate of return. Assuming she leaves this (and any employer contributions) in the account until she retires in 25 years, what is Nina's after-tax accumulation from her 2019 contributions to her 401(k) account? (Use Table 1. Table 2.) (Round your intermediate calculations and final answer to the nearest whole dollar amount.) Problem 13-55 Part c . Assume Nina's marginal tax rate at retirement is 40 percent. After tax proceeds from distribution Future Value of Annuity of $1 Periods 1.0% 2.0% 3.0% 3.75% 4.0% 4.25% 5.0% 6.0% 7.0% 1.00000 2.01000 3.03010 4.06040 5.10101 6.15202 7.21354 8.28567 9.36853 10.46221 11.56683 12.68250 13.80933 14.94742 16.09690 17.25786 18.43044 19.61475 20.81090 22.01900 28.24320 34.78489 1.00000 2.02000 3.06040 4.12161 5.20404 6.30812 7.43428 8.58297 9.75463 10.94972 12.16872 13.41209 14.68033 15.97394 17.29342 18.63929 20.01207 21.41231 22.84056 24.29737 32.03030 40.56808 1.00000 2.03000 3.09090 4.18363 5.30914 6.46841 7.66246 8.89234 10.15911 11.46388 12.80780 14.19203 15.61779 17.08632 18.59891 20.15688 21.76159 23.41444 25.11687 26.87037 36.45926 47.57542 1.00000 2.03750 3.11391 4.23068 5.38933 6.59143 7.83861 9.13255 10.47503 11.86784 13.31288 14.81212 16.36757 17.98135 19.65565 21.39274 23.19497 25.06478 27.00471 29.01739 40.27112 53.79924 1.00000 2.04000 3.12160 4.24646 5.41632 6.63298 7.89829 9.21423 10.58280 12.00611 13.48635 15.02581 16.62684 18.29191 20.02359 21.82453 23.69751 25.64541 27.67123 29.77808 41.64591 56.08494 1.00000 2.04250 3.12931 4.26230 5.44345 6.67480 7.95848 9.29671 10.69182 12.14622 13.66244 15.24309 16.89092 18.60879 20.39966 22.26665 24.21298 26.24203 28.35732 30.56250 43.07648 58.48553 2.05000 3.15250 4.31013 5.52563 6.80191 8.14201 9.54911 11.02656 12.57789 14.20679 15.91713 17.71298 19.59863 21.57856 23.65749 25.84037 28.13238 30.53900 33.06595 1.00000 2.06000 3.18360 4.37462 5.63709 6.97532 8.39384 9.89747 11.49132 13.18079 14.97164 16.86994 18.88214 21.01507 23.27597 25.67253 28.21288 30.90565 33.75999 36.78559 54.86451 79.05819 1.00000 2.07000 3.21490 4.43994 5.75074 7.15329 8.65402 10.25980 11.97799 13.81645 15.78360 17.88845 20.14064 22.55049 25.12902 27.88805 30.84022 33.99903 37.37896 40.99549 63.24904 94.46079 66.43885 Periods 8.0% 9.0% 10.0% 11.0% 12.0% 14.0% 15.0% 20.0% 25.0% 1.00000 2.10000 3.31000 4.64100 6.10510 1.00000 2.08000 3.24640 4.50611 5.86660 7.33593 8.92280 10.63663 12.48756 14.48656 16.64549 18.97713 21.49530 24.21492 27.15211 30.32428 33.75023 37.45024 41.44626 45.76196 73.10594 113.28321 1.00000 2.09000 3.27810 4.57313 5.98471 7.52333 9.20043 11.02847 13.02104 15.19293 17.56029 20.14072 22.95338 26.01919 29.36092 33.00340 36.97370 41.30134 46.01846 51.16012 84.70090 136.30754 9.48717 11.43589 13.57948 15.93742 18.53117 21.38428 24.52271 27.97498 31.77248 35.94973 40.54470 45.59917 51.15909 57.27500 98.34706 164.49402 1.00000 2.11000 3.34210 4.70973 6.22780 7.91286 9.78327 11.85943 14.16397 16.72201 19.56143 22.71319 26.21164 30.09492 34.40536 39.18995 44.50084 50.39594 56.93949 64.20283 114.41331 1 99.02088 1.00000 2.12000 3.37440 4.77933 6.35285 8.11519 10.08901 12.29969 14.77566 17.54874 20.65458 24.13313 28.02911 32.39260 37.27971 42.75328 48.88367 55.74971 63.43968 72.05244 133.33387 241.33268 1.00000 2.13000 3.40690 4.84980 6.48027 8.32271 10.40466 12.75726 15.41571 18.41975 21.81432 25.65018 29.98470 34.88271 40.41746 46.67173 53.73906 61.72514 70.74941 80.94683 155.61956 293.19922 1.00000 2.14000 3.43960 4.92114 6.61010 8.53552 10.73049 13.23276 16.08535 19.33730 23.04452 27.27075 32.08865 37.58107 43.84241 50.98035 59.11760 68.39407 78.96923 91.02493 181.87083 356.78685 1.00000 1.00000 2.15000 2.20000 3.47250 3.64000 4.99337 5.36800 6.74238 7.44160 8.75374 9.92992 11.06680 12.91590 13.72682 16.49908 16.78584 20.79890 20.30372 25.95868 24.34928 32.15042 29.00167 39.58050 34.35192 48.49660 40.50471 59.19592 47.58041 72.03511 55.71747 87.44213 65.07509 105.93056 75.83636 128.11667 88.21181 154.74000 102.44358 186.68800 212.79302 471.98108 4 34.745151181.88157 1.00000 2.25000 3.81250 5.76563 8.20703 11.25879 15.07349 19.84186 25.80232 33.25290 42.56613 54.20766 68.75958 86.94947 109.68684 138. 10855 173.63568 218.04460 273.55576 342.94470 1054.79118 3227.17427 Future Value of $1 Periods 1.0% 2.0% 3.0% 3.75% 4.0% 4.25% 5.0% 6.0% 7.0% 1.01000 1.02010 1.03030 1.04060 1.05101 1.06152 1.07214 1.08286 1.09369 1.10462 1.11567 1.12683 1.13809 1.14947 1.16097 1.17258 1.18430 1.19615 1.20811 1.22019 1.28243 1.34785 1.02000 1.04040 1.06121 1.08243 1.10408 1.12616 1.14869 1.17166 1.19509 1.21899 1.24337 1.26824 1.29361 1.31948 1.34587 1.37279 1.40024 1.42825 1.45681 1.48595 1.64061 1.81136 1.03000 1.06090 1.09273 1.12551 1.15927 1.19405 1.22987 1.26677 1.30477 1.34392 1.38423 1.42576 1.46853 1.51259 1.55797 1.60471 1.65285 1.70243 1.75351 1.80611 2.09378 2.42726 1.03750 1.07641 1.11677 1.15865 1.20210 1.24718 1.29395 1.34247 1.39281 1.44504 1.49923 1.55545 1.61378 1.67430 1.73709 1.80223 1.86981 1.93993 2.01268 2.08815 2.51017 3.01747 1.04000 1.08160 1.12486 1.16986 1.21665 1.26532 1.31593 1.36857 1.42331 1.48024 1.53945 1.60103 1.66507 1.73168 1.80094 1.87298 1.94790 2.02582 2.10685 2.19112 2.66584 3.24340 1.04250 1.08681 1.13300 1.18115 1.23135 1.28368 1.33824 1.39511 1.45440 1.51621 1.58065 1.64783 1.71786 1.79087 1.86699 1.94633 2.02905 2.11529 2.20519 2.29891 2.83075 3.48564 1.05000 1.10250 1.15763 1.21551 1.27628 1.34010 1.40710 1.47746 1.55133 1.62889 1.71034 1.79586 1.88565 1.97993 2.07893 2.18287 2.29202 2.40662 2.52695 2.65330 3.38635 4.32194 1.06000 1.12360 1.19102 1.26248 1.33823 1.41852 1.50363 1.59385 1.68948 1.79085 1.89830 2.01220 2.13293 2.26090 2.39656 2.54035 2.69277 2.85434 3.02560 3.20714 4.29187 5.74349 1.07000 1.14490 1.22504 1.31080 1.40255 1.50073 1.60578 1.71819 1.83846 1.96715 2.10485 2.25219 2.40985 2.57853 2.75903 2.95216 3.15882 3.37993 3.61653 3.86968 5.42743 7.61226 Periods 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 20.0% 25.0% 1.08000 1.16640 1.25971 1.36049 1.46933 1.58687 1.71382 1.85093 1.99900 2.15892 2.33164 2.51817 2.71962 2.93719 3.17217 3.42594 3.70002 3.99602 4.31570 4.66096 6.84848 10.06266 1.09000 1.18810 1.29503 1.41158 1.53862 1.67710 1.82804 1.99256 2.17189 2.36736 2.58043 2.81266 3.06580 3.34173 3.64248 3.97031 4.32763 4.71712 5.14166 5.60441 8.62308 13.26768 1.10000 1.21000 1.33100 1.46410 1.61051 1.77156 1.94872 2.14359 2.35795 2.59374 2.85312 3.13843 3.45227 3.79750 4.17725 4.59497 5.05447 5.55992 6.11591 6.72750 10.83471 17.44940 1.11000 1.23210 1.36763 1.51807 1.68506 1.87041 2.07616 2.30454 2.55804 2.83942 3.15176 3.49845 3.88328 4.31044 4.78459 5.31089 5.89509 6.54355 7.26334 8.06231 13.58546 22.89230 1.12000 1.25440 1.40493 1.57352 1.76234 1.97382 2.21068 2.47596 2.77308 3.10585 3.47855 3.89598 4.36349 4.88711 5.47357 6.13039 6.86604 7.68997 8.61276 9.64629 17.00006 29.95992 1.13000 1.27690 1.44290 1.63047 1.84244 2.08195 2.35261 2.65844 3.00404 3.39457 3.83586 4.33452 4.89801 5.53475 6.25427 7.06733 7.98608 9.02427 10.19742 11.52309 21.23054 39.11590 1.14000 1.29960 1.48154 1.68896 1.92541 2.19497 2.50227 2.85259 3.25195 3.70722 4.22623 4.81790 5.49241 6.26135 7.13794 8.13725 9.27646 10.57517 12.05569 13.74349 26.46192 50.95016 1.15000 1.32250 1.52088 1.74901 2.01136 2.31306 2.66002 3.05902 3.51788 4.04556 4.65239 5.35025 6.15279 7.07571 8.13706 9.35762 10.76126 12.37545 14.23177 16.36654 32.91895 66.21177 1.20000 1.44000 1.72800 2.07360 2.48832 2.98598 3.58318 4.29982 5.15978 6.19174 7.43008 8.91610 10.69932 12.83918 15.40702 18.48843 22.18611 26.62333 31.94800 38.33760 95.39622 237.37631 1.25000 1.56250 1.95313 2.44141 3.05176 3.81470 4.76837 5.96046 7.45058 9.31323 11.64153 14.55192 18.18989 22.73737 28.42171 35.52714 44.40892 55.51115 69.38894 86.73617 264.69780 807.79357