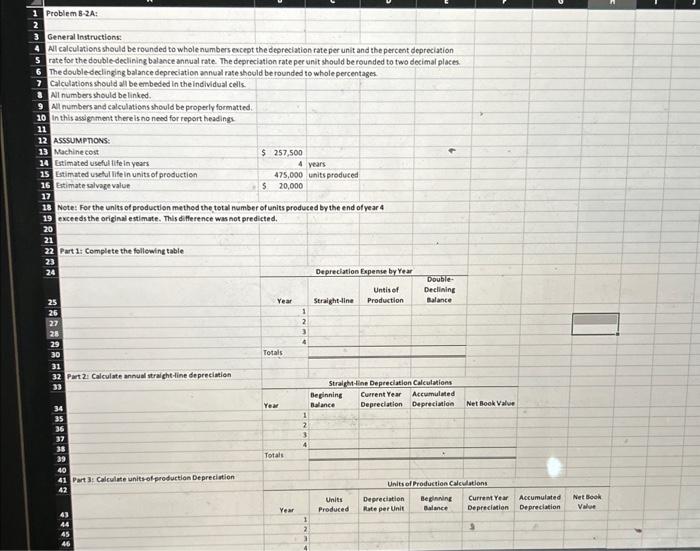

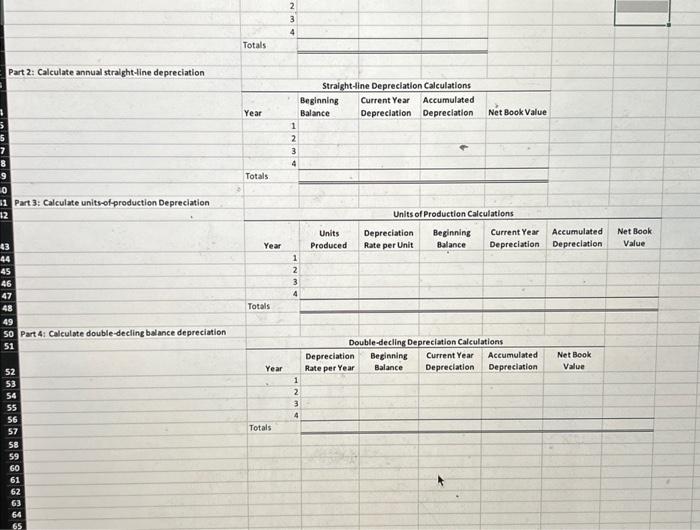

1 Problem 8-2A: 2 3 General Instructions: 4 Al calculations should be rounded to whole numbers except the depreciation rate per unit and the percent depreciation 5 rate for the doubledeclieing balance annual rate. The depreciation rate per unit should be rounded to two decimal places. 6 The doubledeclinging balance depreciation annual rate should berounded to whole percentages 7 Calculations should all be embeded in the individual cells. 8 Nil numbers should be linked. 9 All numbers and calculations should be properly formatted. 10 In this assigment there is no need for report headings. 11 12 Asssumpnons: 13 Machine cost 14 Gatimated useful tife in years 15 Estimated usehul life in units of production 16 Etimate salvage value 5257,500 475,000 unitsproduced 520,000 17 18 Note: For the units of production methed the total number of units produced by the end of vear 4 19 exceeds the original estimate. This difference was not predicted. 2120 Part 1: Complete the followint table 24 25 25 28 28 39 31 32 Part 2. Calculate annual straicht-tine depreciation 34 35 35 17 38 40 41 Part 3: Calculate units-ofproduction Depreciotion Totals Depreclation Expenue by Year Double- Totals \begin{tabular}{|c|c|c|c|c|c|} \hline rear & & \begin{tabular}{l} Becinning \\ nalance \end{tabular} & \begin{tabular}{l} Current Year \\ Deprediation \end{tabular} & \begin{tabular}{l} Accumulated \\ Depreciation. \end{tabular} & Net Book Valve \\ \hline & 1 & & & & \\ \hline & 2 & & & & \\ \hline & 3 & & & & \\ \hline & 4 & & + & & \\ \hline Totals & & & & + & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} Unitsof Production Calculations 1 Problem 8-2A: 2 3 General Instructions: 4 Al calculations should be rounded to whole numbers except the depreciation rate per unit and the percent depreciation 5 rate for the doubledeclieing balance annual rate. The depreciation rate per unit should be rounded to two decimal places. 6 The doubledeclinging balance depreciation annual rate should berounded to whole percentages 7 Calculations should all be embeded in the individual cells. 8 Nil numbers should be linked. 9 All numbers and calculations should be properly formatted. 10 In this assigment there is no need for report headings. 11 12 Asssumpnons: 13 Machine cost 14 Gatimated useful tife in years 15 Estimated usehul life in units of production 16 Etimate salvage value 5257,500 475,000 unitsproduced 520,000 17 18 Note: For the units of production methed the total number of units produced by the end of vear 4 19 exceeds the original estimate. This difference was not predicted. 2120 Part 1: Complete the followint table 24 25 25 28 28 39 31 32 Part 2. Calculate annual straicht-tine depreciation 34 35 35 17 38 40 41 Part 3: Calculate units-ofproduction Depreciotion Totals Depreclation Expenue by Year Double- Totals \begin{tabular}{|c|c|c|c|c|c|} \hline rear & & \begin{tabular}{l} Becinning \\ nalance \end{tabular} & \begin{tabular}{l} Current Year \\ Deprediation \end{tabular} & \begin{tabular}{l} Accumulated \\ Depreciation. \end{tabular} & Net Book Valve \\ \hline & 1 & & & & \\ \hline & 2 & & & & \\ \hline & 3 & & & & \\ \hline & 4 & & + & & \\ \hline Totals & & & & + & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} Unitsof Production Calculations