Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Problem One: A company sells its product for 20 OMR per unit. The Fixed costs for the company are 70000 OMR, and the variable

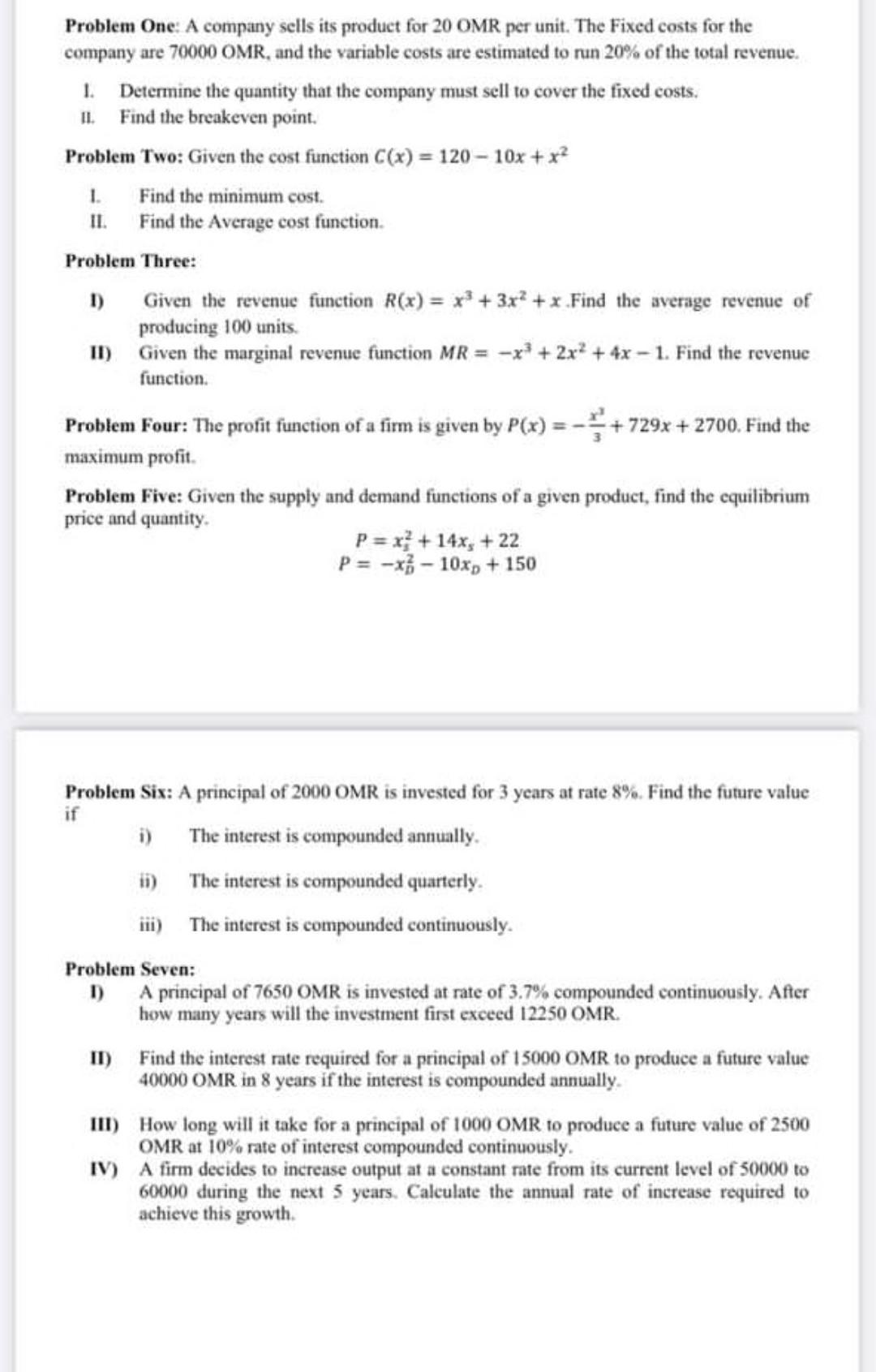

1. Problem One: A company sells its product for 20 OMR per unit. The Fixed costs for the company are 70000 OMR, and the variable costs are estimated to run 20% of the total revenue. 1. Determine the quantity that the company must sell to cover the fixed costs. II. Find the breakeven point. Problem Two: Given the cost function C(x) = 120 - 10x + x2 Find the minimum cost. Find the Average cost function. Problem Three: 1) Given the revenue function R(x) = x2 + 3x2 + x .Find the average revenue of producing 100 units Ih)Given the marginal revenue function MR = -x + 2x2 + 4x - 1. Find the revenue function. Problem Four: The profit function of a firm is given by P(x) =+729x + 2700. Find the maximum profit Problem Five: Given the supply and demand functions of a given product, find the equilibrium price and quantity P= x + 14x3 +22 P= -x- 10x+ 150 Problem Six: A principal of 2000 OMR is invested for 3 years at rate 8%. Find the future value i) The interest is compounded annually. ii) The interest is compounded quarterly. iii) The interest is compounded continuously. Problem Seven: 1) A principal of 7650 OMR is invested at rate of 3.7% compounded continuously. After how many years will the investment first exceed 12250 OMR. II) Find the interest rate required for a principal of 15000 OMR to produce a future value 40000 OMR in 8 years if the interest is compounded annually III) How long will it take for a principal of 1000 OMR to produce a future value of 2500 OMR at 10% rate of interest compounded continuously IV) A firm decides to increase output at a constant rate from its current level of 50000 to 60000 during the next 5 years. Calculate the annual rate of increase required to achieve this growth

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started