Question

1.) Projects A and B both have 5 years of life. The initial investments and cash flows from these two projects are shown below. Year

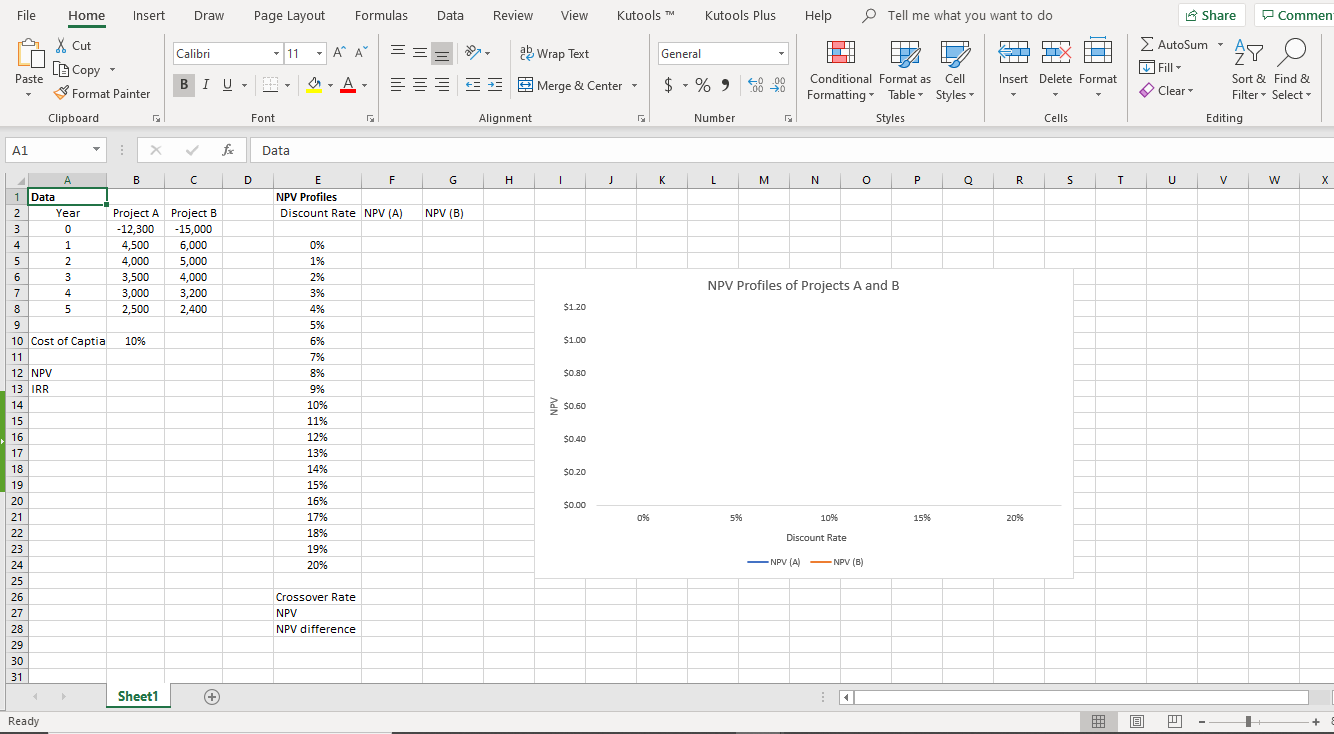

1.) Projects A and B both have 5 years of life. The initial investments and cash flows from these two projects are shown below.

| Year | 0 | 1 | 2 | 3 | 4 | 5 |

| Project A | -12,300 | 4,500 | 4,000 | 3,500 | 3,000 | 2,500 |

| Project B | -15,000 | 6,000 | 5,000 | 4,000 | 3,200 | 2,400 |

A.) Use Data Table tool to find the NPVs of both projects when the discount rate is 10%.

B.) Use Data Table tool to find the IRRs of both projects

C.) Plot the NPV profiles for both projects on the same graph.

D.) Use Goal Seek to find the crossover rate of these two projects. (Note that the solution of this part must include an image of the Goal Seek dialog showing all input values. The image can be shown in a non-Excel file.)

Please show all cells like the given picture (same format if possible). I need to know which cells to use and input. Please show the entire excel file.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started