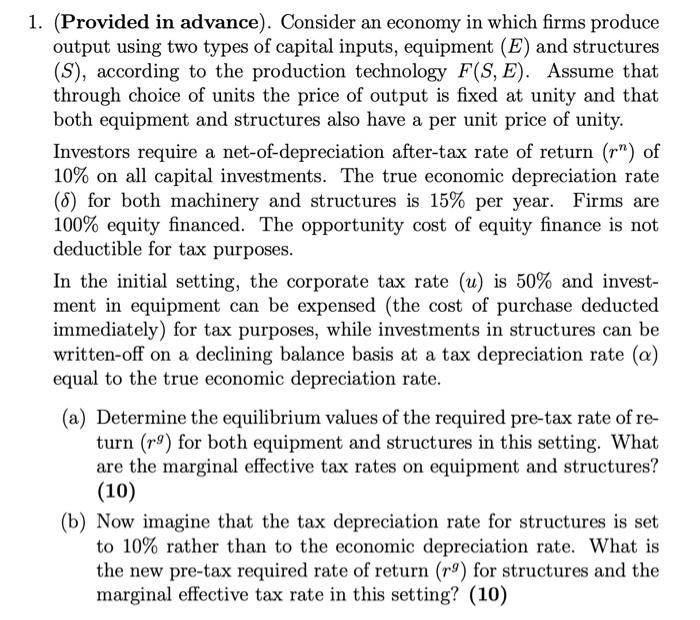

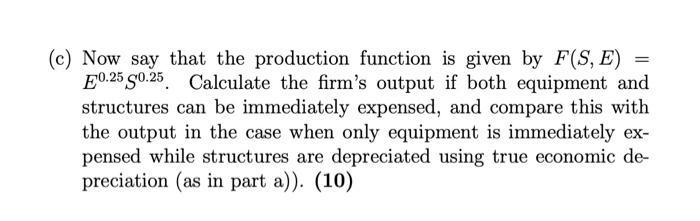

1. (Provided in advance). Consider an economy in which firms produce output using two types of capital inputs, equipment (E) and structures (S), according to the production technology F(S, E). Assume that through choice of units the price of output is fixed at unity and that both equipment and structures also have a per unit price of unity. Investors require a net-of-depreciation after-tax rate of return (r) of 10% on all capital investments. The true economic depreciation rate () for both machinery and structures is 15% per year. Firms are 100% equity financed. The opportunity cost of equity finance is not deductible for tax purposes. In the initial setting, the corporate tax rate (u) is 50% and invest- ment in equipment can be expensed (the cost of purchase deducted immediately) for tax purposes, while investments in structures can be written-off on a declining balance basis at a tax depreciation rate (a) equal to the true economic depreciation rate. (a) Determine the equilibrium values of the required pre-tax rate of re- turn (r) for both equipment and structures in this setting. What are the marginal effective tax rates on equipment and structures? (10) (b) Now imagine that the tax depreciation rate for structures is set to 10% rather than to the economic depreciation rate. What is the new pre-tax required rate of return (r) for structures and the marginal effective tax rate in this setting? (10) (c) Now say that the production function is given by F(S, E) = E0.25 0.25. Calculate the firm's output if both equipment and structures can be immediately expensed, and compare this with the output in the case when only equipment is immediately ex- pensed while structures are depreciated using true economic de- preciation (as in part a)). (10) 1. (Provided in advance). Consider an economy in which firms produce output using two types of capital inputs, equipment (E) and structures (S), according to the production technology F(S, E). Assume that through choice of units the price of output is fixed at unity and that both equipment and structures also have a per unit price of unity. Investors require a net-of-depreciation after-tax rate of return (r) of 10% on all capital investments. The true economic depreciation rate () for both machinery and structures is 15% per year. Firms are 100% equity financed. The opportunity cost of equity finance is not deductible for tax purposes. In the initial setting, the corporate tax rate (u) is 50% and invest- ment in equipment can be expensed (the cost of purchase deducted immediately) for tax purposes, while investments in structures can be written-off on a declining balance basis at a tax depreciation rate (a) equal to the true economic depreciation rate. (a) Determine the equilibrium values of the required pre-tax rate of re- turn (r) for both equipment and structures in this setting. What are the marginal effective tax rates on equipment and structures? (10) (b) Now imagine that the tax depreciation rate for structures is set to 10% rather than to the economic depreciation rate. What is the new pre-tax required rate of return (r) for structures and the marginal effective tax rate in this setting? (10) (c) Now say that the production function is given by F(S, E) = E0.25 0.25. Calculate the firm's output if both equipment and structures can be immediately expensed, and compare this with the output in the case when only equipment is immediately ex- pensed while structures are depreciated using true economic de- preciation (as in part a))