Answered step by step

Verified Expert Solution

Question

1 Approved Answer

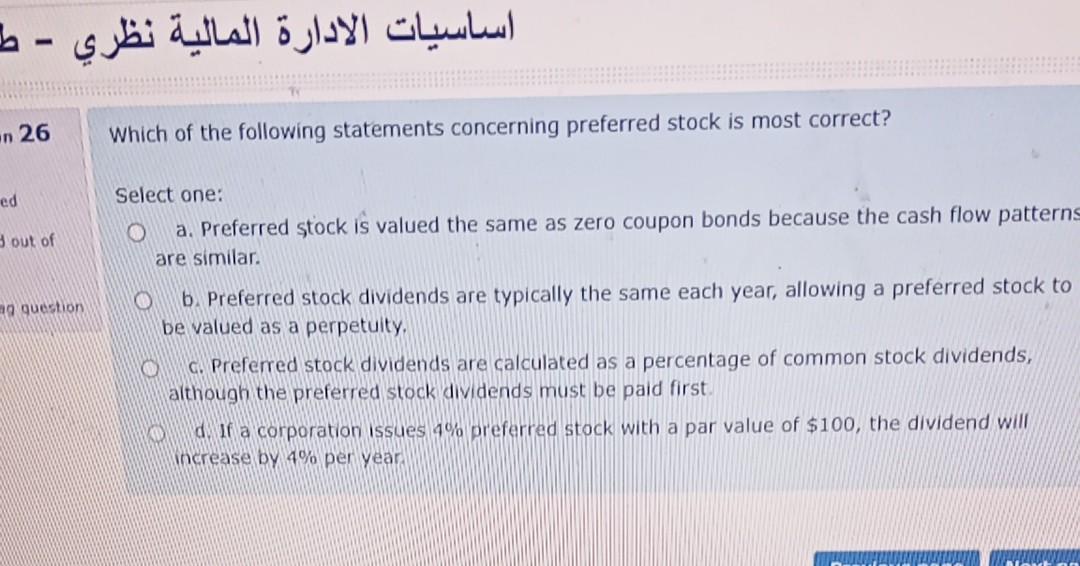

- - n 26 Which of the following statements concerning preferred stock is most correct? ed Select one: O a. Preferred stock is valued the

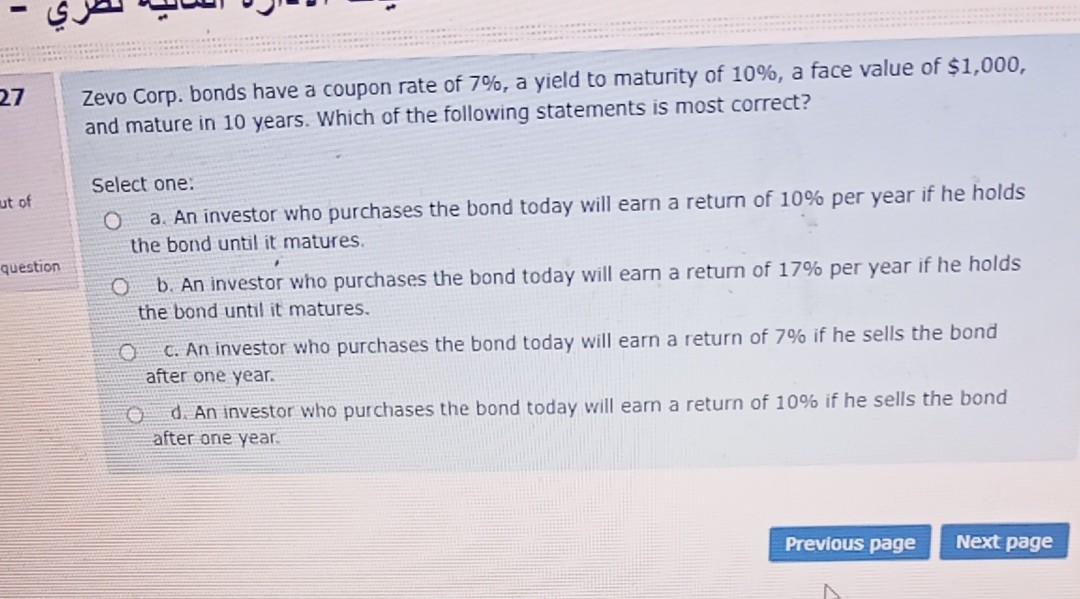

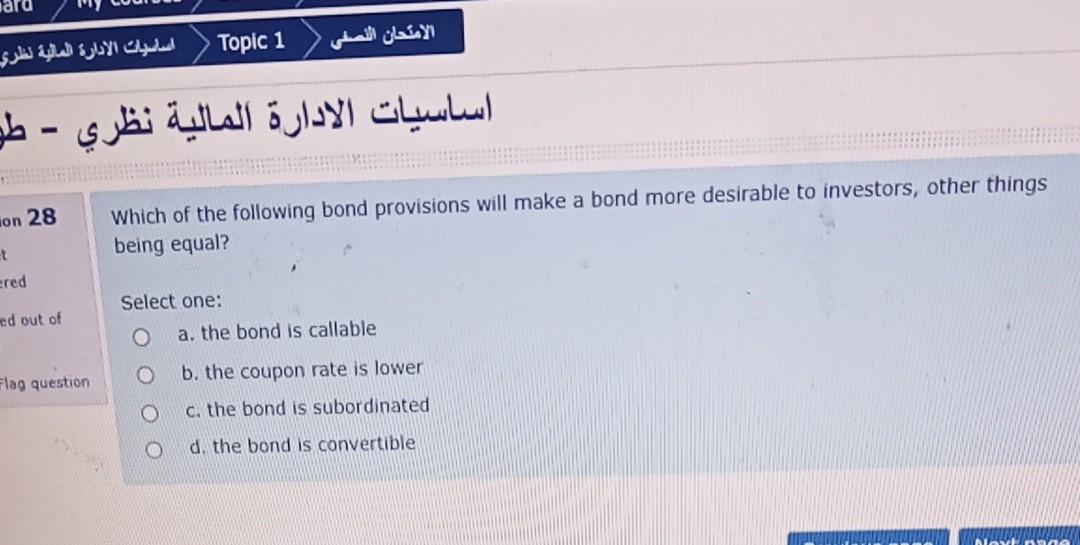

- - n 26 Which of the following statements concerning preferred stock is most correct? ed Select one: O a. Preferred stock is valued the same as zero coupon bonds because the cash flow patterns are similar. out of ag question b. Preferred stock dividends are typically the same each year, allowing a preferred stock to be valued as a perpetuity, c. Preferred stock dividends are calculated as a percentage of common stock dividends, although the preferred stock dividends must be paid first If a corporation issues 1% preferred stock with a par value of $100, the dividend will Increase by 4% per year 27 Zevo Corp. bonds have a coupon rate of 7%, a yield to maturity of 10%, a face value of $1,000, and mature in 10 years. Which of the following statements is most correct? ut of Select one: O a. An investor who purchases the bond today will earn a return of 10% per year if he holds the bond until it matures. question O b. An investor who purchases the bond today will earn a return of 17% per year if he holds the bond until it matures. C. An investor who purchases the bond today will earn a return of 7% if he sells the bond after one year. d. An investor who purchases the bond today will eam a return of 10% if he sells the bond after one year Previous page Next page ara Topic 1 - on 28 Which of the following bond provisions will make a bond more desirable to investors, other things being equal? t ered ed out of Select one: a. the bond is callable Flag question 0 b. the coupon rate is lower C) c. the bond is subordinated 0 d. the bond is convertible NOVE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started