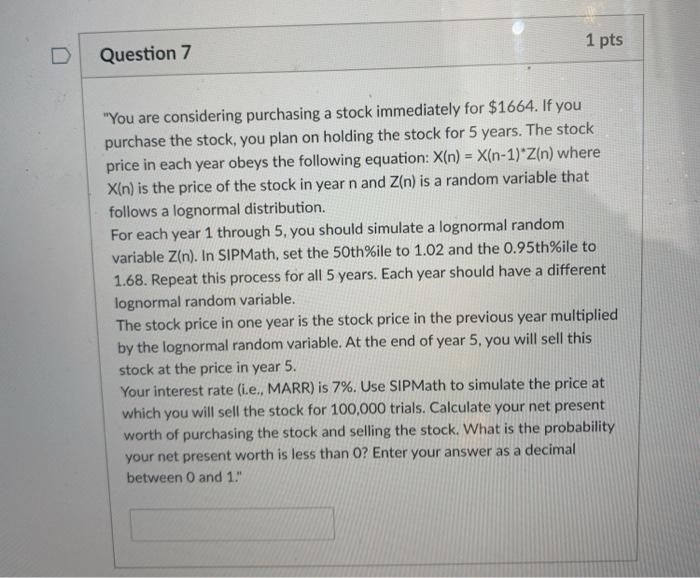

1 pts Question 7 "You are considering purchasing a stock immediately for $1664. If you purchase the stock, you plan on holding the stock for 5 years. The stock price in each year obeys the following equation: X(n) = X(n-1)*Z(n) where X(n) is the price of the stock in year n and Z(n) is a random variable that follows a lognormal distribution. For each year 1 through 5, you should simulate a lognormal random variable Z(n). In SIPMath, set the 50th%ile to 1.02 and the 0.95th%ile to 1.68. Repeat this process for all 5 years. Each year should have a different lognormal random variable. The stock price in one year is the stock price in the previous year multiplied by the lognormal random variable. At the end of year 5, you will sell this stock at the price in year 5. Your interest rate (i.e., MARR) is 7%. Use SIPMath to simulate the price at which you will sell the stock for 100,000 trials. Calculate your net present worth of purchasing the stock and selling the stock. What is the probability your net present worth is less than 0? Enter your answer as a decimal between 0 and 1." 1 pts Question 7 "You are considering purchasing a stock immediately for $1664. If you purchase the stock, you plan on holding the stock for 5 years. The stock price in each year obeys the following equation: X(n) = X(n-1)*Z(n) where X(n) is the price of the stock in year n and Z(n) is a random variable that follows a lognormal distribution. For each year 1 through 5, you should simulate a lognormal random variable Z(n). In SIPMath, set the 50th%ile to 1.02 and the 0.95th%ile to 1.68. Repeat this process for all 5 years. Each year should have a different lognormal random variable. The stock price in one year is the stock price in the previous year multiplied by the lognormal random variable. At the end of year 5, you will sell this stock at the price in year 5. Your interest rate (i.e., MARR) is 7%. Use SIPMath to simulate the price at which you will sell the stock for 100,000 trials. Calculate your net present worth of purchasing the stock and selling the stock. What is the probability your net present worth is less than 0? Enter your answer as a decimal between 0 and 1