Answered step by step

Verified Expert Solution

Question

1 Approved Answer

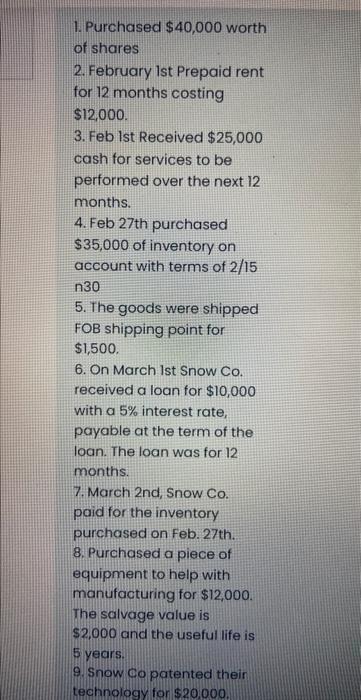

1. Purchased $40,000 worth of shares 2. February 1st Prepaid rent for 12 months costing $12,000. 3. Feb 1st Received $25,000 cash for services

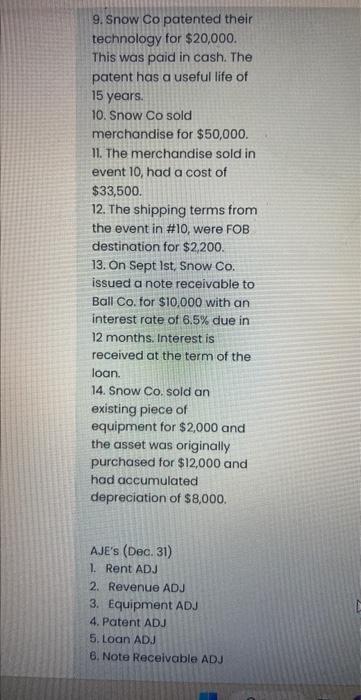

1. Purchased $40,000 worth of shares 2. February 1st Prepaid rent for 12 months costing $12,000. 3. Feb 1st Received $25,000 cash for services to be performed over the next 12 months. 4. Feb 27th purchased $35,000 of inventory on account with terms of 2/15 n30 5. The goods were shipped FOB shipping point for $1,500. 6. On March 1st Snow Co. received a loan for $10,000 with a 5% interest rate, payable at the term of the loan. The loan was for 12 months. 7. March 2nd, Snow Co. paid for the inventory purchased on Feb. 27th. 8. Purchased a piece of equipment to help with manufacturing for $12,000. The salvage value is $2,000 and the useful life is 5 years. 9. Snow Co patented their technology for $20,000. 9. Snow Co patented their technology for $20,000. This was paid in cash. The patent has a useful life of 15 years. 10. Snow Co sold merchandise for $50,000. 11. The merchandise sold in event 10, had a cost of $33,500. 12. The shipping terms from the event in #10, were FOB destination for $2,200. 13. On Sept 1st, Snow Co. issued a note receivable to Ball Co. for $10,000 with an interest rate of 6.5% due in 12 months. Interest is received at the term of the loan. 14. Snow Co. sold an existing piece of equipment for $2,000 and the asset was originally purchased for $12,000 and had accumulated depreciation of $8,000. AJE's (Dec. 31) 1. Rent ADJ 2. Revenue ADJ 3. Equipment ADJ 4. Patent ADJ 5. Loan ADJ 6. Note Receivable ADJ L

Step by Step Solution

★★★★★

3.52 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

The adjusted entries on 31st December are 1 Rent Adjusted Entry Total rent for whole year 12000 Rent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started